Articles

Lindsey Williams Articles

Stocks Began Falling Right At This Time Of The Year Just Prior To The Last Financial Crisis

How well do you remember the financial crash of 2008? Did you know that stocks began falling right at this time of the year prior to the last financial crisis? Traditionally, the period from May through October has been a time of weakness for stocks. On average stocks hit their lowest point of the year on October 27th. Most people don’t remember this, but the Dow Jones Industrial Average actually began plunging right at this time of the year just prior to the financial crisis of 2008. Most people do remember the huge stock crash that happened in the fall of that year, but the market actually started to slide in May. Throughout the first four and a half months of 2008, stocks moved up and down in a fairly narrow range, and on May 19th 2008, the Dow closed at a peak of 13,028.16. From there it was all downhill for the rest of the year. Just checking the Dow right now and the Dow peaked at 18,312.39 on May 19th 2015. On the 8th June 2015 the Dow has fallen to 17,766.55 a fall of 545.84 (2.98%).

The VIX (which is a closely watched measure of market volatility) has just jumped by the highest percentage we have seen so far in 2015. A rising volatility is not a good sign. The US dollar index is surging once again. We just witnessed the largest seven day rise in the US dollar index since the collapse of Lehman Brothers. Based solely on history, this is another indication that trouble is ahead.

US exports have fallen for four months in a row, when exports start going negative for a few months it is warning that we may be entering a recession.

September 13th 2015 – The Feast of Trumpets, end of the Shemitah year, the 29 of Elul

September 25th 2015 – UN Agenda signed, Pope visits NY

September 28th 2015 – Blood Moon

The first day of Shemitah was September 25th 2014. In two weeks the market lost 735 points. The the Shemitah year ends on September 13th 2015. Why compare the end of this Shemitah cycle with the end of the last one? The answer is to be able to learn from it. Looking back, there were so many warning signs leading up to the financial crisis of 2008, but most people totally missed them. Now, many of those same signs are appearing again and they are still being missed. Please realize that the global financial system is in far worse shape than it was in 2008. Debt levels all over the world have exploded over the past seven years. From the last recession, in the United States, our national debt has doubled (9 to 18 trillion dollars). At this point it is mathematically impossible to pay it off. Experts say we are in the midst of the greatest stock market bubble of all time, the greatest bond bubble of all time and the greatest derivatives bubble of all time.

All over the planet, large banks are massively overexposed to derivatives contracts. When this derivatives bubble finally bursts, there won’t be enough money in the world to bail everyone out. The key to making sure all of this does not start collapsing is for interest rates to remain stable. Christine Lagarde, Managing Director of the International Monetary Fund (IMF) has said that the Federal Reserve should hold off raising rates until at least 2016. However, the problem is what is happening in Greece.

After years of intervention by the Troika (European Commission, European Central Bank and IMF) what is happening in Greece is a clear sign to the financial world that no nation in Europe is truly safe. Greece has just put back repayment of its loans until the end of the month. Greeks have been pulling their money out of the banks so the banks’ assets have dropped and liabilities ratios have increased. In April, private sector deposit outflows amounted to approximately 5 billion euros. The question is could people in the USA lose confidence in the banks and start pulling their money. This would put tremendous pressure on banks here and they are already hanging on a thread. Capital controls are now being brought in across Europe limiting the amount of money someone can withdraw at one time. If the Greek government were to default on their loans, the Greek banks surely could no longer be assumed to be solvent. They are holding large amounts of Greek government debt and have been financial a lot of the government’s stop-gap issuance of short-term bills. The ECB would clearly overstep its bounds if it were to continue to raise the ELA ceiling after a Greek default. If the ECB stops funding the Greek banks via this mechanism, a further acceleration in the ongoing bank run has to be expected. It is possible that Bond yields will start spiking in Italy, Spain, Portugal or Ireland and all over the rest of the continent. By the end of it, we could be faced with the greatest interest rate derivatives crisis we have ever seen.

As we have seen the payment due on 5th June 2015 didn’t happen. Three further payments in June 2015 have been postponed until the end of June. The Greek interior minister explained during a television interview “The money won’t be given – it isn’t there to be given”. If Greece is allowed to fail, it would tell bond investors that their money is not truly safe anywhere in Europe and bond yields will spike. If interest rates start spiking this could create serious problems in the financial world. It isn’t going to take much to topple the current financial order. We’re looking at 2008 multiplied by a hurricane. Once one domino falls, the rest will topple quickly behind it.

It may not be Greek debt default that starts the domino effect that will circle the financial markets of the globe. It may be interest rate increases or the bankruptcy of another bank. They will try and hold it together that little bit longer, but eventually the house of cards will fall. What are you going to do when this happens?

Gold Is A Safe Haven!

Now that the Elite have confirmed the financial crash for between September and December 2015 you have no other choice other than to secure your investments. You maybe have three months to protect yourself. But, it may come sooner – the bond market has already started to crash. Please take the advice of Pastor Williams and buy physical gold and silver. Gold and silver are safe havens within periods of economic uncertainty. As you know a global financial crash creates economic uncertainty. It is time to get out of paper and into tangible assets.

If you have an IRA you can rollover to physical gold and silver until economic stability resumes or if you can liquidate your IRA take physical possession of precious metals please do so. Please contact your financial advisor or local gold dealer to get the process moving. If you do not have a financial advisor or have personal dealings with a local gold dealer I can recommend a gold dealer that specialises in conversion of IRAs and 401ks into physical gold. I have recommended them since 2013 and I know they have helped many visitors to LindseyWilliams.net. The gold dealer I recommend is Birch Gold. Leave your name and number and they will call you back. If you have over $10,000 in your IRA or 401k or have cash of more than $5,000 they can help you start the process. They are very good with those who are unfamiliar with buying precious metals.

The process of converting your paper IRA to physical gold takes a few weeks so it would be imperative that you start the process now. Remember, when the financial crash happens in September everyone will be running for the shelter of gold and silver. This may mean that if you leave it until later there may not be the physical metal available or have to pay much higher prices. Gold and silver are trading at low prices, so investing now will mean you will receive more gold and silver for your money. If you are worried about gold confiscation there is no need to panic. Pastor Williams already stated that his Elite friend said before that there would be no gold confiscation.

Some interesting news I’ve received from a friend regarding gold says “Don’t Dare Sell Your Gold”:

From Jeff Clark, Editor Big Gold – The Non-Dollar Report: The gold price may be stagnant, but forces behind the scenes are signalling that something big is brewing. A scan of recent headlines reveals a growing fervour for gold:

China Creates Gold Investment Fund for Central Banks. China announced a new international gold fund. More than 60 member countries have already invested. The fund expects to raise 100 billion yuan ($16 billion). It will develop gold-mining projects in the new Silk Road economic region.

China Could Send Gold Up at Least $200. Saxo Bank’s Steen Jakobsen says China’s multi-billion dollar Silk Road Initiative will prompt Beijing to pull money out of Europe and the United States for infrastructure investments elsewhere. This could send commodities higher and push Europe into recession. As a result, his 2015 price for gold is $1,425 to $1,450, more than $200 higher than its current level.

Red Kite Launches New Base and Precious Metals Fund. The fund has already deployed almost $1 billion in equity, loans and royalty streams into at least 17 junior mining firms. It hired a physical metals trade to handle the entire supply. The fund will likely fund underserved juniors that have struggled to get funding.

Texas Senate Passes Bill to Establish Bullion Depository for Gold and Silver Transactions. A bill to make gold and silver legal tender in Texas passed the state Senate by an overwhelming 29-2 vote. The bill essentially creates a way to transact in precious metals. It will allow citizens to deposit precious metals in the state depository and then use the electronic system to make payments to any other business or person who also holds an account.

Gold Smuggling in India at All-Time High. Customs agencies seized over 3,500 kilograms of gold (112,527 ounces) in 2014-2015, the largest stash ever confiscated in Indian history. The report says gold smuggling has grown by 900% in just two years. It also estimates that seizures could be less than 10% of actual smuggling.

Russia Boosts Gold Holdings as a Defence Against “Political Risks”. Dmitry Tulin, monetary policy manager at the Russian central bank, said the bank is increasing its gold holdings because “it is a 100% guarantee from legal and political risks.” Part of the motivation is certainly that their overseas assets could be frozen if sanctions over the Ukraine crisis tighten.

