Articles

Lindsey Williams Articles

What are my choices?

Pastor Williams has asked me to share with you this information from an unknown source regarding your choice in the upcoming November presidential election. Please share it with everyone you can…

If I were not already convinced this message would have convinced me. It is also a good read as it makes its points!

WHAT ARE MY CHOICES?

The folks speaking out against Trump are helping me make up my mind a little more every day!

- Is he the Perfect Candidate whose thoughts mirrors mine on all fronts? NOPE

- Does he say everything the way I wish he would say it? NOPE

- Am I absolutely sure that his motives are absolutely Pure? NOPE

- Can I point to any other Dem Politician that I like better? NOPE

- Is there any of the other RINO Politicians I like better? NOPE

- Am I going to sit home, refuse to Vote, and let Hillary win; because he is NOT Perfect? NOPE

- Do I like what I have seen for the last 7-1/2 years with the Jerk that sleeps in my White House? NOPE

- Do I like the “fundamental changes” that same Jerk has brought about in MY America? NOPE

OK, your turn to decide what you are going to do in about 4 months!

Trump's presidential qualifications…

- Obama is against Trump… Check

- The Media are against Trump… Check

- The establishment Democrats are against Trump… Check

- The establishment Republicans are against Trump… Check

- The Pope is against Trump… Check

- The UN is against Trump… Check

- The EU is against Trump… Check

- China is against Trump… Check

- Mexico is against Trump… Check

- Soros is against Trump… Check

- Black Lives Matter is against Trump… Check

- Move On is against Trump… Check

- Koch Brothers are against Trump… Check

- Bushes are against Trump… Check

- Planned Parenthood is against Trump… Check

- Hillary & Bernie are both against Trump… Check

- Illegal aliens are against Trump… Check

- Islam is against Trump… Check

- Kasich is against Trump… Check

- Hateful, racist, violent Liberals are against Trump… Check

NOW THAT BEING SAID…

It seems to me, Trump MUST BE the Best Qualified Candidate we could ever have.

If you have so many political insiders and left wing NUT CASES— all SCARED TO DEATH, that they all speak out against him at the same time!

Most of all, it will be the People's Choice…

PLUS

- He's not a Lifetime Politician… Check

- He's not a Lawyer… Check

- He's not doing it for the money… Check

- He's a Natural Born American Citizen born in the USA from American parents… Check

Bonus points!

- Whoopi says she will leave the country…

- Rosie says she will leave the country…

- Sharpton says he will leave the country…

- Cher says she will leave the country…

- Cyrus says she will leave the country…

- The Constitution and the Bill of Rights will prevail….

- Hillary will go to jail…..

- The budget will be balanced in 8 years….

- Americans will have first choice at jobs…..

- You will not be able to marry your pet….

- You will be able to keep your gun(s) if you qualify (Not a criminal or crazy, etc.)…

- Only living, registered U.S. citizens can vote….

- MUST SHOW ID TO VOTE…

- You can have and keep your own doctor…

- You can say whatever you want without being called a racist, Islamophobic, xenophobic, etc….

He will make AMERICA GREAT AGAIN!

Come to think of it, we have no place to go, but UP!…

REMEMBER IN NOVEMBER!!!!!!!

Pass it on and God Bless America!!

Lindsey Williams: I feel a moral obligation to tell you the truth about Donald Trump

Lindsey Williams: I feel a moral obligation to tell you the truth about Donald Trump…

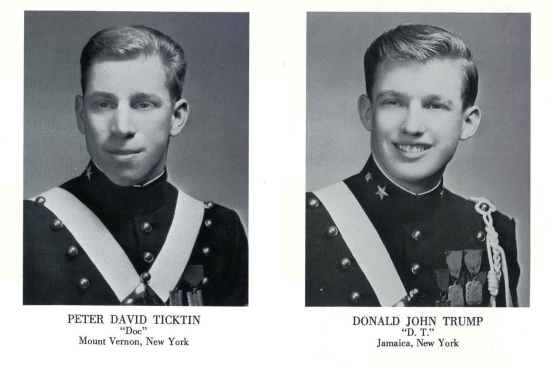

“VOTE AS YOU WISH, AND LET ME TELL YOU ABOUT TRUMP – – A personal note from Peter Ticktin who knows the guy from high school:

As a law firm, we at The Ticktin Law Group do not like to get involved in politics. As soon as we endorse one side, we risk alienating everyone on the other side. Also, our lawyers and staff are, themselves, on both sides. Politics is not our game. However, Justice is!

If you saw a guy get publicly smeared, and you knew him well from the days you were friends and seniors together in high school, if you knew him to be a decent and honest man, would you want to say something? This is why I need to share what I know.

I was aghast at watching last night's debate. It was a set-up. The moderators, Cruz, and Rubio were all like little alligators trying to take a bite out of Trump. Yes, Donald Trump has had some failures, but he has been exceedingly successful. None of this came out. Instead, there was a general attack. Rubio simply makes up lies. He pretends that Trump has small hands and makes fun of him for something which isn't even real. He pretends that Donald wets his pants, and makes fun of him, as though it was true, and then he calls Donald Trump a “Bully.”

I am not suggesting that you should vote or not vote for anyone. I just need to defend a former friend who is being smeared.

Like Donald Trump, I attended New York Military Academy (“NYMA”) for high school. In fact, in our senior year, together, Donald was my captain, and I was his 1st Platoon Sergeant. I sometimes joke that I ran his first company for him, Company “A.”

People don't really change much from the ages of 17 and 18, and I know this guy. I know him to be a good decent guy. We lived and breathed an Honor Code in those years. It wasn't just a rule. It was our way of life. Neither Donald, nor any other cadet who graduated with us would ever lie, cheat, or steal from a fellow cadet. These values became irreversibly intertwined in the fabric of our personalities, of who we are.

Of the 99 guys (no girls in those days) in our class, there is not one who I know who has a bad word to say about Donald Trump. Think of it. With all the jealousies which arise in high school and thereafter, with all the potential envy, not one of us has anything other than positive memories of this man. How could we? He was an “A” student, a top athlete, and as a leader, he was highly respected. We never feared him, yet we never wanted to disappoint him. He had our respect. He was never a bigot in any way, shape or form. He only hates those who hate. Of course he denounces the KKK.

As to the discussion with the New York Times, it is his choice to release the ‘off the record' remarks. However, if he does, it opens the door for all political opposition to make that demand for everyone, and that means that our press will never get those ‘off the record' remarks which help them to understand the realities of the campaign. Moreover, the idea that Donald Trump confessed some alternate theory of his position is preposterous. Can anyone believe that all those NY Times reporters are walking around knowing some deep dark nasty secret about a guy who is seeking an endorsement?

The Republican establishment is afraid of Donald Trump. Why? They are afraid that he will lose to Hillary. They don't hate Donald. They hate her. They are so fearful that they fail to see that by expanding the base of voters for Trump, he is more likely to win.

Watching the chorus of whiners, decriers, denigrators, and self-righteous put-down experts from so many directions, from Mit Romney, to Megyn Kelly, Little Mario, it has to make you wonder. Why? Why are so many people so angry with Donald Trump, that they are lying, name calling, ridiculing, and demeaning him as they do. Either they are afraid, or they know him to be evil.

This is why I feel the need to speak out at this time. I know this man. He is a lot of things, but he is not evil. He is a decent honest guy who loves this country, and who is willing to sacrifice so much of what is left of his life, because he knows that this country needs to be fixed, and that it is going to require someone who can do the job. He just doesn't see anything around him other than political hacks, so he is willing to take this huge responsibility.

I'm not saying that he is the only one who can do the job. My point is simply as to his motivation and his goodness.

