A few days ago Pastor Williams received an email from his elite friend. He sent him a lengthy article indicating that this is what we can expect in the next several months. The article is called “When Shale Goes Subprime”. It was sent to Pastor Williams by his Elite friend personally, not a Wall Street friend. “This is what is expected to happen in the eminent future.”

The second article Pastor Williams shared this week was an article entitled “Deflation Strikes the Eurozone.” It is an important article since Pastor Williams Elite friend warned us what would happen if the Eurozone crashes, and the Eurozone is already worried by announcing Quantitative Easing of 60 billion euros a month with a total of 1.08 trillion euros.

Tom Fyler, one of Pastor Williams' Wall Street friends has also contributed an article, this month it is entitled “Patience, Foresight, and Courage” and says we are already in a “crashing.”

In light of all that is happening – Everyone needs “Special Events Scheduled for 2015”

Pastor Williams' Wall Street friend today also said “As you have warned for quite some time, markets and economies are unraveling—now at a quickening pace. People tend to wait until the last minute to do something—so hopefully the 2015 newsletters can prompt people to act ASAP!

I remember quite some time ago that you warned to watch for currency wars. And such might serve as a mechanism to quickly deteriorate the global financial/monetary system. And perhaps usher in a global currency. What type of feedback have you received on the recent Swiss central back action? Some speculate that it is a bold escalation of an already “boiling” currencies manipulations or battles.”…

When Shale Goes Subprime

Dave Gonigam

The 5 Min. Forecast

And so it begins.

“U.S. Steel Corp. said it will idle plants in Ohio and Texas and lay off 756 workers,” reports this morning’s Wall Street Journal, “becoming one of the first big U.S. industrial casualties of the recent collapse in global oil prices. Both factories make steel pipe and tube for energy exploration and drilling.”

Most of the jobs are being cut in Lorain, Ohio. “What appeared just a few short weeks ago as being a productive year, [with new hires in December and extra turns going on] has most abruptly turned sour,” said a letter from the president of the union local.

Overnight Brent crude prices slipped below $50 a barrel. They’ve recovered a bit since. Ditto for West Texas Intermediate, $48.38 as we write.

“The oil collapse is going to cause far more pain than most people seem to realize,” ventures our Chris Mayer.

“If history is any guide, there will be no quick recovery. And the effects will go well beyond just oil stocks.

“The oil bust will sting banks that lent freely to the oil patch.” That’s what happened three decades ago. Oklahoma’s Penn Square Bank failed in 1982… which snowballed into the 1984 failure of Continental Illinois, the biggest U.S. bank bust up until the Panic of 2008. (Indeed, the modern bailout got its start with Continental Illinois, as The 5 chronicled last year.)

This time around, “the latest energy boom needed a lot of money to build out infrastructure and drill wells,” Chris explains. “Lenders happily funded these efforts. Such loans were often made assuming $80 oil. Many of these loans were riskier high-yield bonds, or junk bonds. A JPMorgan analyst estimated if oil stayed below $65 a barrel, then 40% of all energy junk bonds could wind up in default.

“Most oil companies have hedges in place for 2015, meaning they’ve locked in higher oil prices. But even conservative energy companies will see their hedges expire in 2016 and could run into trouble.”

Vulnerable banks identified by SNL Financial include Comerica… International Bancshares… and ViewPoint Financial. “This makes for a good list of stocks to avoid,” says Chris, “or at least be careful about.

“It’s not just loans to energy firms that bite back,” Chris goes on.

Again the ’80s are instructive: “Oil patch banks got stuck with real estate debt that the oil boom supported,” he explains. “The same thing could happen again. Hotels, retailers and homebuilders with energy exposure could all suffer. KB Home, for instance, generates 30% of its sales from Texas.

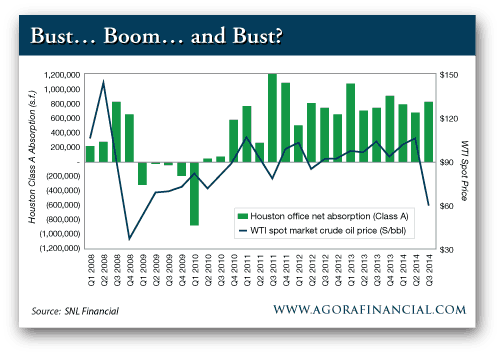

“Houston is at the center of this energy ecosystem. You can clearly see the impact of oil prices in its real estate statistics. Much like the tree rings of an oak, they mark the lean and flush years. Net absorption, for example, tells you how many square feet the market leases each year. The chart below gives you a look at office space. You can see the last time the price of oil fell a bunch — in 2008. Absorption went negative. Meaning the amount of empty space went up.