Austria Repatriates 110 Tonnes of Gold from UK. Austria is repatriating 110 tonnes (3.53 million ounces) of gold from the Bank of England. It eventually wants to have 50% of its holdings stored at home. The country has reportedly been transferring its official gold reserves from unallocated to allocated accounts in recent years, and also reduced its leased gold by 60%.

D.E. Shaw Buys $231 million of SPDR Gold Trust. D.E. Shaw & Company bought $231.07 million worth of SPDR Gold Trust (NYSE: GLD) last quarter. This is a new position for the company.

Canadian Fund Makes $700 Million Bet on Gold Trust. Canadian asset manager CI Investments purchased a whopping 6,117,900 shares of Gold Trust last quarter, worth $703.6 million. Gold Trust is now the single largest holding of the fund – bigger even than its position in Apple.

More Funds Increase Their Shares In Gold Trust. A Swiss investment bank increased its position in Gold Trust by 490%, to more than 4 million shares. Lazard Asset Management doubled its holding to over 2 million shares. Morgan Stanley increased its holding by 8.3%, and BlackRock Group added 167% more to its position.

Traders Buy Gold and Silver at Fastest Pace in More Than a Decade. Large speculators haven’t bought silver this aggressively since September 1997. Net speculative longs in gold also added over 45,000 contracts, the most since July 2005.

These news stories suggest the gold market is setting the table for its next major bull market… And it could be a biggie!

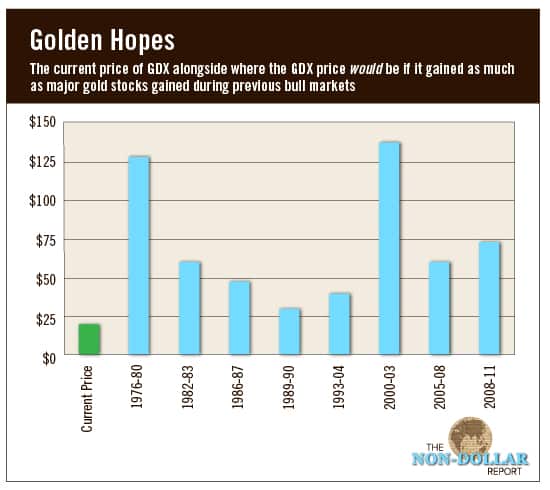

We measured every bull cycle of gold stocks and found there have been eight distinct upcycles since 1975.

We also discovered something exciting: Only one was less than a double. Even more enticing is that the biggest one – a 600% advance in the early 2000s – occurred just after a prolonged bear market. And our current bear market has been going longer than the last one.

To get a sense for the potential upside, we applied the percentage gain from each of those upcycles to the Market Vectors Gold Miners ETF (NYSE: GDX). Its price on June 1: $19.49

Clearly, the potential upside is large. No other sector is as depressed as the precious metals sector. So a return to anything close to some of the stronger past bull markets would deliver tremendous gains.

Pastor Williams has been telling you to buy physical gold and silver for many years. Throughout the last bull market as well as the current bear market. Please heed these warning signs. Get out of paper and get into physical gold and silver. Time is running out!

World Wide Financial Collapse Scheduled for between September and the end of December 2015!

WARNING!

From Lindsey Williams: I just received an email from my Elite friend.

My Elite friend indicated that they have a World Wide Financial Collapse scheduled between September and the end of December 2015!

You may have just THREE (3) months to prepare!

MAY 2015 HEALTH AND FINANCIAL NEWSLETTER from Pastor Lindsey Williams

WARNING! – Finally my Elite friend answered one of my emails after not replying to my emails for some time. The Elite are aware that there is something affecting the earth from out in space. They will not tell me what, but my Elite friend did make this statement in their email:

‘Something is throwing the earth of kilter. The Alaska natives have made observations that such changes are affecting their hunting and fishing patterns.’

I have received several messages asking if Pastor Williams will be doing any more radio shows. Unfortunately for the time being he will not be doing radio shows due to health reasons. However, Pastor Williams did have two important messages to say: “The worldwide crash appears to be imminent” and “If ever people needed to prepare IMMEDIATELY, it is now.”

The Cause of a Crash

By Tom Fyler

There are a lot of factors that signal a prospective economic and market crash. There is one though, that causes it. Those on the inside of the financial system know what it is, and know it approaches. And they prepare themselves for the inevitable. They position themselves to make fortunes on the back of the one factor that causes financial and market crashes. This one causing factor is unseen to the “naked” or Unknowing Eye. And yet, if you know where to look, you can see it—and prepare for it.

We all know that the U.S. and other nations are sporting record balance sheet debt. So-called stimulus or money printing is an international addiction. Yet, no crash. The same with U.S. corporations—more debt than ever. But no crash. Currencies throughout the world are crumbling. The U.S. dollar is attacked as the world reserve currency. Mideast and other military conflicts and terrorist attacks abound. But no crash.

So what is this cause of financial and market crashes? According to some research studies*, this cause preceded such economic and market crises as the 1987 stock market crash, the early 1990s credit crunch, the late 1990s Russian Debt Crisis, the 1998 Long-Term Capital hedge fund meltdown, the dot.com bubble and market crash from 2000-2003, the sub-prime lending crisis in 2007 and the subsequent 2008 global financial crash.

Ben Bernanke perhaps summed up the cause best at the Conference Co-sponsored by the Center for Economic Policy Studies and the Bendheim Center for Finance, Princeton University, on September 24, 2010: “Market illiquidity…..” In short, liquidity is necessary to support and stabilize the value of assets that are being sold. Without liquidity, asset values crash.

And now today, to the Seeing Eye, there are increasing signs of faltering liquidity in the global financial system. The Institute for International Finance in an April 30, 2015 release reported that in numerous emerging market global regions—“…bank lending conditions tightened abruptly to their weakest level in three years in 2015Q1.” They report a plunge in loan demand, a tightening of bank lending, and increasing loan defaults. A clear sign of growing “market illiquidity.”

An associate of mine deep in the financial system expressed a concern of “no liquidity (in the system) to absorb selling.” Another person of even greater prominence a week ago referred to open-end mutual funds “…and the potential liquidity risks the funds could face amid a wave of redemptions (or selling).” Was this a wild-eyed Crash Conspiracy Theorist? No—it was Fed Chairperson Janet Yellen answering a question from none other than Christine Lagarde at an International Monetary Fund (IMF) Finance and Society conference.

We’ve been warned. Are you ready? I would be pleased to provide you with a nine question survey that might help you better understand how prepared you are and what you might be able to do to not only be protected from a crash, but to be positioned to possibly benefit from one. You may email me to request the survey at fyler@tiac.net

Tom Fyler is Managing Director of Fountain Wealth Associates, LLC , a consultant in Wealth & Natural Resources. Mr. Fyler is also President of Commodities & Securities, Inc., a Commodity Trading Advisor registered with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor with the State of North Carolina.

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.*The author is pleased to direct readers to research studies that discuss causes of financial and market crashes upon request.

Consider a hospital within five miles of the American border

You as the patient come first.

Where natural methods of healing are practiced.

Where there is an Internationally approved Operating Room in which there has never been an incident of someone contracting some disease in the course of the operation which they did not have prior to the operation. Most all types of operations are performed.

The only place IN THE WORLD where the Alivizatos Cancer Treatment is given. Lindsey Williams says – My personal friend was diagnosed with lung and liver cancer and sent home to die. He was given the twenty one day Alivizatos treatment. That was twenty years ago. Today his cancer is in remission and he is living a normal life.

Joint Replacements of all kinds – Knee joint replacement – Hip joint replacement in a tender loving care environments where you can afford to recuperate in the hospital instead of at home. The therapist will come to your room.

Stem Cell treatment using your bodies own stem cells was pioneered at BioCare Hospital.

CALL TOLL FREE – 1800-262-0212 – Ask for Teresa – Tell her that Lindsey Williams suggested you ask for the (60) sixty page booklet – FREE OF CHARGE.

You will need BioCare Hospital when American doctors and hospitals can no longer be trusted. Get to know BioCare now before you need then.