This next decade is going to be one of major changes. We all see the climate changing, and the world food supply is getting lower. Our fish stock around the world is running low. Oil prices will cause countries to fail. The Middle East is beyond repair, and we have become weak and ineffective around the world. Donald Trump sees the issues and knows that he can assemble leaders who would have the best chance of fixing things. This is why he is running. He does not need it for his own aggrandizement. He doesn't need another big jet or to take up residence in the White House. He just wants things to be fixed, and he knows that the politicians won't fix anything.

I knew Donald Trump and was close to him in our senior year in high school. I just want you to know that there is nothing to fear from him. His character is as good as it gets. He is a patriot, taking on a heroic task, and being thanked by massive abuse.

If you want to see a true reflection of a man, look at his children. Need I say more?”

Source: https://www.facebook.com/Peter.Ticktin/posts/10205751789135961

ANNOUNCEMENT

The Elite have just told Chaplain Williams everything he has wanted to know for months. Answers – Finally. This information will be made available to you. Please be sure that we know how to contact you by email. Watch lindseywilliams.net for future ANNOUNCEMENTS.

NEW DVD WILL BE RELEASED ON

WEDNESDAY JANUARY 27, 2016!

Precious Metals Are The Only Lifeboat!

The price of gold is down about 11 per cent in 2015 and nearly 45 per cent from its September 2011 nominal peak. Commodity prices are collapsing around the globe amid an economic slowdown. By the Federal Reserve raising rates, it may or may not strike another blow against the gold trade. But, don't tell the gold bugs. The US Mint said it sold 97,000 ounces of American Eagle gold coins in November, marking a 185 per cent monthly jump and a 62 per cent gain from the same period in 2014, Reuters reported. Silver coin demand also surged and already has broken the record it set last year.

Peter Schiff said “The demand is there. It's growing. It's even greater outside the US than domestically … The reality is that there's never been a better time where people should be buying gold than now. Currencies are being intentionally and deliberately debased around the globe, interest rates are at absurdly low levels and likely to stay there for the indefinite future.” He also thinks buying gold and silver is a great way to profit from the coming crises, and he explained that silver whilst having more volatility than gold there is more upside potential in silver relative to gold, given the ratio is very extreme in gold's favor against silver. He also said “I would look in this bull market, when the new bull market resumes, and if gold is $2,000, $3,000, $5,000, wherever it ends up maybe higher than that. I think the appreciation of silver on a percentage basis will be even higher…”

Rob Kirby, a macroeconomic analyst and expert in gold helps his ultra-wealthy clients attain gold by the ton. He says “They can't get enough of precious metals. They scour the earth looking for large amounts of metal … People that I work with represent money so large that they know they're going to end up in the very end game, that they are going to end up with a whole lot of dollars that are going to be worth nothing. They accept that, but in the meantime, they are going to convert as many of those dollars as they can into things that are tangible and are going to maintain value once the world gets it and realizes the US dollar is tapioca and is worth nothing.” Kirby also said “… Gold has a derivative complex, futures and options connected to it where price discovery is nonexistent. People who have an interest in making the dollar look strong can sell paper contracts and keep the real price of gold suppressed.” Can the “powers that be” do this indefinitely? Kirby says, “Not a chance in a finite world. You see, to keep the game running, they need an endless supply of physical precious metal which they don't have. When they run out of physical metal to back up the fraudulent paper exchange, the game runs out.”

Egon Von Greyerz, founder and managing partner of Matterhorn Asset Management AG (MAM) says this about the tight supply of gold and silver “As I have discussed many times, the physical market for gold and silver is very tight. Bullion banks have low stock levels and central banks have leased or sold a major part of their gold. But since they refuse to be properly audited, they are desperately trying to hide the real position. China and India are continuing to buy more than the annual production of gold by the miners. And the supply situation from the refiners is tight with delivery delays for bigger orders.” He also says this about the strength of the US dollar “Gold seems very weak, but that is only in US dollars. In virtually every other currency gold is holding well. That includes the Euro, the Pound, the Canadian dollar, the Australian dollar, the Yen, even the Swiss Franc and of course weaker currencies like the Ruble as well as most others. The dollar is on its last swansong. The strength could last a bit longer but the reserve currency of the world is living on borrowed time. The technical picture for gold is indicating misplaced optimism for the dollar bulls. And fundamentally the most indebted country in the world will soon realize that the road to prosperity cannot be built with printed pieces of paper. No economy that runs budget deficits for over 50 years and current accounts deficits for over 40 years can survive. Retail sales are declining and the major retailers trading is under real pressure. Industrial production is weak and so is housing. Freight and trade is declining fast and these are important advance indicators of economic activity.” On the intrinsic value of paper gold he says “But just like the paper money printing will fail so will the creation of paper gold. It makes absolutely no sense that unlimited supply of paper gold should have any value. I don’t believe that we are far from the point when the paper gold holders will realise that the intrinsic value of their paper is ZERO. The geopolitical situation in the world is also looking very grim. Sadly the war industry is likely to prosper greatly in coming years. And investors in the bubble assets of stocks, bonds and property will see a wealth destruction that they could never have imagined whilst holders of physical gold and silver (held outside the banking system) will maintain their purchasing power and preserve wealth.”

Von Greyerz also said “Gold should not be bought for speculation or for a short term investment. Instead, for the privileged few that have savings, gold should be bought as insurance against a rotten financial system and in order to preserve wealth. But remember it must be held in physical form and stored outside the banking system. When we advised investors in 2002 to put an important percentage of financial assets into gold at $300, our target was $10,000 in today’s money. We still stand by that target as a minimum. The problem for the world is that we are unlikely to have today’s money for very much longer because soon all central banks will print unlimited amounts of money to try save the world financial system from collapsing. But sadly, solving a problem using the same method that caused it will not work and eventually we will see a deflationary implosion of the financial system. But before that we will have a brief period of hyperinflation that in nominal terms could take gold to $100,000 or $100 million.”

38% of all gold in Hong Kong Comex warehouse left on November 13. Roughly 21 tonnes, or 685,652 troy ounces of gold in .999 fine kilo bars, was withdrawn, net of a small deposit of 27,328 ounces, from the Brinks warehouse in Hong Kong. To put that into some perspective, that is the same amount of all gold in the entire JPM warehouse in the US. And that is a potentially dangerous development, especially with respect to a commodity that is being traded at a leverage in excess of 300:1. And in the face of shrinking inventories of gold available for delivery at current prices in both New York and London. And if people should choose to stand for physical delivery given the relative scarcity, how much of a price adjustment might be required if they could even find any to be had without an onerous delay and in sufficient numbers?

300 paper contracts that never result in physical deliver. If the paper contracts were all considered fraudulent, gold would jump in value. $315,000 an ounce?

One of the world's top gold producers says market dynamics may well lead to shrinking gold supplies in the future. Randgold Resources Ltd. CEO Mark Bristow told Bloomberg that half the gold mined today is not viable at current prices. In other words, many mines aren't even hitting their break-even point on half of the gold they dig out of the ground. That means new supplies of gold could begin to dry up in the near future. Amplifying this problem is the fact that many companies have already mined the easily accessible ore on their claims, leaving only gold that will prove much more difficult and expensive to dig out of the ground, according to Bloomberg:

“Gold miners buffeted by the drop in prices are shortening the life of mines by focusing only on the best quality ore, a practice known as high grading, which will restrict future output and support higher prices, according to Bristow. He said in a presentation to bankers in Toronto that the industry life span is down to about five years because companies have been aggressively high grading at the expense of future production.”

The latest World Gold Council Report hints at the coming supply squeeze. Year-over-year quarterly mine production shrank by 1% to 828 tons in the third quarter of 2015.

“The long term indication is that supply will remain constrained as the mining industry continues to proactively manage costs and optimize its operational performance. The reductions in expenditure on activities such as exploration and development will likely have a detrimental effect on production levels in the future.”

Some experts even predict the world will soon reach what is known as peak gold. This means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s.