“Property companies with big exposure to Houston include: EastGroup Properties, Cousins Properties and Parkway Properties,” says Chris. “It’s going to be a tough 2015 for them unless oil makes a quick reversal.”

Footnote: Nearly 20% of the workers U.S. Steel is letting go are based in Houston.

It’s at this moment we pause to consider an uncomfortable thought: Perhaps the boom in America’s shale patch — a meaningful part of it, anyway — was a big hairball of malinvestment.

“Malinvestment”: Near as we can tell, this delicious English-language word was coined by the Austrian School economists of the 20th century — Mises, Hayek, Rothbard. Malinvestment is the flow of capital into places where no sane person would ordinarily put it — were it not for the stupidity of central bankers and their easy-money policies.

The Federal Reserve’s easy money delivered us the dot-com bubble in the late ’90s and the housing bubble of the mid-2000s. Malinvestment.

How much of the shale boom might have happened if the Federal Reserve hadn’t been keeping its thumb on interest rates the last six years? How much exploration and drilling took place simply because explorers and drillers could borrow cheaply?

Or to put it in more stark terms: Were $17-an-hour Wal-Mart greeters in North Dakota the embodiment of a newfound American prosperity… or a sign something was profoundly wrong?

We’re not prepared to say it’s an either-or proposition. No doubt good old American know-how played a role in the boom… and we won’t rule out connivance between Washington and the Saudi Arabian princes playing a role in the bust. But we’d be remiss to ignore the malinvestment question…

“The combination of easy money from the Fed with high oil prices (arguably caused by the former) led to massive malinvestment in the shale industry that now must be unwound,” asserts our acquaintance Erik Townsend — a hedge fund manager who trades oil futures.

Erik says much of the problem lies in the kind of trades shale producers used to hedge their production — called “three-way collars.”

If you want to dive into the details of how these trades work, check out today’s Overtime briefing, below. In the meantime, here’s the bottom line: “We needed $60 crude to hold to avoid an outright crisis in high-yield credit issued by shale drillers, and it didn’t. Now we’re going to have an outright bloodbath… I expect $40 Brent before this is over, and the risk of credit contagion on the scale of subprime mortgages is very real.”

Erik then picks up a theme we touched on Monday: “Shale drillers are going to lay down a LOT of rigs and stop drilling. This will lead to supply destruction. Then the price of oil will go to the moon and it will be time to restart the shale revolution.”

But the story doesn’t end there: “High-yield debt issues from shale drillers will have exactly the same connotation as ‘subprime-backed CDOs’ had in 2009,” Erik explains. “You won’t be able to sell the stuff for half what it’s worth just because of the stigma. Where’s the money going to come from to re-start the shale revolution?”

It won’t come from the banks; they’ll be too gun-shy to lend to the smaller players. So those smaller players will have to issue new shares if they want to raise money.

“That may occur in a significantly depressed equity environment compared with today,” says Erik. “The result — oil prices keep screaming higher, as the easy-money policies that enabled the last round of the shale ‘revolution’ aren’t there this time.”

What if the Federal Reserve resumes “quantitative easing” and steps on the monetary gas pedal? Erik won’t rule it out. “But investors who get nailed by the coming wave of high-yield defaults will still have the taste of blood in their mouths, and will still be reluctant to buy more debt issued by the shale patch.

“This all sets up for a MAJOR resurgence of inflation a couple years down the pike, led by an oil price spike.”

Deflation Strikes the Eurozone

Brad Hoppmann

Uncommon Wisdom Daily

Folks in the Eurozone can stop wondering if deflation will strike their economies. Deflation isn’t coming. It’s here.

Today, Eurostat confirmed that consumer prices in the common currency area dropped 0.2% in 2014. With fuel prices still dropping, experts expect more of the same in 2015.

We’re all familiar with inflation. We don’t know as much about deflation. Today, we’ll look at the difference.

Inflation is easy to understand; it means prices are generally rising. There might be exceptions here and there, but the cost of most goods and services is going up.