Dr. Rodriguez, who founded BioCare Hospital over thirty years ago, describes his theory of Natural Health Treatment as follows –

Dr. Rodriguez

To attain positive results in surgery

To get surgery done right, we must procure optimum performance and healing of the body: planning and following up the intervention.

When we face our physician’s statement about the need to undergo a surgical procedure, we face many questions and doubts about the final outcome, results, and benefits we can expect. In doing so, we think and analyze of course our own physician’s credentials, the technical capacities of the hospital and OR, the quality of the staff and of course drugs involved.

But I would invite you to think inwards, because one of the most important factors involved in order to obtain desired results is nonetheless the patient. Our internal milieu or terrain is after all the scene of the surgical procedure. Our biological resources supported by nutrition, sufficient supply of critical nutrients and energy, freedom from toxins, excellent vascular and heart condition with proper blood supply and oxygenation, prompt and efficient immune response and lack of stress and a spiritual foundation will provoke the response, resistance to infection, quality of tissue for the surgeon to work on and the healing capacity we all expect and desire.

International Bio Care Hospital and Wellness Center has centered medical care in the promotion of all the biological capabilities to generate energy, healing and ultimately quality of life. Our programs review and asses all of them to assure from the start their enhancement and fulfillment to achieve optimum performance.

We are proud of the quality and results that this approach has produced. Our biological control of the internal milieu apply also to our facilities and specially to our surgical areas. Back in the 1990’s, we pioneered the use of chlorine dioxide for the non-antibiotic management of microbial infestations of the body and we expanded that to the cleansing and preparation of surgical areas and all surfaces including the skin of patients and personnel. Together with a definitive support of the patient’s assets, that fight off from within the settling and replication of microbial presence we have created a surgical environment where hospital-borne infections are practically non-existent.

Optimum body resources produce optimum outcome. Healing is the final result of huge metabolic efforts of the body to restore health. Nutritional programs that not only provide the best quality of foods but are also assisted by careful and programmed supplementation; constant detection and elimination of immune challenges and attention to the protocols that help the restoration and renewal of cells and tissues damaged either by the disease itself or even by the procedures themselves, have to come together in a well orchestrated, inclusive protocol that will best serve the individual cases.

Modern medical facilities, board certified professionals, integrative-complementary environment bringing together metabolic therapies for restorative care and wellbeing to help surgical procedures to develop their full potential.

International Bio Care Hospital and Wellness Center avails its expertise to any individual that would like to consult with us.

For further information relating to IBC Hospital & Health Center please call toll-free: 1-800-262-0212 FREE – Ask for Teresa – Tell her that Lindsey Williams suggested you ask for the (60) sixty page booklet – FREE OF CHARGE.

Website: http://www.biocarehospital.com

Facebook: https://www.facebook.com/BioCareHospitalPage

Daily Supplement Regime From Leading Health Freedom Authority

By James Harkin

For the past six years I have been helping the world's oldest health freedom organisation get established in the UK. The National Health Federation was established in 1955 and is an international non-profit, consumer-education, health-freedom organisation working to protect individuals' rights to choose to consume healthy food, take supplements, and use alternative therapies without government restrictions. With consumer members all over the world, and a Board of Governors and Advisory Board containing representatives from 7 different countries, the Federation is unique as being not only the World's oldest health-freedom organization for consumers, but the only one accredited by Codex to attend and speak out at meetings of the Codex Alimentarius Commission, the highest international body on food standards.

Codex Alimentarius is Latin for ‘Food Code'. The Codex Alimentarius Commission, based in Rome, Italy, and created in 1963, is an international organization jointly run by the Food and Agricultural Organization (FAO) and the World Health Organization (WHO) of the United Nations. One of its 27 committees, the Codex Committee on Nutrition and Foods for Special Dietary Use (CCNFSDU) is responsible for Dietary Supplements and Special Foods. The CCNFSDU meets once yearly in Germany (it's host country) and the National Health Federation is the only health-freedom group that is a Codex recognized organization with the right to attend, submit documents, interact in real time with other Codex delegates, and speak out at these meetings. Codex's published goals are to develop and adopt uniform food standards for its member countries and to promote the free and unhindered international flow of food goods, thereby eliminating barriers to food and providing food safety.

In the 1950's The National Health Federation fought and won the battle for mandatory inspection of poultry. In the 1960's the NHF coordinated a major drive to help chiropractors become legally licensed in over 40 states. In the 1970's the NHF waged very successful campaigns against water fluoridation. In the 1980's the NHF pushed through legislative recognition of acupuncture. In the 1990's the NHF lobbied to pass the Dietary Supplement Health and Education Act S-784, fought malathion spraying, promoted public education on the dangers of vaccinations, and continued fighting the fluoridation battle. In the 2000's the NHF are working to prevent the Codex attempts to restrict your freedom to take vitamins and minerals and many more battles in Health Freedom.

Recently the National Health Federation had their 60th Anniversary celebration. I asked NHF President Scott C. Tips, JD for a supplement regime that people can use to stay healthy. He emailed me a list of supplements that he regularly takes to keep in optimal health. The supplement regime is shared below. I have added some description and some food sources:

These statements have not been evaluated by the FDA. This information is not intended to diagnose, treat, cure or prevent any disease.

- Vitamin A – 10,000iu – every two days

Vitamin A is key for good vision, a healthy immune system, and cell growth. There are two types of vitamin A. This entry is primarily about the active form of vitamin A – retinoids – that comes from animal products. Beta-carotene is among the second type of vitamin A, which comes from plants.

Foods that contain Vitamin A: Sweet Potato (cooked), Carrots (cooked), Dark Leafy Greens (Kale, cooked), Squash (Butternut, cooked), Cos or Romaine Lettuce, Dried Apricots, Cantaloupe Melon, Sweet Red Peppers, Tuna Fish (Bluefin, cooked), Tropical Fruit (Mango)

- Omega-3 fatty acids 2x/day

When it comes to fat, there’s one type you don’t want to cut back on: omega-3 fatty acids. Two crucial ones — EPA and DHA — are primarily found in certain fish. ALA (alpha-linolenic acid), another omega-3 fatty acid, is found in plant sources such as nuts and seeds. Not only does your body need these fatty acids to function, but also they deliver some big health benefits on Blood, Rheumatoid arthritis, Depression, Baby development, Asthma, ADHD, Alzheimer’s disease and dementia.

Foods that contain Omega-3 fatty acids: Anchovies, Bluefish, Herring, Mackerel, Salmon (wild has more omega-3 than farmed), Sardines, Sturgeon, Lake Trout, Tuna.

- B-50 Complex

This product is a combination of B vitamins used to treat or prevent vitamin deficiency due to poor diet, certain illnesses, alcoholism, or during pregnancy. Vitamins are important building blocks of the body and help keep you in good health. B vitamins include thiamine, riboflavin, niacin/niacinamide, vitamin B6, vitamin B12, folic acid, and pantothenic acid.

- Boron: 3 mg/day

Boron is used for building strong bones, treating osteoarthritis, as an aid for building muscles and increasing testosterone levels, and for improving thinking skills and muscle coordination.

Foods that contain Boron: Almonds, Walnuts, Avocados, Broccoli, Potatoes, Pears, Prunes, Honey, Oranges, Onions, Chick Peas.

- Vitamin C: 1000 mg, in divided doses, 2-3x/day

Vitamin C is used most often for preventing and treating the common cold. Some people use it for other infections including gum disease, acne and other skin infections, bronchitis, human immunodeficiency virus (HIV) disease, stomach ulcers caused by bacteria called Helicobacter pylori, tuberculosis, dysentery (an infection of the lower intestine), and skin infections that produce boils (furunculosis). It is also used for infections of the bladder and prostate.

Foods that contain Vitamin C: Guava, Red Pepper, Kiwi, Orange, Green Pepper, Grapefruit, Strawberries, Brussels Sprouts, Cantaloupe.

- Vitamin E mixed tocopherols 400 IUs/day (A.C. Grace Unique E Mixed Tocopherols)

Scientists isolated vitamin E from wheat germ oil in the 1920s and called it the “antisterility” vitamin. Its name, alpha-tocopherol, is from the Greek tokos, “offspring” and phero, which means “to bear”. Vitamin E is an antioxidant, protecting cell membranes from free radical damage. It supports cardiovascular function by blocking formation of compounds that can increase risk for atherosclerosis.