Chuck Jeannes announced in September that he believes the world will reach “peak gold” either this year or next. Jeannes serves as the chief executive of the world's largest gold mining company, Gold corp, so he certainly understands the dynamics of gold supply. And last April, Goldman Sachs analysts predicted gold production would peak in 2015, saying there are “only 20 years of known mineable reserves of gold and diamonds.”

Meanwhile, gold demand continues to surge. Global gold demand in the third quarter of this year grew a healthy 8%.

Given all the data, it appears the gold industry will soon enter a long-term and potentially irreversible period of tight supply, even as demand remains robust. Investors would be wise to take note of the fundamental dynamics on both supply and demand side of the gold market, and not just focus on the current economic data or most recent Federal Reserve pronouncements.

Asian countries are not only buying up gold, they also have a huge appetite for silver. Chinese imports for silver are on record-breaking pace this year, driven partly by strong demand for jewelry and industrial applications such as solar panels. According to the Wall Street Journal, based on the current trend, Chinese silver imports will top 3,000 tons in 2016, making it the best year since 2011.

“China which accounts for around one-fifth of global silver demand imported 282 tons of the precious metal in October, up 36% year-over-year. Its total imports of 2,678 tons in the first 10 months of the year are already around the same level as achieved in the whole of 2014.”

The Chinese aren't alone in their silver binge. Silver demand in India has remained robust after a record-breaking 2014. India accounts for another 10% of global silver demand.

The bottom line is Chinese and Indians value gold and silver. And once they get it, they are reluctant to let it go.

Right now it takes over 77 ounces of silver to buy one ounce of gold, the so-called gold/silver ratio. So far this century, on average, it has taken less than 60 ounces of silver to buy one ounce of gold. Just get back to that level silver would have to jump 30% higher than today's price. For all of the 20th century it took just 47 ounces of silver to buy one ounce of gold and historically that is 65% higher than today's prices. In 2011, when precious metals prices peaked, the ratio got down to 30/1. To be able to buy one ounce of gold would be 30 ounces of silver. That is 158% higher than it trades today. In 1980 it took just 17 ounces of silver to get one ounce of gold. It makes sense to hold a portion of your investments in physical silver.

China continued adding to its gold reserves and accelerated its pace in November. According to Bloomberg, the Chinese upped their stash of gold an estimated 21 tons in November, the largest increase in at least five months. China announced its gold holdings for the first time in six years in July. Since then, it has continued to buy gold, adding 14 tons in October, 15 tons in September, 16 tons in August, and 19 tons in July. Many analysts say the gold buying spree was part of China's strategy to stabilize the yuan as it pushed for inclusion in the IMF's benchmark currency basket. China isn't the only country growing its reserves of gold. Russia and Kazakhstan are also buying up gold. Central banks and other institutions boosted gold purchases to the second-highest level on record in the quarter to September, according to the World Gold Council. Central bankers recognize the value of gold as a stabilizing force and a traditional store of wealth. Wise investors will follow their lead and buy gold

Axel Merk from Newsmax says in his 2016 outlook to take an alternative look at your investments and diversify your portfolio with underlying assets that aren't highly correlated with one another. He says specifically to embrace gold since gold has been a profitable diversifier in each bear market since 1971, except for the one induced by Paul Volcker in 1980.

Investors around the world continue to wake up to the fact that the collapse of the World's Greatest Financial Ponzi Scheme in history is approaching faster than ever. We are seeing the demand for Global Gold Exchange Traded Funds (ETFs) decline 2011 to 2015 compared to the previous five years, it went negative by 21.2 million ounces. This was in stark contrast to the huge increase in demand for physical gold bars and coins of 208.8 million ounces during the same time period. The same trend is happening in the silver market where investors purchased 994.1 million ounces of physical silver bars and coins during the 2011 to 2015 period compared to 18.2 million ounces in the Global Silver ETFs.

Bill Holter from JS Mineset says “The money worldwide is FAKE. Gold is, has been and always will be REAL money. Gold is God's money. That's what this is about. This is about forcing the population of the world to us FAKE money and the REAL money is being accumulated.” And in a world of increasingly worthless fiat Bill reminds us of one critical fact, “Silver is a no brainer. Silver is the cheapest ASSET on the planet.”

Hugo Salinas Price says “When push comes to shove, China, with 1.3 billion or more population, will take unorthodox measures. The pressure of the enormous population of China, made up of quite intelligent men and women, is going to force its government to stop adhering to international covenants. China will take whatever measures can offer hope to the Chinese. China will then say to the world: “We sell cheap. Very cheap. But, we sell for gold, for very little gold; and we pay with gold for what we buy – for very little gold, but we pay gold. You want our stuff, you find a way to pay us in gold. Or else, what do you have to offer us, in exchange for our stuff? You have something we want – we pay in gold. Rest of the world, do as you please.” The nations of the world are not going to flounder endlessly in the crisis that is upon us. Out of the huge crisis, China will break away and state its terms. And the terms will be: GOLD. The rest of the world will follow.”

Pastor Williams, myself and many financial analysts and reporters as well as Pastor Williams' Elite friend has suggested for some time that owning a significant amount of physical gold and silver. People across the world consider gold and silver money, including the Elite themselves. They have for thousands of years. If our governments eliminate paper currency, you won't be able to store wealth by keeping cash at home or in a vault. You'll have to store all your cash in digital form, at a bank, or another financial institution.

With gold and silver, you can store a portion of your wealth at home or in a vault, outside the banking system. And, unlike cash in a bank, reckless government printing and spending cannot destroy the value of gold and silver.

At $1050 its trading at less than cost of extraction and refinement. Therefore, not too long before gold vaults run dry. The current spot price for gold is no longer workable, we are going to start seeing some high mark-up prices going past peak gold. China is sucking up physical gold for their strategy of inclusion within the SDR and JPM and Comex Hong Kong are virtually empty. Ultimately WHEN, not IF the crash happens, there will not be enough life rafts for everyone. Its only a matter of time before the major crisis hits that will see the SDR unveiled. Those in the know are already cashing out of paper and into tangibles.

Pastor Williams pleaded with you to get prepared by September 15th, 2015. The reason was what was said in this newsletter. It's time to get as much physical gold and silver as possible. Suppose you do not have a local dealer with whom you already have a relationship. In that case, I recommend Birch Gold, an expert in transferring your paper into physical precious metals, whether you have cash or a retirement account, to convert it into gold and silver. They can guarantee delivery within seven business days. Contact Birch Gold NOW before it is too late!

Worldwide Financial Collapse

On Wednesday afternoon Janet Yellen announced that the Federal Reserve would raise interest rates 0.25%. The first raise in interest rates since 2006. She didn't raise them because the economy is strengthening. The economy just happens to be weakening rapidly, as global recession takes hold. The stock market is 3% lower than it was in December 2014, and has basically done nothing since the end of QE3. Janet would have preferred not to raise rates, but the credibility and reputation of her bubble blowing machine was at stake. The Fed has enriched their Wall Street benefactors over the last six years, while destroying the real economy and the middle class. Do not get caught up in the rate-hike hype and the short term impact that it may or may not have on gold prices. No matter what the Fed does, its bullish for gold in the long term. In the meantime, just thank the Fed for extending the opportunity to buy gold for less than $1,100 an ounce – or cost price!