Deflation is the opposite condition, in which prices are generally falling.

Both inflation and deflation are actually symptoms of an underlying disease. The real problems are fractional reserve banking and monetary manipulation. While those are interesting subjects, today I want to think about the way deflation “feels.“

People and businesses usually respond to economic incentives. If the price of something you want is rising, you will probably buy it as soon as possible. If the price is falling, you will more likely wait.

Those simple, individual decisions can add up to economic chaos. Under deflation, a country’s economy will halt. No one wants to buy anything, even if he has money.

Sellers respond to low demand by reducing prices, which cuts their own income and reduces overall spending even further. This vicious cycle is painful for everyone.

One group does benefit from deflation, though. Lenders can prosper because they are receiving debt payments in a currency with more spending power than the one they originally loaned.

On the other hand, borrowers with no money might fall behind on payments. In that case, the lender’s incentive is to foreclose and seize collateral as soon as possible, before it loses even more of its value.

Europe has been dealing with deflation in a small way for several years. Now, it’s getting worse. The European Central Bank apparently wants to respond with quantitative easing, much like the Federal Reserve’s bond-buying program that ended last year.

People can argue whether QE helped the American economy. Even if it did, it still took years to make a difference.

So good luck, Europe. You’re going to need it.

Patience, Foresight, and Courage

By Tom Fyler

EssentialsInvesting.com

January 22, 2014

The following are a few thoughts for investors to consider when planning investment strategies for 2015 and beyond.

For those that have questioned government and Federal Reserve policies and strategies—and the legitimacy of various market and asset valuations, now just might be the time that your sense, analysis and insights are bearing fruition. Your perspective and foresight–prudently considered, meticulously planned and timely executed—with the benefit of experience and knowledge, might just provide you with an advantage in the coming years to generous opportunities in the management of your wealth.

It is possibly “Game On” now as you seek and find discounted values in the midst of the “rubble” of broken economies, fiscally sense-less governments, and manipulated markets and assets to which the “chickens have come home to roost.”

Waiting for “The” or “A” Crash

Don’t wait—we are in a “crashing”. In most cases, a crash is not a single event but rather a series of substantial assets devaluations that over time, when we look back, are viewed as a crash. The most recent asset to “crash” or significantly decline is oil. It has devalued by more than 57% in six months. Natural gas has declined 44% since May 2014. Silver has declined by 66% since 2011. How about the declines of other commodities: copper down over 17% in six months; sugar down 38% in eight months; nickel down 35% in seven months. Various countries’ equities have declined significantly: Brazil minus 56% since 2010; emerging markets minus 23% since 2011; Russia minus 54% since February 2013; Mexico minus 45% since March 2013. Based on a trend of these and other asset devaluations, there is certainly the possibility that other assets will follow. (Historical results or trends are not necessarily an indicator of future performance. Some of the cited asset performance information is approximate. Cited performance data was derived from: Oil as represented by WTI Crude Oil–New York Mercantile Exchange [NYMEX] @CL.1; Natural Gas—NYMEX: NGG15; Silver–iShares Silver Trust symbol SLV; Copper–Exchange-Traded Note [ETN]: JJC; Sugar–ETN: SGG; Nickel–ETN: JJN; Brazil–Exchange-Traded Fund [ETF]: EWZ; Russia–ETF: ERUS; Mexico–Closed-End Fund: MXF.)

Buying REALLY Low

Conventional wisdom suggests that the best time to buy is when an asset’s value is low—i.e. “Buy Low, Sell High.” But an asset looks the worst when it is low. And the bottom is never known without or until the benefit of hindsight. So low may be low, but still not near a bottom. Investing in an asset when it is “ugly” in performance is a scary and a risky proposition for investors. So it takes courage and foresight to buy low. It also takes a measured and prudent plan when buying declining assets that is designed to help mitigate the risk of an uncertain asset bottom value. Such a strategy should be only used for an appropriate limited portion of an investment portfolio. And it normally takes time and patience for these assets to substantially appreciate. But the wait—in many historical instances, has been worth it more times than not. For example, the recent decline in oil price brings to mind a previous period when oil declined substantially in 2008 and 2009. As measured by the ETF: OIL, it hit a low in March 2009 and two years and one month later it had risen 66%. (Some investment strategies may not be appropriate for all investors. There is no guarantee that any investment strategy or plan will result in a gain and may result in a loss.)