Foods that contain Vitamin E mixed tocopherols: Nuts, Fish, Green Leafy Vegetables and Vegetable Oils.

- Unique Vitamin E Tocotrienol (A.C. Grace Unique E Tocotrienols) 1x/day

Tocotrienols help maintain healthy cholesterol levels. Research indicates that they may also contribute to improving vascular and cardiometabolic integrity, help support a healthy cardiovascular system, and help maintain normal blood glucose levels.

Foods that contain Vitamin E Tocotrienols include: Palm, Rice, Rice Bran, Barley, Oats, Rye, Wheat, Nuts.

- Alpha lipoic acid: 100 mg-600 mg/day

Alpha-lipoic acid is used for diabetes and nerve-related symptoms of diabetes including burning, pain, and numbness in the legs and arms. High doses of alpha-lipoic acid are approved in Germany for the treatment of these symptoms. Some people use alpha-lipoic acid for memory loss, chronic fatigue syndrome (CFS), HIV/AIDS, cancer, liver disease, diseases of the heart and blood vessels (including a disorder called cardiac autonomic neuropathy) and Lyme disease.

Foods that contain Alpha Lipoic Acid: Spinach, Broccoli, Yams, Potatoes, Yeast, Tomatoes, Brussels Sprouts, Carrots, Beets and Rice Bran. Red meat, especially organ meat is also a source of alpha-lipoic acid.

- Coenzyme Q10: 100 mg/day

Many people use coenzyme Q-10 for treating heart and blood vessel conditions such as congestive heart failure (CHF), chest pain (angina), high blood pressure, and heart problems linked to certain cancer drugs. It is also used for diabetes, gum disease (both taken by mouth and applied directly to the gums), breast cancer, Huntington’s disease, Parkinson’s disease, muscular dystrophy, increasing exercise tolerance, chronic fatigue syndrome (CFS), and Lyme disease. Some people think coenzyme Q-10 will treat hair loss related to taking warfarin (Coumadin), a medication used to slow blood clotting.

Foods that contain Coenzyme Q10 include: Sulfurous vegetables such as Broccoli and Cauliflower, Oranges, Strawberries. Fatty fish also include coenzyme Q10, such as herring and beef and poultry as well as peanuts, sesame seeds as well as soybean oil and canola oil.

- Hyaluronic acid: 100 mg/day (for those 40 or older)

People take hyaluronic acid for various joint disorders, including osteoarthritis. Hyaluronic acid works by acting as a cushion and lubricant in the joints and other tissues. It's benefits are for skin, joints, eyes and for reducing gum disease.

Foods that contain Hyaluronic acid: Organ meats including gizzards, livers, hearts and kidneys. However, a diet of starchy root vegetables enables the body to continue to produce its own hyaluronic acid.

- Magnesium citrate 400 mg/day

This product is used to clean stool from the intestines before surgery or certain bowel procedures (e.g., colonoscopy, radiography), usually with other products. It may also be used for relief of constipation. However, milder products (e.g., stool softeners, bulk-forming laxatives) should be used whenever possible for constipation.

Foods that contain Magnesium citrate: Dark leafy greens (raw spinach), Nuts and seeds (squash and pumpkin seeds), Fish (mackerel), Beans and Lentils (soy beans), Whole grains (brown rice), Avocados, Low-fat dairy (plain non-fat yogurt), Bananas, Dried fruit (figs), Dark chocolate

- MSM: 1000 mg/day

MSM is a chemical in animals, humans, and many plants. People use it most often to try to treat arthritis. People take MSM to try to relieve pain or swelling from: Osteoarthritis or rheumatoid arthritis, Bursitis, tendinitis, or tenosynovitis, Osteoporosis, Muscle cramps, Scleroderma, Temporomandibular joint (TMJ) disorders, Headaches or hangover, Premenstrual syndrome, Inflammation in eyes or mucous membranes.

Foods that contain MSM: Fruit, Corn, Tomatoes, Tea and Coffee, Milk.

- Pycnogenol: 1 capsule/day

Pycnogenol is the US registered trademark name for a product derived from the pine bark of a tree known as Pinus pinaster. The active ingredients in pycnogenol can also be extracted from other sources, including peanut skin, grape seed, and witch hazel bark. Pycnogenol is used for treating circulation problems, allergies, asthma, ringing in the ears, high blood pressure, muscle soreness, pain, osteoarthritis, diabetes, attention deficit-hyperactivity disorder (ADHD), a disease of the female reproductive system called endometriosis, menopausal symptoms, painful menstrual periods, erectile dysfunction (ED), and an eye disease called retinopathy.

Foods that contain Pycnogenol include: Small amounts are available in the peels, skins or seeds of grapes, blueberries, cherries, and plums; in the bark of the lemon tree and the Landis pine tree; and in the leaves of the hazelnut tree.

- Selenium: 200 mcg/day (preferably Jarrow brand “Selenium Synergy”)

Selenium is a mineral found in the soil. Selenium naturally appears in water and some foods. While people only need a very small amount, selenium plays a key role in the metabolism. Selenium has attracted attention because of its antioxidant properties. Antioxidants protect cells from damage. There is some evidence that selenium supplements may reduce the odds of prostate cancer. Selenium does not seem to affect the risk of colorectal or lung cancer. But beware: selenium also seems to increase the risk of non-melanoma skin cancer.

Foods that contain Selenium include: Brazil nuts, Seafood (Oysters – cooked), Fish (Tuna – cooked), Whole-wheat bread, Seeds (Sunflower), Pork (lean tenderloin – cooked), Beef and lamb (Lean beef steak – cooked), Chicken and turkey (turkey, back or leg meat cooked), Mushrooms (crimini), Whole grains (rye).

- Zinc: 15-30 mg/day

Zinc is used for treatment and prevention of zinc deficiency and its consequences, including stunted growth and acute diarrhea in children, and slow wound healing. It is also used for boosting the immune system, treating the common cold and recurrent ear infections, and preventing lower respiratory infections. It is also used for malaria and other diseases caused by parasites.

Foods that contain Zinc include: Seafood (cooked oysters), Beef and lamb (cooked lean beef shortribs), Wheat germ (toasted), Spinach, Pumpkin and squash seeds, Nuts (cashews), Cocoa and chocolate (cocoa powder), Pork and chicken (cooked lean pork shoulder), Beans (cooked mung beans), Mushrooms (cooked white mushrooms).

- Curcumin: 500 mg/day (preferably as 95% curcuminoids)

Curcumin is found in Turmeric, which is a plant. You probably know turmeric as the main spice in curry. It has a warm, bitter taste and is frequently used to flavor or color curry powders, mustards, butters, and cheeses. But the root of turmeric is also used widely to make medicine. Turmeric is used for arthritis, heartburn (dyspepsia), stomach pain, diarrhea, intestinal gas, stomach bloating, loss of appetite, jaundice, liver problems and gallbladder disorders.

Foods that contain Curcumin: Turmeric (Curcuma longa). Turmeric, sometimes called “poor man's saffron”, is the best known natural source of curcumin. Ground turmeric is a common ingredient in curry powders, but also fresh turmeric has some culinary uses. Other foods that contain curcumin include: Curry powder and Mango Ginger (curcuma amada Roxb.).

- Quercetin: 500 mg/day

Quercetin is used for treating conditions of the heart and blood vessels including “hardening of the arteries” (atherosclerosis), high cholesterol, heart disease, and circulation problems. It is also used for diabetes, cataracts, hay fever, peptic ulcer, schizophrenia, inflammation, asthma, gout, viral infections, chronic fatigue syndrome (CFS), preventing cancer, and for treating chronic infections of the prostate. Quercetin is also used to increase endurance and improve athletic performance.

Foods that contain Quercetin: It is found in many plants and foods, such as red wine, onions, green tea, apples, berries, Ginkgo biloba, St. John's wort, American elder, and others. Buckwheat tea has a large amount of quercetin.

- Gingko Biloba: 120 mg/day

Ginkgo is often used for memory disorders including Alzheimer’s disease. It is also used for conditions that seem to be due to reduced blood flow in the brain, especially in older people. These conditions include memory loss, headache, ringing in the ears, vertigo, difficulty concentrating, mood disturbances, and hearing disorders. Some people use it for other problems related to poor blood flow in the body, including leg pain when walking (claudication), and Raynaud’s syndrome (a painful response to cold, especially in the fingers and toes).