Peter Schiff thinks that the Federal Reserve will immediately lower them again when it becomes clear the economy is in recession in 2016. The quarter point increase will be reversed in short order as soon as we experience market collapse part two. It will be followed with negative interest rates and QE4, as these academics have only one play in their playbook – print money. They created the last financial crisis and have set the stage for the next – even bigger collapse. John Hussman explains how their zero interest rate policy has driven speculators into junk bonds as the only place to get any yield. “Over the past several years, yield-seeking investors, starved for any “pickup” in yield over Treasury securities, have piled into the junk debt and leveraged loan markets. Just as equity valuations have been driven to the second most extreme point in history (and the single most extreme point in history for the median stock, where valuations are well-beyond 2000 levels), risk premiums on speculative debt were compressed to razor-thin levels. By 2014, the spread between junk bond yields and Treasury yields had fallen to less than 2.4%. Since then, years of expected “risk-premiums” have been erased by capital losses, and defaults haven’t even spiked yet (they do so with a lag).”

Last week, a large junk bond fund barred investors from pulling their money out. Third Avenue Management LLC is barring investor withdrawals while it liquidates its high-yield bond fund. This means that investors in the $789 million First Avenue Focused Credit Fund may not receive all their money back for months, if not more. This is reflected by the Wall Street Journal reporting that US junk bonds are down 2% on the year. Echoed by activist investor Carl Icahn renewed his warnings about the high-yield debt market, criticizing a perceived lack of liquidity in junk bond funds. “The high-yield market is just a keg of dynamite that sooner or later will blow up,” Icahn's comments echoed remarks he has made in recent months about the dangers of high-yield debt. If bonds end the year down, it would be their first losing year since 2008. Additionally bond defaults are at their highest level since 2009. Worldwide, companies have already defaulted on $95 billion in debt this year. That translates to 102 corporate defaults, or 42 more than last year (2014). US companies account for over half of these defaults. Moreover, the US energy sector accounts for 26% of global defaults this year. Credit rating agency Standard & Poor's says half of all energy junk bonds are distressed and that means these bonds have a high risk of default.

Shares of gadget maker Apple have fallen 21% from its recent high of $134.54 a share. This has obliterated $160 billion in shareholder wealth. The decline is larger than 477 companies in the S&P 500 are worth. Does this sound like a recovery?

John Hussman explains that the liquidation of insolvent criminal Wall Street banks would have set the country back on the path to legitimate recovery. Instead, the ruling class chose accounting fraud, QE to infinity, and screwing senior citizens with 0% interest rates. “In hindsight, the financial crisis actually ended – precisely – in March 2009. How? The Financial Accounting Standards Board changed rule FAS 157 and overturned the mark-to-market requirement, instead allowing financial institutions “significant judgment” in the way they valued their assets: often called mark-to-model (or as some of us call it, mark-to-unicorn).” He also warned those who chose to listen in 2000 and 2007 about the impending collapses. He has been warning those who choose to listen for months again. This market has gone nowhere in the last 13 months. It’s about to go somewhere, and that is DOWN. Remember 2000 and 2007. Enjoy the trip – deja vu all over again. “In the absence of clear improvement in market internals – and last week was categorically opposite to that – I view the stock market as being in the late-phase of an extremely overvalued top formation that will likely be followed by profound losses over the completion of this market cycle, and the U.S. economy as being on the cusp of a new recession.”

Peter Schiff also believes the inclusion of the Chinese yuan in the IMF's basket of reserve currencies signifies the end of an era for America on the global stage. He also said “… gold prices are going higher, because it's already fully discounted into the market. I believe more rate hikes than are actually going to be delivered have been built into the market. Lots of people have shorted gold on anticipation of a rate hike. They are buying the fact beforehand.”

Leading up to the Federal Reserve's important December decision on whether to raise interest rates, or keep them near zero, the US central banks conducted two emergency secret meetings over the past two weeks in which the public had little disclosure of what was behind the discussions. However, one interesting and perhaps controversial decision that appears to have come out of them is that the Fed has passed a new law on November 30, 2015 which eliminates one of its original 1913 mandates as being the lender of last resort for the banks.

Out of all the functions and programs implemented by the Federal Reserve since the Credit Crisis of 2008, this appears to be the most confusing since it goes against the primary reason why a central bank was instituted back in 1913. And to suddenly change course seven years after the last financial crisis rocked the global banking system by choosing to shut off the liquidity spigot says a great deal about the solvency of the Fed itself. It doesn't mean that the Fed will not lend to banks in times of emergency, but the bank must prove to the Fed it can pay the emergency funding back.

With the Dodd-Frank Banking Reform Act now allowing banks to re-hypothicate its own customer's money and accounts in the event of a liquidity crisis shows that the US central bank no longer has to follow their original mandate of being the lender of last resort since it is now the public that will provide the funds to bail out banks during future crisis. And with this new law being instituted not by Congress, but by the Fed itself, one must ask if the need and purpose of a private central bank is even necessary anymore, since its primary purpose is no longer being used to protect the banking system from bankruptcy or insolvency.

Regular stress tests of all major banks will be carried out to establish risk. As Pastor Williams already said. Big banks need to come up with $1.2 trillion to cushion themselves from the next financial meltdown. Wells Fargo, JP Morgan Chase, Goldman Sachs, Bank of America and four other banks are most affected. JP Morgan, Bank of America, Citigroup among 8 US banks ratings were cut by Standard & Poor's due to Fed's decision to limit emergency funding. Morgan Stanley will eliminate 1,200 jobs (reflecting 2% of Morgan Stanley's total workforce), including 470 fixed-income and commodities traders and salespeople, as Wall Street's outlook for its debt-markets business dims.

This new legislation with legislation that banks cannot declare bankrupt, they can only refinance themselves in the form of a bail-in of depositors monies or be purchased by another bank and the US tax payer is now liable for all derivatives losses of those banks could possibly be setting up the global financial collapse to be bigger than all the other collapses combined.

Macroeconomic analyst Rob Kirby says the US dollar is constantly manipulated by the Treasury. Kirby contends, “I think we are palpably close to major dislocations in the market … China has been selling US securities on an all-out basis. So, the US Treasury market is weak. So, when the Treasury sees this, it runs counter-intuitive to the strong US dollar which has been a rig job from the get go … The strong dollar and swap spreads trading negative are absolutely in opposition to each other. It exposes that something is tragically wrong, and it is something that doesn't make sense. It's like shining light on cockroaches.” Kirby predicts, “I'm guessing the window is four or five months. We are certainly working our way to a blow off event that is going to change our financial universe forever. … These are end game machinations. This is like going to see David Copperfield and he ends up with the biggest illusion of the night. That's what this is. That's what we are seeing.”

In an interview with Finance and Liberty in November 2015, Jim Willie says “The trigger event for the Western banks breakdown will be emerging market debt default. There's been between $5 and $10 trillion of it and it's already started.” Willie said “I think it's an absolute ‘lock' we're going to see a couple trillion dollars in defaults from emerging market nations in the next several months. The Fed is going to be in a very difficult position along with the Bank of England to cover the failed emerging market debt, just like they covered the Wall Street … mortgage bonds.” On oil he said “I think the domestic trigger in the US will be the failures from oil hedges. Outside the US will come from emerging market debt default. The combination is going ti put tremendous pressure on the ‘dollar managers'.” He also spoke about insolvent banks hiding losses “the big banks] profits are not just ‘down', but that their profits are overwhelmed by losses ten times larger – but hidden. We've got a new sub-prime problem that's going to hit the banks. It's for car and student loans. The student loans are now up to $1.5 trillion, and a remarkable statistic is out there … something like 30-40% of graduates are not finding a job, so they're facing default.”

In June auto sales had reached 10-year highs on record credit. In short, the “renaissance” in US auto sales is being driven by increasingly risky underwriting practices and is leading directly to the securitization of shoddier collateral pools in a return to the “originate to sell” model that drove the housing bubble over a cliff in 2008. Thomas Curry Comptroller of the Currency recently stated “what's happening in the auto loan market reminds me of what happened in mortgage-backed securities in the run-up to the crisis.”

According to top trends forecaster Gerald Celente, 2016 is going to be very rough. Celente says “Global recession, and it's already happening, all they have to do is open their eyes and open their ears. Iron ore, copper, aluminum, nickel, zinc, one after another from wheat to dairy products to corn. When you look at the Bloomberg Index, it's down to 1999 levels on average. What is that telling us? There is too much product and not enough demand. It's the same thing with oil. There's too much production and not enough demand. What we are looking at is a global slowdown because commodities are the canary in the mine shaft.”

Celente says all this is signalling another financial bust bigger than 2008. Celente explains, “So, what you have is a bubble, a debt bubble that has grown to $220 trillion worldwide since this fake quantitative easing and negative interest rate schemes that have gone on with central bank after central bank … You can't make this up. Interest rates and negative yields have never happened before in the world. This is brand new. They are over their heads and out of their league. They don't know what they are doing. They are making panic decisions trying to keep the Ponzi alive.”

On global war, Celente says, “Unfortunately, when all else fails, they take us to war. Look, go back to 1929 and the market crash. You had market crashes, Great Depression, currency wars, trade wars, world war. Voila, here we are again. Panic of '08, Great Recession, currency wars, world war … When the market collapses, the war talk will heat up.”

Gold and silver are running counter to other commodities. Why? Celente says, “Demand is up for gold and silver. To me, it is the ultimate safe haven. I've been saying since 2012 and 2013 that the bottom for gold is about $1,050 an ounce. I gave that number out because that's about what it costs to pull it out of the ground. Gold is about planning for the worst.”

So, is the spike in gold and silver demand a precursor to the next crash, which Celente is predicting to be coming soon? Celente says, “I totally believe so. It's definitely worse now. Look at the bubble they created. If there is a terror strike, they will use this as the excuse to rob us to try and mitigate the disaster that they have caused. I believe they will declare a bank holiday and devalue the currency. That's the way they are going to get us out of this.”

Analyst and trade Karl Denniger predicted years ago that Obama Care would “kill the economy” and “eventually implode”. That is exactly what is happening now. Denniger contends, “The majority of the money we spend in healthcare is jacked up due to these monopolist policies which raise the cost four or five times where it ought to be. On top of that, we are being forced to pay for people who have made lifestyle choices that dramatically raise their cost of healthcare. The health insurance people are faced with an untenable problem because if the only people who buy car insurance wreck one car a year, the cost of car insurance is $20,000 a year because that is the cost of the car.” Denniger goes on to point out, “The rate increases that are coming down this year are astronomical. I am seeing rate increases as high as 50% for inferior coverage. Benefits come off your top line as an employer. So, all this means much slower growth if any at all because all this money is being siphoned into the health insurance and healthcare system.”

With the economy sinking in part due to Obama Care, is the Fed going to raise rates soon? Denniger says, “Janet Yellen doesn't have any choice but to raise rates. We have an emergency policy rate right now that is destroying the pension funds and the insurance companies in this country. This is where the pressure is coming from. It has nothing to do with the economy. It has everything to do with fixed income bond ladders. That is a mathematical problem that Yellen has to confront. She certainly is going to take a lot of heat, but rates are going to go up.”

Denniger also accurately predicted “It's going to be a quarter of a point, and everybody will scream but it does not mean anything from an economic perspective. What it does is it signals to the market that the game of rolling down interest rates is over, and increasing systemic leverage, that era is over. It is mathematically certain that it has ended. So, how long does the bubble remain? Where do we go from here? Not in a positive direction.”

Raising interest rates will restore some credibility in the short-term. However, the Federal Reserve risks squeezing itself financially, along with the rest of the world, due to the rising cost of borrowing. The decision could eventually create disastrous consequences when it comes to managing the US debt – perhaps sooner than the Fed would anticipate. Whatever decision the Fed made, it doesn't benefit itself or the economy. Even Billionaire Sam Zell warned that the Fed is too late, “Recession Likely In Next 12 Months”.

As Karl Denniger stated, and Pastor Williams and myself have said for quite some time now, low interest rates harms retirement funds. In order to keep paying out retirees, pension funds need good returns and therefore they needed the interest rate hike. 0.25% is a start, but we'll see in early 2016 if this was a mistake. Already the world's largest pension fund Japan's Government Pension Investment Fund posted a $64 billion loss. How long before other retirement funds post losses?

Trader and analyst Gregory Mannarino says this about the surging stock market, even know the economic and geopolitical news is bad “Forget about the stock market. It has absolutely disconnected from reality in every way, shape or form you can think about. We are now existing in economic fantasyland. The market top from May has held so far. Will it continue to hold? Here's what I'm thinking now. I do believe it has the potential to hold, but why is the market up on the shooting down of this Russian jet and helicopter? Because they are expecting the world central banks to do something. We have terror all over the world and war building up. This is going to give them an excuse to print and stimulate. That is going to have an effect on the markets, and that is why its higher.”

Financial expert and expert in the federal budget and a former Assistant Housing Secretary Catherine Austin Fitts says this about the biggest financial problem the world faces “The reality is the big mother lode on the whole planet, whether you are talking about derivatives, the bond market or the stock market, is the U.S. federal budget. What is slowly begging to happen is the dawning realization that we are not only going to have to re-engineer and cut the federal budget, but we are talking about reinventing the U.S. economy. There are going to be extraordinary choices, and this is why nobody wanted to be the Speaker of the House. Paul Ryan did not want to be the Speaker because Paul Ryan knows this is coming. They will probably be able to delay it until after the election (2016), but then after the election, we’re going to have to sit down and say we can’t keep doing this. Why is this relevant? All the markets globally work off the federal budget. It is extraordinary the amount of cash flows and credit that work off the federal budget. The credit and cash flows coming out of that budget are enormous. The reality is it is going to have to be re-engineered. That’s going to be a very shocking experience for many people.”

Richard Russell, founder of Dow Theory Letters said “The end of capitalism will be due to the unbelievable amount of debt that is currently being created. This will create monster inflation that will destroy every currency. The only currency that cannot be destroyed is gold. When investors realize this, we'll have the makings of the greatest bull market in gold ever seen.” Jim Rickards, writing in The Daily Reckoning newsletter said “The military and intelligence communities are absorbing the new reality, but most investors are still behind the curve. Traditional stocks and bonds are digital assets that can be hacked, wiped-out or frozen with a few keystrokes. It's important to allocate part of your portfolio to physical assets that cannot be wiped out in financial warfare. These assets include silver, gold, fine art, land, rare stamps, cash (in banknote form, not bank deposits) and other physical stores of value.”

Renowned money manager Eric Sprott is still very bullish on physical gold and silver. Why? Sprott procaims “The US is broke … About a thousand professors have signed up and told Congress you’ve got to deal with this issue, and it is immediately ignored, but it is by far the biggest issue. It’s not just government. It’s corporate pension plans, and state pension plans and all these unfunded obligations where everyone thinks they are going to receive something only to find out that they are not going to receive something … We can’t keep extending and pretending and suggesting everything is great. Unfortunately, someone is going to pay the price, and I am not sure when the price is going to be paid. The analogy I use is we all knew ten years ago that Detroit was broke. It was so mathematically certain that you knew what was going to happen. The same thing will happen to the United States.” On his physical gold and silver investments, Sprott says, “I don’t lose any sleep over the price of gold going down in the sense that I believe what I believe. I believe it’s been manipulated. It’s very much about currency and economics of the Keynesian scheme that we’re going to spend money, print money and it’s all going to work. It’s not working. I don’t want to wait and find out the day it falls apart because when it falls apart someday, then it will be too late. I want to be positioned beforehand.” Sprott predicts, “There has to be a collapse. It will be way bigger than 2008. We had a debt problem in ‘07 and ‘08 and the debt has exploded.”