Foods that contain Ginkgo Biloba: Ginkgo Biloba is a seed that is a common ingredient in many Asian dishes. The Chinese incorporate gingko biloba in congee or rice porridge. The Japanese prefer to integrate the gingko biloba seeds in a dish known as chawanmushi, which is a steamed egg custard.

- Vitamin D3: 5,000-10,000/day

Vitamin D is used for preventing and treating rickets, a disease that is caused by not having enough vitamin D (vitamin D deficiency). Vitamin D is also used for treating weak bones (osteoporosis), bone pain (osteomalacia), bone loss in people with a condition called hyperparathyroidism, and an inherited disease (osteogenesis imperfecta) in which the bones are especially brittle and easily broken. It is also used for preventing falls and fractures in people at risk for osteoporosis, and preventing low calcium and bone loss (renal osteodystrophy) in people with kidney failure.

Foods that contain Vitamin D3: Cod liver oil, Oily fish (trout – cooked), Mushrooms (portabello), Fortified cereals (whole grain Total), Tofu (Firm – lite), Caviar, Dairy products (queso fresco), Pork (extra lean ham), Eggs (hard boiled), Dairy alternatives (plain soy yogurt).

- Vitamin K2 (Menaquinone-7): 90 mcg/day

Vitamin K2 (the menaquinones) is a group name for a family of related compounds, generally subdivided into short-chain menaquinones (with MK-4 as the most important member) and the long-chain menaquinones, of which MK-7, MK-8 and MK-9 are nutritionally the most recognized. It has been suggested that vitamin K2 may play an important role in maintaining healthy levels of bone mineral density (BMD). Patients suffering from osteoporosis were shown to have extensive calcium plaques, which impaired blood flow in the arteries. Research showed that vascular calcification might not only be prevented, but even reversed by increasing the daily intake of vitamin K2.

Foods that contain Vitamin K2: Natto, Hard cheese, Soft cheese, Egg yolk, Butter, Chicken liver, Salami, Chicken breast, ground beef, Spinach, Broccoli, Asparagus, Collard greens, Swiss chard, Bok Choy, Peas, Parsely and Lentils.

- Resveratrol: 100 mg as LONGEVINEX

Many of the headlines about the possible anti-ageing and disease fighting possibilities for resveratrol have come from laboratory or animal studies rather than evidence from trials involving humans. Some of the conditions that early research suggests resveratrol might help protect against include: Heart disease, Cancer, Alzheimer's and Diabetes.

Foods that contain Resveratrol include: peanuts, pistachios, grapes, red and white wine, blueberries, cranberries, cocoa and dark chocolate.

The National Health Federation are not a huge organization, they are operating on a shoestring budget, unlike other health organizations they are not affiliated with any corporate entity. Therefore, funds to fight health freedom are generated from donations and memberships. Membership to The National Health Federation includes Health Freedom News magazine four times per year as well as two wonderful health freedom books.

You can contact The National Health Federation at: +1 (626) 357-2181 or by email: contact-us@thenhf.com. You can also visit their website (currently under redevelopment) at http://www.thenhf.com. You can make a donation too http://www.thenhf.com/make-a-donation/

Request from Pastor Lindsey Williams

Chaplain Williams, his wife and twenty one year old son would like to leave the Arizona area for this summer, where it is so hot, and go where it is cooler – Does anyone have a place that you could offer them? – Anywhere in the world?

If you have a place that you could offer them, please use the contact us form at LindseyWilliams.net and your message will be forwarded to Pastor Williams directly.

Second Newsletter…

Because of the information that Pastor Williams has shared there is too much for just one newsletter. I am currently compiling a second newsletter that will expand on what was discussed in the last newsletter entitled ‘Global Financial Events, Collapse & Gold', which discussed what was happening later in 2015. I will be writing an article about ‘The Post-2015 Development Agenda' and what this will mean for the American people as well as humanity globally. I will also detail a recent article from Billionaire Hugo Salinas Price who is predicting Apocalypse and Enormous Disorder coming. This newsletter will be released within the next week or so.

September 24, 2015 Asteroid Prediction NOT Made By Pastor Lindsey Williams

A few days ago Pastor Lindsey Williams was made aware of a video circulating the Internet that stated that Pastor Williams had made a prediction that an asteroid would hit the earth on September 24, 2015. This prediction was not made by Pastor Williams. He has told me this:

“I did NOT write this – I did NOT produce this video or make this prediction. It is being attributed to me but I had nothing to do with it.”

I have contacted the video producer, YouTube and Vimeo to have Pastor Williams' name removed from the video. As far as I am aware this has been carried out. There are still many articles circulating the Internet that have not removed Pastor Williams' information even know I have personally contacted them to advise them.

I am at a loss to understand why these websites have not contacted LindseyWilliams.net to ask if the story was correct before repeating it.

Therefore, please disregard any predictions presumably made by Pastor Williams unless they are made through his official channels, namely LindseyWilliams.net and ProphecyClub.com.

Regards

James Harkin

On behalf of LindseyWilliams.net

IMPORTANT NEWS From Pastor Lindsey Williams – March 30th 2015

It has been two months since Pastor Williams’ last email newsletter. Over the past months many things are happening around the world. It is almost like things are happening moment to moment. Further on in this month’s newsletter is an important article from Mark D. Johnson entitled ‘Information Overload’ as well as an article by LindseyWilliams.net webmaster James Harkin entitled ‘Global Financial Events, Collapse & Gold’. There is also a two hour video linked within this newsletter that is very important viewing and will explain a lot of what Pastor Williams has been saying in his recent DVDs.

Firstly, Pastor Williams shared an important article stating ‘VERY IMPORTANT! This email was just sent to me from my Wall Street Insider friend. An interest rate hike will impact the Derivative market – Which will probably bring down the Euro and in a short time devastate the dollar.’ The article is entitled ‘Bob Doll: Fed Rate Hikes Likely in September’.

A few days ago Pastor Williams received an email from his Wall Street Insider. The information relates to the possibility of “a move to replace the USD as the world reserve currency at some time in the future.” There was a press release from the IMF entitled ‘IMF and China’s Ministry of Finance Sign Agreement on Strengthening Fiscal Institutions and Capacity Development’. Another article sent to me by Pastor Williams with a note ‘Very interesting turn of events. These nations will not use the dollar. The demise of the dollar must be very near’, was entitled ‘Washington Blinks: Will Seek Partnership With China-Led Development Bank’ in relation to the US conceding defeat and is seeking a partnership with the Chinese-Led Asian Infrastructure Investment Bank (AIIB) after initially blasting allies such as Britain for signing up to be a founder.

Another article Pastor Williams shared and he stated ‘Food for thought – Not worry’is from Trend forecaster Gerald Celente of the Trends Journal. Entitled ‘Collapse: It’s Coming! Are You Ready?’ the article discusses that while pundits argue over whether or not a double dip recession is coming, many on the street have finally begun to realize that another recession is the least of our problems.

Something interesting from The End Times Forecaster: “Jewish tradition believes that lunar eclipses signal judgement for Israel and solar eclipses signal judgement for the nations. Are the three solar eclipses on Av 1 in 2008-10 an indication that a time of distress is to begin for the world? Think of what happened after August 2008 – the beginning of the financial collapse. Are the three solar eclipses a sign that the 70thweek will begin between the first and last eclipse? Also note that in 2015 you have 2 lunar and 2 solar eclipses all on significant days”.

Pastor Williams shared with me an email about the recent total eclipse over the North Pole on the first day of spring. Pastor Williams said ‘More and more signs in the heavens by the day’. The article entitled ‘Passover Blood Moon Preceded by Exceedingly Rare Solar Eclipse’ talks about this rare event occurring once every 100,000 years. For it to appear on the first day of the first month of the Biblical calendar year is, however, entirely unprecedented since this is only the year 5775 according to Jewish tradition, meaning that there has never been such a solar occurrence in human history.