Larry Edelson said that the stock market was looking bearish and that “all available evidence tells me that U.S. and European stock markets are now a recipe for disaster.” He announced FIVE problem areas: FIRST, has been accompanied by declining volume. When a market rises and volume simultaneously declines, it's a bearish sign. SECOND, most stocks traded — both here and in Europe — are actually declining. There are very few leaders pushing the major indices higher. In fact, as I pen this column, here in the US. Of all publicly traded stocks – 44.63% or fully 6,442 are now down at least 10% year-to-date – While a whopping 36.9% or 5,204 are down more than 15%. And only 32.5% are actually up for the year. 77.5% of all publicly traded U.S. stocks are either flat for the year or down more than 10%. THIRD, of the stocks that are actually advancing, their numbers are also shrinking. Also a very bearish omen. FOURTH, most other indices are actually down for the year. The Dow Transports are down 10.2%. The Dow Utilities, down 3.5%. The Russell 2000, down 2.5%. FIFTH, total margin buying of U.S. equities — according to latest data (Sept. 30) — stands at a whopping $454 billion, just a tad below record highs. His answer to these five problem areas is “If you're heavily invested, just get out now.”

The Bloomberg Commodity Index is now trading lower than it did in 2008, and after 9/11. This is a stunning collapse in compdities prices. Companies like Anglo-American, are announcing layoffs. Anglo is laying off 85,000 people, 2/3rds of the company. China just announced over 100,000 coal miners to be laid off. Also, in November it was a record month for China in terms of the pace of its liquidation of foreign exchange reserves. The People’s Bank of China reported on Monday, December 7 that foreign exchange reserves, which mostly consist of U.S. Treasury debt, dwindled by another $87 billion in November. This constitutes a stunning 2.5% drop in one month.

Brazil is sinking deeper into its worst economic crisis in decades. It's economy shrunk by 4.5% during the third quarter, according to government data released recently. It was the biggest quarterly decline since Brazil started keeping GDP records in 1996. Its economy has shrunk three quarters in a row. The downturn is only getting worse. Brazil's economy is spiraling into a a full-blown depression. Since July 2014, Brazil's currency has lost 41% of its value against the US dollar. Meanwhile, Brazil's annual inflation rate just topped 10% for the first time in 12 years. And the country's unemployment rate hit a six-year high of 7.9% in October.

China's slump is one reason why Brazil is unraveling. China's economy grew 9.7% per year from 1990 through 2014. In 2010, China became the world's second-largest economy. During this time, China's explosive growth helped boost the global economy. China needed a lot of raw materials to build its infrastructure. This helped countries, like Brazil, that export those materials. In fact, China's rapid growth helped Brazil become the seventh-largest economy in the world. But, China's economy is slowing now. Last year, China grew at its weakest pace since 1990. That's creating big problems for Brazil.

Brazil sends 19% of its exports to China. That's more than it sends to any other country and nearly twice as much as it sends to the US. China's slowing economy means it's building fewer factories, office buildings, and bridges. That's hurting demand for Brazil's largest exportL iron ore, the main ingredient in steel. Iron ore accounts for 19% of Brazil's exports. It's by far the country's largest export.

The US economy also appears to be slowing down. According to the Wall Street Journal, spending on capital goods fell 3.8% during the first 10 months of 2015. Capital goods include equipment and machinery. Meanwhile, business investment only grew 2.2% during the third quarter. That's one of the smallest increases since the Great Depression, according to the WSJ. The energy sector is a big reason those figures are so weak. As you likely know, energy prices have plummeted. The price of oil has dropped 40% over the past year. And the price of natural gas has dropped 34%. Energy consulting firm Wood Mackenzie estimates that North American oil companies have cut spending by $220 billion since last summer.

US exports fall to the lowest level in three years. The US trade deficit climbed 3.4% in October as exports of American-supplied goods and services fell to the lowest level in three years. The gloomier trade picture, the result of a strong dollar and weak global growth, is likely to weigh on the US economy again in the fourth quarter. A higher deficit subtracts from GDP. Exports dropped 1.4% to $184.1 billion, hitting the lowest level since October 2012. A strong dollar had made it more expensive for US companies such as manufacturers to sell goods and services to foreign customers. A weak global economy has also made it harder for customers outside the US to buy American goods. US imports also dipped, down 0.6%, though most of the decline stemmed from the cheaper oil. The value of US oil imports was the lowest since 2003. Similarly, the gap between how much petroleum the US imports and how much it exports also slide to $4.5 billion, the lowest deficit since 1999. The falling petroleum gap largely reflects a surge in US oil production owing to fracking.

The WSJ also reported that companies in other sectors are dialing back investments as well. The industries that are pulling back range from retailers and manufacturers to energy companies and service firms. Major retailers such as Macy's are cutting back on spending. Macy's Inc. plans to close 35 to 40 stores early next year, joining J.C. Penney Co. and Abercrombie & Fitch & Co. among retailers announcing cutbacks this year.

Based on credit card data, this holiday spending period is a disaster. Following disappointing sales over the Black Friday to Cyber Monday weekend, there has been absolutely no follow-through momentum as is usually seen. Chain store same-store-sales crashed 6.3% week-over-week. It appears that shoppers were sated after the hefty promotions offered in the prior week associated with Black Friday. There may also have been a drop off in brick-and-mortar shopping activity while many online retailers were offering deals for Cyber Monday.

Companies buy more equipment and machinery when they're optimistic about the economy. They cut back on spending when they think the economy is slowing. Right now, declining business investment is one of the many signs pointing to a slowing US economy.

The ratio of inventories to sales rose slightly in October to the highest level since the recession, a potentially worrying sign that companies are having trouble selling what they are producing. The ratio of inventories to sales rose to 1.38 from 1.37, the highest since 2009, the Commerce Department reported on Friday. Generally speaking, a rising ratio is not healthy, unless companies foresee an acceleration in demand. Business inventories were flat in October, as manufacturers and wholesalers slightly reduced stockpiles while retailers added to them.

The Baltic Dry Freight Index has collapsed to all time lows at a time of typical seasonal strength for freight and thus global trade around the world, Reuters reports that spot rates for transporting containers from Asia to Northern Europe have crashed a stunning 70% in the last few weeks alone. This almost unprecedented divergence from seasonality has only occurred at this scale once before… 2008!

More evidence is revealed each week that the unexpected is happening. Instead of economic strength and robust growth, economic fundamentals are breaking down. Manufacturing is slowing. Consumer spending is soft. For additional edification, just look at copper, iron ore, or aluminum…

In the UK retail sales are flatlining, the CBI Industrial Trend Survey is down, consumer confidence is down, manufacturing output is down and the trade deficit in goods has ballooned last year to £134 billion.

IMF director, Christine Lagarde, has been recklessly advocating for a wholesale seizure of 10% of all accounts in the Eurozone, but because there may be riots and even a revolution if there are wholesale bail-ins, the IMF has settled on a more incremental plan of economic subjugation in which a 10% tax will be implemented against all bank account holders in order to pay down the debt. What the IMF and the central bankers are not telling you is that the debt can never be paid down because the primary source of the debt comes from the derivatives market which totals a minimum of one quadrillion dollars. In short, these bankers are merely trying to stay one step ahead of the burning bridge by stealing your pensions and bank accounts. And does anyone truly believe that these bankers will stop at looting just 10% of your bank account? When does 10% become 20%, which becomes 30%, which becomes 100%? This will be followed by the bankers issuing neo-feudalism syle of welfare to all citizens. Mark my words, the 10% “tax” is just the starting point.

The IMF Report states “The tax rates needed to bring down public debt to precrisis levels, moreover, are sizable: reducing debt ratios to end-2007 levels would require (for a sample of 15 euro area countries) a tax rate of about 10 percent on households with positive net wealth… Simulations show that maintaining the overall budget at a level consistent with the IMF staff's medium-term advice would bring the average debt ratio to about 70 percent of GDP by 2030, although in a few countries it would remain above 80 percent. However, the large debt stock, the uncertain global environment, weak growth prospects, and the absence of well-specified medium-term adjustment plans in systematic economies like Japan and the United States complicated the task.”

The FDIC has only about $25 billion in its deposit insurance fund, which is mandated by law to keep a balance equivalent to only 1.15% of insured deposits. If a banking collapse were to be on the near horizon, the bankers are not going to notify you because they would not want to incite a bank run. With only 1.15% of all deposits being insured by the FDIC, your money would be left vulnerable and only the Elite would be warned as they quietly transfer their money to a safer haven. During the Gulf oil spill, it was revealed that Goldman Sachs issued a “put option for preferred insiders” in Transocean (the owner of the Deep Water Horizon oil rig) and the Elite had their stock profit margin guaranteed while everyone else took a financial bath. This is the undeniable pattern of the global Elite.

Additionally your bank account has been collateralized against the derivatives debt. The bankruptcy reform laws stemming from the Bankruptcy Reform Act of 2005, derivatives counter-parties are given preference over all other creditors and the customers of the bankrupt financial institution, including FDIC insured depositors. This gives what the experts say “super priority” in terms of the line of succession from which to collect bankruptcy monies. Bank of America has conspicuously co-mingled their derivatives debt with your savings account and as such they have every legal right to use your money to cover their debt. During the MF Global debacle, the reson that MF Global customers lost their segregated account funds because the MF Global debt load was caused primarily because of their derivatives debt which, under bankruptcy laws, gave derivatives claimants super-priority in the bankruptcy proceedings.

If you move to withdraw the bulk of your money, there are three federal banking laws that you should be aware of, namely, Cash Transaction Report (CTR), a Suspicious Activity Report (SAR) and structuring. CTR. Federal law requires that the bank file a report based upon any withdrawal or deposit of $10,000 or more on any single given day.The law was designed to put a damper on money laundering, sophisticated counterfeiting and other federal crimes. Structuring and SAR. It is a federal crime to break up transactions into smaller amounts for the purpose of evading the CTR reporting requirement. In these instances, the bank is required to file a SAR which serves to notify the federal government of an individual’s attempt to structure deposits or withdrawals by circumventing the $10,000 reporting requirement.

JP Morgan Chase is banning wire transfers from their bank to foreign banks to prevent American capital flight which will surely happen as America wakes up to the desperate situation that the banks are in. The bank is also prohibiting any cash withdrawals of $50,000 or more. HSBC followed suit and its highly likely that all five megabanks will enact the same policies in the near future.

It is getting increasingly difficult to get away from the system. Even if you were to leave the country, it is becoming much more difficult for your money to come with you. There is a war on cash and it is becoming increasingly difficult to barter without a paper trail. If you have taxes outstanding the government can restrict your passport until those taxes and fines are paid. Obama quietly signed H.R. 22 into law and deep within those pages is a provision giving the government the authority to revoke your passport if they believe in their sole discretion that you have “seriously delinquent tax debt”. You have no alternative but to work with the system. However, one thing you must do immediately is no longer be faithful to just one banking institution. Open multiple accounts and spread your risk. Do not focus on just large banking companies also investigate small institutions, but make sure you do your due diligence. Keep just enough money in your bank accounts to pay regular bills and keep some in cash at home because with the introduction of negative interest rates the banks you will pay the bank to hold your money. Buy a safe and security system to secure your home. If your state allows, it may also be wise to arm yourselves as I have heard certain states police no longer have the ability to protect its citizens. Obviously when the crash does occur the US dollar may be worthless until the currencies of the world are reset and the new world currency is revealed. Therefore, for cash in excess of a few thousand dollars it would be better to invest any excess in tangible items such as physical gold and silver that you can sell or trade at a later time. Keep some physical gold and silver at home and some in a vault. Certain gold dealers have the ability to store physical metal offshore in such jurisdictions as Singapore, which has very good banking secrecy. However, as we have already proven, things can change rapidly in the global political and financial arena so continue to keep abreast of latest developments worldwide.

You have two choices, wait and see what happens or sell your worthless paper and invest in gold, silver, fine art, land and other tangible items. It is up to you, we can only share the facts of what is happening. Plan for the worst. This is what Pastor Williams has been telling you.

New World Currency Announced

In October 2015 the New World Currency was not officially announced. It was expected that the IMF would announce a reserve currency alternative to the US dollar. However, on November 30th, 2015 the Chinese Renminbi was approved by the International Monetary Fund (IMF) as a Main World Currency and will be included in the Standard Drawing Rights (SDR) basket from October 1st, 2016 with a 10.92 percent weighting, which is nationalistically greater than Japan's Yen and Britain's pound. This heralds a giant step towards the end of the US Dollar as the sole world reserve currency. However, that being said whilst the British pound's weight in the SDR will fall from 11% to 8%, the Japanese Yen from 9% to 8% and the Euro from 37% to 31%, conspicuously absent from this list of demotions is the US dollar, which remains a rock-solid 42% weighing. But, does the weighting really matter?

Does the public announcement of a new reserve currency really matter when many countries are already no longer using the US dollar to trade? The US dollar has been the dominant reserve currency since the end of WWII, on terms that were dictated by the US government practically by gunpoint. In the decades since, they have continually and viciously abused this privilege, violating the trust of the rest of the world. It's no wonder why there is now so much demand for an alternative. This has happened so many times throughout history. Dominant reserve currencies come and go.

On October 8, 2015 China launched its own cross-border Yuan payments system. Currently most global payments are handled by SWIFT (Society for Worldwide Interbank Financial Telecommunication). The new and streamlined China International Payments System (CIPS) is modelled on the US Clearing House International Payment System. The new system will thereby bypass the US dollar for international financial transactions. Russia is already developing their own SWIFT alternative based upon CIPS success and in time, this will be rolled out amongst the other BRICS nations. When sanctions threatened to cut off Russia from SWIFT, one of its top bankers said it was the equivalent of a declaration of war.

The BRICS nations have also created the BRICS New Development Bank (NDB) and China’s Asian Infrastructure Investment Bank (AIIB). These developments are expected to protect BRICS from exchange rate volatility. We must also mention that Russia and China have already signed a deal to bypass the US dollar for oil trading.

Gulf Arab states are also planning along with China, Russia, Japan and France to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese yen and Chinese Yuan, the euro, gold and a new, unified currency planned for nations in the Gulf Co-operation Council, including Saudi Arabia, Abu Dhabi, Kuwait and Qatar. Iran has also announced that its foreign currency reserves would be held in euros rather than US dollars and Russia has included the Chinese yuan in its reserve currency basket to boost the yuan's presence in the Russian financial market.

With regards to Gulf Arab States planning to end dollar dealings, Standard and Poor’s has downgraded its sovereign credit rating for Saudi Arabia. According to figures published by the IMF this year, the kingdom’s budget deficit will hit $130 billion this year. The IMF has also warned that Saudi Arabia could be bankrupt within the next five years if the government maintains its current policies. The crude price decline has prompted the government to cut spending, delay projects, and sell bonds. The kingdom’s finances are depleting at an alarming rate by continued subsidies, hand outs to public sector workers in order to keep dissent in check, the deadly aggression against Yemen, and a patronage system that has expanded over years. As soon as sanctions against the Islamic Republic of Iran are removed, they will pump even more oil into world markets that will further reduce the price. The fall of the House of Saud is inevitable. As Pastor Williams Elite friend has said, Saudi Arabia will be the last regime to fall. On another note the UN granted Saudi Arabia the chair of a key UN Human Rights Council panel, Saudi Arabia has put to death well over 100 people so far this year. What does this tell you about the UN? But, I digress…

There may have been no official announcement of a new global currency, the Global Currency Reset, according to Pastor Williams’ Elite friend there has been a backlash by several countries which could see their economies severely impacted from such a reset. It is possible there will not be a reset. It may go straight to the new world currency that would also include physical gold, hence many countries converting US debt to physical gold. That doesn’t mean that the GCR will not go ahead, but it may go ahead under considerable revision especially due to a world-wide collapse of the financial markets that would see the IMF step in and announce the SDR as the world reserve currency, whilst resetting currency rates based upon asset to debt ratios. It is also possible that because of political red tape at the IMF several countries around the world are going ahead with major financial changes that will affect the global financial market without the IMF.