There is a television program that Pastor Williams shared with me that he wishes you to watch. Pastor Williams said ‘Please view the TBN program below. I think you will find it exceptionally interesting and informative. It is the best interview I have seen Jonathan Cahn give.’ The show is called ‘Praise the Lord’ and it was broadcast on March 9, 2015. It features Perry Stone hosting Jonathan Cahn, Mark Biltz and Bill Salus. It is very important that you watch this video because it will explain a lot of what Pastor Williams has said within his three recent DVDs ‘2015 Elite Agenda’, ‘Special Events Scheduled for 2015’ and ‘The New Elite for 2015’. It also means that other influential researchers are predicting events for the latter half of 2015, especially around September & October 2015.

For those who wish to read the book about the prophecies shared by Jonathan Cahn his book is: ‘The Mystery of the Shemitah: The 3,000-Year Old Mystery that holds the Secret of America’s Future, the World’s Future, and Your Future!’ If you would like to read his previous book that lines up The Mystery of the Shemitah, it is called ‘The Harbinger – The Ancient Mystery that holds the Secret of America’s Future’.

Information Overload

By Mark D. Johnson

25 And there shall be signs in the sun, and in the moon, and in the stars; and upon the earth distress of nations, with perplexity; the sea and the waves roaring;

26 Men's hearts failing them for fear, and for looking after those things which are coming on the earth: for the powers of heaven shall be shaken.

27 And then shall they see the Son of man coming in a cloud with power and great glory. Luke 21:25-27

Everyone is looking for information. They want to know what is going on. They want information that nobody else has. They want to be on the inside track.

There is no lack of information available today. We have radio, television, cell phones and the internet. We receive hundreds of emails every day from people who want to be our number one provider of information. Friends and relatives forward us the latest jokes, political gossip, and outrageous events. In many cases the information we receive has been cropped, edited, tweaked, and falsified. How many times have we forwarded some of this information only to find out later that the information was inaccurate? Even if you check the facts sites they too can be wrong or can be pushing a political agenda.

So by having all this information has it made our life easier, is it is easier to make decisions, has it freed up our time, or has all this information made our lives more stressful? For many people all this information has created more fear and anxiety.

Information overload is the theme of the day. So many questions:

- Is the Fed going to raise interest rates this year?

- Is gold going to go up or down?

- Is the dollar going to crash?

- Are oil price going to plummet further?

- Is there going to be inflation or deflation?

- The year of the Shemitah– what might happen?

- What will the blood moons forebode?

All of these questions have no current answers. We will have to wait to see what actually transpires. In the mean time we still have to make decisions today based on what we think may happen in the future. We will only know if the decisions we make today will be good choice as we see how they are affected by the future events.

Sometimes knowing too much can be a problem. We have so much information that we are either unable to filter out the noise and make a decision or we become paralyzed with information overload.

When I graduated from college and got my first job I took my extra money and started to buy real estate properties for investments. The prices seemed very reasonable and the rents more than covered the mortgage and expenses. I bought several properties that appreciated very nicely as inflation was quite high. I found out later that we were in the middle of a recession. As a result I was able to negotiate some very good purchases because few people were buying real estate during the recession. I did very well with my properties. I guess if someone would have educated me on how bad the economy was and that it was foolish for me to invest based on the current economy I would have missed out on a very good opportunity.

Today we have access to lots of information. But you can read an equal number of articles supporting either side of an issue. Let’s take a look at the topic of gold, which way is the price going to go. You can read articles that the price is going to break $5000 per ounce and others that predict that it is on its way to $750 per ounce. The strange thing is that both may be correct. Gold may go to $750 before it goes to $5000. Most of the time you have to look at who is writing the article, is it someone selling gold or someone selling a newsletter. I believe that gold will be a good long term investment but you must have a strategy with a long term perspective, be prepared for volatility and remember to buy on the dips.

I talk to a lot of people who are very fearful of what may or may not happen. Now it is important to take into account what may happen and to be prepared to make adjustments as future events unfold. But it is equally important to not let fear keep you from moving forward.

As we talk to people about managing their investments they appreciate the fact that we understand their concerns for the possibility of disruptive events. Because we understand and are aware of these possible events, we can develop portfolios that allow us to move forward while still taking into account each client’s tolerance for risk, concerns and the need for getting a return on their investments.

I have never been able to predict the future and have not met anyone else who can either. Even Pastor Lindsey Williams has told me many times that he does not hold himself out as a prophet but says that he is only passing on information heard from others. I do know there are people who try to guess at what may happen in the future, some may even make you think they know what is going to happen and even others that try to manipulate the future, but in the end, the reality is that the future is unknown.

The Bible tells us not to worry about tomorrow. Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own. Matt 6:34

And there shall be signs in the sun, and in the moon, and in the stars; and upon the earth distress of nations, with perplexity; the sea and the waves roaring; 26 Men's hearts failing them for fear, and for looking after those things which are coming on the earth. Luke 21:25-26

Knowing the signs is critical, as well as getting information from reliable sources, no matter how disturbing it is, we cannot let this information allow us to become people of fear. Instead of paralyzing us let’s use that knowledge to make good decisions.

We have been positioning our client’s portfolios to prepare for the uncertainties of the markets. If you would like to work with an advisor who understands your fears and concerns call us today.

Stay tuned for Pastor Lindsey Williams next update.

Mark D. Johnson, CFP

P.S. And then shall they see the Son of man coming in a cloud with power and great glory.

PO Box 17656

16921 E Palisades Blvd Ste 105

Fountain Hills, AZ 85269

(480) 837-5971

www.FountainWealth.com

–

Global Financial Events, Collapse & Gold

I think that there is no doubt that September and October will herald a global event that will have a lasting effect for years to come. Prophecy, numerology, history, astrological alignments and occult events all have proven themselves to predict future crises and point to a series of events in the autumn of 2015. If what Pastor Williams’ and many researchers and analysts have been saying is true we are about to witness something potentially catastrophic.Around the world events are happening including:

- Alternative SWIFT payments system in China and in Russia bypassing the US dollar. This shows the world that the US dollar is replaceable as a reserve currency.

- Britain, France, Germany, Italy and over thirty other nations have joined the Chinese-led AIIB development bank as founders (against the wishes of the US).

- Austria’s Hypo bank went bust (in 1929 an Austrian bank Creditanstalt went bust leading to the great depression).

- 0% interest rates always cause deflation (except to things people actually buy, like food).

- With 0% interest rates the wealth/income gap increases, dollar increases in value (bubble), social unrest flares up.

- The surging dollar is a signal that a colossal financial event is just around the corner. The biggest quarterly gains since 1992. The dollar gains against other currencies pretty much only happen during periods of extreme geopolitical distress.

- G20 declared money deposited in banks assets of the bank.

- Banks can no longer be declared bankrupt. The banks can be refinanced by bail-ins using depositors’ money or be bought out.

- Congress passed a spending bill that makes the American taxpayer responsible for any derivative losses that a bank may suffer.

- The US Treasury has ordered survival kits for employees of the federal banking system.

- GDP figures in the UK slowed in the last quarter of 2014 to a rate not seen since the immediate aftermath of the financial crisis in 2009.

- The Bank of England have announced out another “stress test” on the UK’s biggest banks.

- The average rate of interest on easy-access Individual Savings Account’s in the UK have plunged to a record low of 1.02 per cent.

- The Euro is at a 12 year low.

- The ECB has initiated a 1.2 Trillion Euro quantitative easing program that will see banks offload bad debts to the central bank.

- 50% of Greeks want out of the Eurozone. Syriza has gone against the wishes of the electorate. Germany knows if Greece leave there will be serious repercussions for the Eurozone. Italy, Spain, Portugal, France and Ireland are also not in good shape. If the Troika (European Commission, ECB and IMF) fails to stop Greek exit from the Eurozone, Greece could dishonour 320 Billion Euros of debt forced upon them.

- Capital controls in France. French citizens may not withdraw more than 1,000 euros in cash in one transaction and 10,000 euros in cash per month without being questioned like a crimintal.

- Japanese economy at 250% debt to GDP.

- China also has problems with its debt rising from $2 Trillion in 2000 to $28 Trillion today. During the crisis of 2008 its debt was $7 Trillion. In seven years rising $21 Trillion.

- The stock market is being manipulated by corporations buying back their own stock to distort P/E ratios. Being able to borrow at 0% interest allows them to buy back the stock and since there’s less stock available on the market the earnings look better divided by less stock.

- The Baltic Dry Index is at an all-time low. The BDI is an assessment of the price of moving the major raw materials by sea. Basically telling people the state of the global economy. Falling from 3929.00 in May 2010 to 596.00 in March 2014.

- On the spring equinox on 20th March 2015 we witnessed a full moon eclipse. On this day in London the historical ‘London Gold Fix’ changed to the ‘LBMA Gold Price’. This is significant because the ‘London Gold Fix’ has been constant since 1919. Additionally the FTSE 100 broke 7,000 points for the first time since the dotcom bubble 15 years ago.

- Gold is within 10% of an all-time high against the Euro, Japanese yen and double against the Russian rouble.

- Rise of interest rates are being threatened by the Fed for June 2015.

- 2015 marks the 7 year anniversary of the financial crisis of 2008. Seven years previously was 2001 was a year of recession for the US economy and of big trouble for stocks as well as 9/11 and the burst of the dotcom bubble. Seven years previously was the 1994 was the bond market massacre. Seven years prior to that was the Wall Street crash of 1987. Seven years previous to that was the S&L crisis and “stagflation”. Seven years prior to this was the Arab oil embargo.

- On September 23rd 2015 Pope Francis will first visit the White House. On September 24th 2015 Pope Francis will address Congress (the first time a pontiff has ever addressed congress). On September 25th 2015 Pope Francis will also address the U.N. General Assembly in New York, which is also the first day of the United Nations Summit to adopt the post-2015 development agenda.

The governments around the world are preparing for the New World Order. There is no recovery. The derivatives bubble will collapse and it may not be because of interest rate increases. It maybe because bond investors realise the bond issuers cannot repay the bonds with real money. As bondholders liquidate their assets the markets will panic and the derivatives bubble will implode.

If you have not taken the advice of Pastor Williams I recommend that you do so immediately. The only lifeboat in a sinking ship is gold. In the Cyprus crisis those that hedged their investments with gold survived. In Greece there are many who fear Grexit, they are turning to gold. During periods of monetary uncertainty people will always think gold is a useful addition to their portfolios.

I have heard many people are selling their gold holdings because the price has fallen. Personally I think this is a big mistake. As the price hovers just above its approximate cost price it is a great opportunity to hedge your paper investments. As you should be aware the gold price is manipulated to be low by central banks and the large investment banks because there are over 50 paper gold contracts to one physical gold contract. Some have said it is closer to 100 paper contracts to one physical contract. This manipulation may end this year when the market sees that there is no physical gold for the paper long contracts. When this happens investment banks will have to settle in cash at a considerable loss. The paper is worthless. The physical is valuable and will always be desired as a store of wealth.

Speaking of price manipulation, in 2014 Barclays Bank was fined £26 million for systems and controls failures, and a conflict of interest in relation to the gold fixing over the nine years to 2013, and for manipulation of the gold price on 28thJune 2012 to prevent a derivative product previously sold to a client from leading to a payout.

I have always stated that gold costs approximately $1,100 to extract and refine and gold has not fallen beyond those levels. If they do, we will see mines close or start to store precious metals until the price rises. We’ve seen it recently with several silver mines start to withhold metal until the price rises. If there is a lack of new physical gold coming to market it is likely the price will rise because of the high demand from buyers around the world, especially in the east. Chinese buyers always take delivery. It is unlikely the price will fall so low as production slows. The Elite have always said Gold and Silver are their currency. Hypothetically, if markets drop considerably and there is little supply of gold available, what are you going to do? Pay $5,000, $10,000, $20,000 an ounce? Doesn’t it make sense to buy when the price is suppressed and demand isn’t based on panic buying?

Pastor Williams has been telling you for many years to get out of paper and to buy gold. Every fiat currency has always ended in disaster. It has been said by many financial researchers that 2015 may see a breakdown of the paper currencies and a revaluation that will see gold return to the top currency. Everyone always goes back to physical gold. I think it is the only thing that will save your retirement funds. You cannot rely on third parties to look out for your interests especially when the whole role of stock brokers is to churn investors-money to generate commissions.

If what Pastor Williams has said is correct and prophecy, numerology, history, astrological alignments and occult events are all pointing to the latter half of this year, then you have six months to prepare. Remember the DVD Pastor Williams produced entitled ‘Emergency Elite Data’. Within this presentation were ten steps to save yourself and your family from financial collapse. In 2013 I wrote a free guide that showed people what they could do to protect themselves expanded upon the ten steps shared by Pastor Williams. It is getting late to prepare, we have six months until the next financial crisis, if history predicts the future. You can download a copy of the FREE guide ‘10 Steps to Avoid The Crash’ here.

Deflation, Oil & The Crashing – Newsletter 01/15

A few days ago Pastor Williams received an email from his elite friend. He sent him a lengthy article indicating that this is what we can expect in the next several months. The article is called “When Shale Goes Subprime”. It was sent to Pastor Williams by his Elite friend personally, not a Wall Street friend. “This is what is expected to happen in the eminent future.”

The second article Pastor Williams shared this week was an article entitled “Deflation Strikes the Eurozone.” It is an important article since Pastor Williams Elite friend warned us what would happen if the Eurozone crashes, and the Eurozone is already worried by announcing Quantitative Easing of 60 billion euros a month with a total of 1.08 trillion euros.

Tom Fyler, one of Pastor Williams' Wall Street friends has also contributed an article, this month it is entitled “Patience, Foresight, and Courage” and says we are already in a “crashing.”

In light of all that is happening – Everyone needs “Special Events Scheduled for 2015”

Pastor Williams' Wall Street friend today also said “As you have warned for quite some time, markets and economies are unraveling—now at a quickening pace. People tend to wait until the last minute to do something—so hopefully the 2015 newsletters can prompt people to act ASAP!

I remember quite some time ago that you warned to watch for currency wars. And such might serve as a mechanism to quickly deteriorate the global financial/monetary system. And perhaps usher in a global currency. What type of feedback have you received on the recent Swiss central back action? Some speculate that it is a bold escalation of an already “boiling” currencies manipulations or battles.”…

When Shale Goes Subprime

Dave Gonigam

The 5 Min. Forecast

And so it begins.

“U.S. Steel Corp. said it will idle plants in Ohio and Texas and lay off 756 workers,” reports this morning’s Wall Street Journal, “becoming one of the first big U.S. industrial casualties of the recent collapse in global oil prices. Both factories make steel pipe and tube for energy exploration and drilling.”

Most of the jobs are being cut in Lorain, Ohio. “What appeared just a few short weeks ago as being a productive year, [with new hires in December and extra turns going on] has most abruptly turned sour,” said a letter from the president of the union local.

Overnight Brent crude prices slipped below $50 a barrel. They’ve recovered a bit since. Ditto for West Texas Intermediate, $48.38 as we write.

“The oil collapse is going to cause far more pain than most people seem to realize,” ventures our Chris Mayer.

“If history is any guide, there will be no quick recovery. And the effects will go well beyond just oil stocks.

“The oil bust will sting banks that lent freely to the oil patch.” That’s what happened three decades ago. Oklahoma’s Penn Square Bank failed in 1982… which snowballed into the 1984 failure of Continental Illinois, the biggest U.S. bank bust up until the Panic of 2008. (Indeed, the modern bailout got its start with Continental Illinois, as The 5 chronicled last year.)

This time around, “the latest energy boom needed a lot of money to build out infrastructure and drill wells,” Chris explains. “Lenders happily funded these efforts. Such loans were often made assuming $80 oil. Many of these loans were riskier high-yield bonds, or junk bonds. A JPMorgan analyst estimated if oil stayed below $65 a barrel, then 40% of all energy junk bonds could wind up in default.

“Most oil companies have hedges in place for 2015, meaning they’ve locked in higher oil prices. But even conservative energy companies will see their hedges expire in 2016 and could run into trouble.”

Vulnerable banks identified by SNL Financial include Comerica… International Bancshares… and ViewPoint Financial. “This makes for a good list of stocks to avoid,” says Chris, “or at least be careful about.

“It’s not just loans to energy firms that bite back,” Chris goes on.

Again the ’80s are instructive: “Oil patch banks got stuck with real estate debt that the oil boom supported,” he explains. “The same thing could happen again. Hotels, retailers and homebuilders with energy exposure could all suffer. KB Home, for instance, generates 30% of its sales from Texas.