Speaking about a revised Global Currency Reset, the UN Conference on Trade and Development (UNCTAD) has said the system of currencies and capital rules which binds the world economy is not working properly, and was largely responsible for the financial and economic crises. It added that the present system, under which the dollar acts as the world's reserve currency, should be subject to wholesale reconsideration. Although a number of countries including China and Russia have suggested replacing the dollar as the world's reserve currency, the UNCTAD report is the first time a major multinational institution has posited such a suggestion. In essence, the report calls for a new Bretton Woods-style system of managed international exchange rates, meaning central banks would be forced to intervene and either support or push down their currencies depending on how the rest of the world economy is behaving.

The proposals would also imply that surplus nations such as China and Germany should stimulate their economies further in order to cut their own imbalances, rather than, as in the present system, deficit nations such as the UK and US having to take the main burden of readjustment. “Replacing the dollar with an artificial currency would solve some of the problems related to the potential of countries running large deficits and would help stability,” said Detlef Kotte, one of the report's authors. “But you would also need a system of managed exchange rates. Countries should keep real exchange rates [adjusted for inflation] stable. Central banks would have to intervene and if not they would have to be told to do so by a multilateral institution such as the International Monetary Fund (IMF).

Recently the Chinese president visited the United Kingdom (the main financial center of the world), there was so much fawning over China by the British government and British Royal Family that 40 billion pounds ($62 billion) of deals have been made including: Nuclear power project, automobiles, theme parks, financial center, healthcare, oil and gas, cruise ships, aircraft engines and insurance industry. China’s president Xi said “With growing interdependence and interwoven interests, countries in the world are increasingly becoming a community of shared future.” With closer ties to China and BRICS, is the UK hedging its bets against continuing control of globe by the US? After the visit to the UK by the Chinese president, the US warned the UK not to leave the EU stating the UK would face barriers trading with the US due to the Transatlantic Trade and Investment Partnership (TTIP) between the EU and USA.

This closer tie with Britain includes the founding of the Bank of China Trading Center (London). The Bank of China is committed to developing London as the world’s leading offshore Renminbi (RMB) center “through promoting the economic and financial cooperation between the two countries and acting as a long-term and trusted partner and financial advisor for all global customers involved in China related business.” This goes hand in hand with the China Construction Bank joining HSBC, JPMorgan Chase, Mitsui & Co Precious Metals, Bank of Nova Scotia – ScotiaMocatta, Toronto Dominion Bank, and UBS in taking part in the daily auction process hosted by CME Group and Thomson Reuters for the silver price-setting mechanism. Eastern markets continue to play an increasingly important role in global finance, and the Chinese are steadily positioning themselves to become essential to the international gold and silver trade.

Before Ken From died he said that China was the “Big one – Watch China.” Is it possible that he was not talking about the crash of China, but the global expansion of China?

China has called for a New Global Reserve Currency to Replace the Dollar. Gov. Zhou Xiaochuan recommended creating a currency controlled by the International Monetary Fund and made up of a basket of global currencies. Xiaochuan said the move would help “to achieve the objective of safeguarding global economic and financial stability.” Earlier in October, the Yuan passed the yen to become the fourth most-used currency for global payments and is very much one of the reasons why the IMF has chosen to announce China's currency as part of the SDR. China has been stockpiling gold as part of its strategy to raise the stature of the Yuan on the world stage. After announcing its reserves for the first time since 2009 in July 2015, the world’s largest consumer of gold has upped its holdings steadily. The Chinese gold stash increased another 1% in September 2015.

The IMF has two major criteria for admission into the SDR:

- The country must be a major trading nation. China easily passed.

- The currency must be “freely usable”. China has passed this test too. China is rapidly closing in on the British pound in third place (the US dollar and the Euro occupy the top two spots). Over 1,000 banks in 100 countries use the Yuan for payments with China – up 20% over the past two years. Trading in Yuan was almost non-existent five years ago when it was looking to enter the SDR before, but today ranks among the most globally traded currencies.

There is no doubt that the United States was against its inclusion. However, its power is limited. China gained over the threshold of 70% approval from IMF shareholders. The US had a voting share of 16.7%, so it alone could not block China’s entry. Plus, it’s unlikely that the US wanted a repeat of the embarrassment of its opposition to the China-led Asian Infrastructure Investment Bank (AIIB). Despite its opposition, most US allies joined the AIIB anyway.

A word of warning and potential risk to the global financial markets is, IMF inclusion of the Yuan could trigger $1 trillion of inflows into the Yuan, as central banks add the currency to their reserves. It is unsure how the Yuan would be included, there are current reforms of the SDR currently under way that would allow multiple SDR’s that would take the politics out of reserve currency determination and let the market decide the basket. However, what the Chinese do not want is for these new found buyers of the Yuan to send the currency soaring beyond its pre-devaluation levels, thereby slamming the Chinese economy further which could result in a full-blown global crash. China is a parallax economy. From one position China appears to be in a massive financial crisis thanks to a bursting credit bubble that has the potential to drag most of Asia, and possibly the world, into an era of massively depressed trade and asset prices. From another China has already become the world's second largest economy, and has accumulated more savings than every other nation on the planet.

Financial writer and gold expert Bill Holter says “China used fiat debt to build real infrastructure, and when the system blows up, the fiat debt blows away and they are left with infrastructure. Do they have 20% bad loans? They very well could and probably do. If that is true that they are going to have a debt blow up, don’t forget China has been importing big tonnage of gold for years now. Over the last five years, they have imported 9,000 tons of gold. Their way out is the old way out. The old way out was to revalue gold higher. They could revalue gold and step up and say they will pay $50,000 or $100,000 per ounce for any and all ounces for sale. You can’t say there is not enough gold. What you can say is that it’s not priced correctly to support the system. If they have an implosion of debt which leaves their balance sheets impaired, the way to recapitalize the balance sheets is to revalue the price of gold higher. It creates capital, in other words.”

China are backing their currency with gold and real infrastructure assets since “gold forms the very material basis for modern fiat currencies.” and Gold is the world's only monetary asset that has no counter party risk, and is the only cross-nation, cross-language, cross-ethnicity, cross-religion and cross-culture globally recognized monetary asset.

Gold is a monetary asset that transcends national sovereignty, is very powerful to settle obligations when everything else fails, hence it’s exactly the basis of a currency moving up in the international arena. When the British Pound and the USD became international currencies, their gold reserve as a share of total world gold reserves was 50% and 60% respectively; when the Euro was introduced, the combined gold reserves of the member states was more than 10,000 tonnes, more than the US had. If the RMB wants to achieve international status, it must have popular acceptance and a stable value. To this end, other than having assurance from the issuing nation, it is very important to have enough gold as the foundation, raising the ‘gold content’ of the RMB. Therefore, to China, the meaning and mission of gold is to support the RMB to become an internationally accepted currency and make China an economic powerhouse.

As was stated above, China wants to found the Bank of China Trading Center in London, UK. China Construction Bank is also taking part in the daily auction process for the silver price-setting mechanism. The Chinese are also establishing a Gold bank. This is to break the barrier between the commodity and monetary world. It is designed to acquire more reserves and gives China more say and control within the gold market. When Pastor Williams says the new world currency will be GOLD BACKED. It is true as that is what China has done to secure its place within the SDR basket. “Gold & Silver, that's the currency of the Elite!”