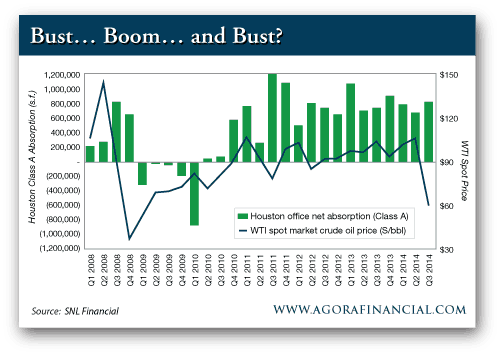

“Houston is at the center of this energy ecosystem. You can clearly see the impact of oil prices in its real estate statistics. Much like the tree rings of an oak, they mark the lean and flush years. Net absorption, for example, tells you how many square feet the market leases each year. The chart below gives you a look at office space. You can see the last time the price of oil fell a bunch — in 2008. Absorption went negative. Meaning the amount of empty space went up.

“Property companies with big exposure to Houston include: EastGroup Properties, Cousins Properties and Parkway Properties,” says Chris. “It’s going to be a tough 2015 for them unless oil makes a quick reversal.”

Footnote: Nearly 20% of the workers U.S. Steel is letting go are based in Houston.

It’s at this moment we pause to consider an uncomfortable thought: Perhaps the boom in America’s shale patch — a meaningful part of it, anyway — was a big hairball of malinvestment.

“Malinvestment”: Near as we can tell, this delicious English-language word was coined by the Austrian School economists of the 20th century — Mises, Hayek, Rothbard. Malinvestment is the flow of capital into places where no sane person would ordinarily put it — were it not for the stupidity of central bankers and their easy-money policies.

The Federal Reserve’s easy money delivered us the dot-com bubble in the late ’90s and the housing bubble of the mid-2000s. Malinvestment.

How much of the shale boom might have happened if the Federal Reserve hadn’t been keeping its thumb on interest rates the last six years? How much exploration and drilling took place simply because explorers and drillers could borrow cheaply?

Or to put it in more stark terms: Were $17-an-hour Wal-Mart greeters in North Dakota the embodiment of a newfound American prosperity… or a sign something was profoundly wrong?

We’re not prepared to say it’s an either-or proposition. No doubt good old American know-how played a role in the boom… and we won’t rule out connivance between Washington and the Saudi Arabian princes playing a role in the bust. But we’d be remiss to ignore the malinvestment question…

“The combination of easy money from the Fed with high oil prices (arguably caused by the former) led to massive malinvestment in the shale industry that now must be unwound,” asserts our acquaintance Erik Townsend — a hedge fund manager who trades oil futures.

Erik says much of the problem lies in the kind of trades shale producers used to hedge their production — called “three-way collars.”

If you want to dive into the details of how these trades work, check out today’s Overtime briefing, below. In the meantime, here’s the bottom line: “We needed $60 crude to hold to avoid an outright crisis in high-yield credit issued by shale drillers, and it didn’t. Now we’re going to have an outright bloodbath… I expect $40 Brent before this is over, and the risk of credit contagion on the scale of subprime mortgages is very real.”

Erik then picks up a theme we touched on Monday: “Shale drillers are going to lay down a LOT of rigs and stop drilling. This will lead to supply destruction. Then the price of oil will go to the moon and it will be time to restart the shale revolution.”

But the story doesn’t end there: “High-yield debt issues from shale drillers will have exactly the same connotation as ‘subprime-backed CDOs’ had in 2009,” Erik explains. “You won’t be able to sell the stuff for half what it’s worth just because of the stigma. Where’s the money going to come from to re-start the shale revolution?”

It won’t come from the banks; they’ll be too gun-shy to lend to the smaller players. So those smaller players will have to issue new shares if they want to raise money.

“That may occur in a significantly depressed equity environment compared with today,” says Erik. “The result — oil prices keep screaming higher, as the easy-money policies that enabled the last round of the shale ‘revolution’ aren’t there this time.”

What if the Federal Reserve resumes “quantitative easing” and steps on the monetary gas pedal? Erik won’t rule it out. “But investors who get nailed by the coming wave of high-yield defaults will still have the taste of blood in their mouths, and will still be reluctant to buy more debt issued by the shale patch.

“This all sets up for a MAJOR resurgence of inflation a couple years down the pike, led by an oil price spike.”

Deflation Strikes the Eurozone

Brad Hoppmann

Uncommon Wisdom Daily

Folks in the Eurozone can stop wondering if deflation will strike their economies. Deflation isn’t coming. It’s here.

Today, Eurostat confirmed that consumer prices in the common currency area dropped 0.2% in 2014. With fuel prices still dropping, experts expect more of the same in 2015.

We’re all familiar with inflation. We don’t know as much about deflation. Today, we’ll look at the difference.

Inflation is easy to understand; it means prices are generally rising. There might be exceptions here and there, but the cost of most goods and services is going up.

Deflation is the opposite condition, in which prices are generally falling.

Both inflation and deflation are actually symptoms of an underlying disease. The real problems are fractional reserve banking and monetary manipulation. While those are interesting subjects, today I want to think about the way deflation “feels.“

People and businesses usually respond to economic incentives. If the price of something you want is rising, you will probably buy it as soon as possible. If the price is falling, you will more likely wait.

Those simple, individual decisions can add up to economic chaos. Under deflation, a country’s economy will halt. No one wants to buy anything, even if he has money.

Sellers respond to low demand by reducing prices, which cuts their own income and reduces overall spending even further. This vicious cycle is painful for everyone.

One group does benefit from deflation, though. Lenders can prosper because they are receiving debt payments in a currency with more spending power than the one they originally loaned.

On the other hand, borrowers with no money might fall behind on payments. In that case, the lender’s incentive is to foreclose and seize collateral as soon as possible, before it loses even more of its value.

Europe has been dealing with deflation in a small way for several years. Now, it’s getting worse. The European Central Bank apparently wants to respond with quantitative easing, much like the Federal Reserve’s bond-buying program that ended last year.

People can argue whether QE helped the American economy. Even if it did, it still took years to make a difference.

So good luck, Europe. You’re going to need it.

Patience, Foresight, and Courage

By Tom Fyler

EssentialsInvesting.com

January 22, 2014

The following are a few thoughts for investors to consider when planning investment strategies for 2015 and beyond.

For those that have questioned government and Federal Reserve policies and strategies—and the legitimacy of various market and asset valuations, now just might be the time that your sense, analysis and insights are bearing fruition. Your perspective and foresight–prudently considered, meticulously planned and timely executed—with the benefit of experience and knowledge, might just provide you with an advantage in the coming years to generous opportunities in the management of your wealth.

It is possibly “Game On” now as you seek and find discounted values in the midst of the “rubble” of broken economies, fiscally sense-less governments, and manipulated markets and assets to which the “chickens have come home to roost.”

Waiting for “The” or “A” Crash

Don’t wait—we are in a “crashing”. In most cases, a crash is not a single event but rather a series of substantial assets devaluations that over time, when we look back, are viewed as a crash. The most recent asset to “crash” or significantly decline is oil. It has devalued by more than 57% in six months. Natural gas has declined 44% since May 2014. Silver has declined by 66% since 2011. How about the declines of other commodities: copper down over 17% in six months; sugar down 38% in eight months; nickel down 35% in seven months. Various countries’ equities have declined significantly: Brazil minus 56% since 2010; emerging markets minus 23% since 2011; Russia minus 54% since February 2013; Mexico minus 45% since March 2013. Based on a trend of these and other asset devaluations, there is certainly the possibility that other assets will follow. (Historical results or trends are not necessarily an indicator of future performance. Some of the cited asset performance information is approximate. Cited performance data was derived from: Oil as represented by WTI Crude Oil–New York Mercantile Exchange [NYMEX] @CL.1; Natural Gas—NYMEX: NGG15; Silver–iShares Silver Trust symbol SLV; Copper–Exchange-Traded Note [ETN]: JJC; Sugar–ETN: SGG; Nickel–ETN: JJN; Brazil–Exchange-Traded Fund [ETF]: EWZ; Russia–ETF: ERUS; Mexico–Closed-End Fund: MXF.)

Buying REALLY Low