Commodities Don’t Lie

The great characteristic of commodities is their valuation relationship to “supply and demand.” We all learned in school that as demand increases against low supply, the asset’s valuation will increase. And as demand decreases against high supply, the asset’s valuation will decrease. In the end, this dynamic more times than not will prevail. Thus, the trend or movement of the value of commodity assets will eventually be reflected in the trend or movement of the values in any goods or services underlayed or impacted by a commodity—which is virtually most goods and services. And it is of course goods and services that are produced or provided by companies, and the valuation of these goods and services—influenced by commodity valuations, that will eventually reflect these companies’ equity or stock valuations. Economies and equity markets rise and fall on commodity valuations. To the contrary, asset valuation strategies or policies such as Fed stimulus, stock buybacks, manipulation of interest rates, currency devaluations, excessive government spending and debt, are all manipulated asset valuation “lies.” Thus, the negative performance or trend of commodity valuations many times may serve as the “Canary in the Coal Mine” warning of other assets devaluations to come. Learn to be a “Commodities Whisperer”, or at least know one.

“Crash Strategy” Recommendations—Investment industry regulations do not allow specific investing strategies to be recommended in public information. Interest in strategies appropriate to personal circumstances and risk sensitivity, or any questions, may be directed to Tom Fyler at email address fyler@tiac.net.

Mr. Fyler is President of Commodities & Securities, Inc., a firm registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor. Mr. Fyler is also licensed in real estate.

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Information provided in this communication should be understood as the analysis and/or opinion of the author. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies, any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.

10 STEPS TO AVOID THE CRASH

We have less than 9 months before September. We all need to prepare as much as possible so we can weather the coming storm. I wrote the FREE guide '10 Steps To Avoid The Crash' to help you survive and even thrive through the coming collapse, which is well under way. If you haven’t already downloaded a copy of the e-book, please do so because it covers ten steps you must carry out if you are to survive and even prosper during the collapse. It contains some great information relating to gold and how the gold market has been manipulated to stave off the crash of the American Dollar. This information is essential if you are considering buying gold and silver. The guide extensively talks about why you need to get out of debt, get out of paper assets as well as pay off your house mortgage. It also discusses why you need to store food, water and defensive equipment, why you need to get out of the city and purchase everything you need. The e-book also covers sorting out your medicine cabinet, which took many aspects of Pastor Williams’ DVD “Healing the Elite Way”, which is also essential viewing. Most importantly it talks about getting your spiritual house in order. Please print '10 Steps To Avoid The Crash' and share it with your friends and family.

TRUMP OR HARRIS – The war for the US and the World…

CONGRATULATIONS PRESIDENT TRUMP! Hi. I am James Harkin, and I am the webmaster of LindseyWilliams.net. I sent this as an email on Monday, November 4th, 2024, to all of the current subscribers to LindseyWilliams.net. I think a lot of the emails got blocked. So, I am creating this blog post that includes the entire email. […]

Finding Healing and Hope: Joanna Williams’ Heartfelt Journey at IBC Hospital

Discover Healing Beyond Medicine: Joanna Williams’ Journey at IBC Hospital Finding the right healthcare provider can often feel like searching for a needle in a haystack. Joanna Williams, the widow of the esteemed Pastor Lindsey Williams, knows this journey all too well. Since 2011, she and her late husband sought quality care, eventually discovering BioCare. […]

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams In Celebration of LINDSEY WILLIAMS January 12, 1936 – January 23, 2023 On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of […]

What’s the deal here? Has anyone else noticed that crude oil is getting slammed but the price of gas here in the U.S. is’nt moving!? Greed! They are making a killing! Makes me sick!

Does this mean the Elite are now caving in on just about everything?

http://www.zerohedge.com/news/2015-03-12/wests-plan-drop-russia-swift-hilariously-backfires

http://www.zerohedge.com/news/2015-03-11/we-have-grandstand-seats-imminent-market-shock-hedge-fund-billionaire-warns

does anybody know the difference between a bank and a credit union? Will money be safer in a credit union?

(ED: Your money will be worthless in a bank or credit union. Once you give away possession of your money the banks can legally do whatever they want with it. You are better off keeping a certain amount in cash for day to day expenses and the rest in precious metals that you hold in your hand.)

SWIFT now faces competition:

http://www.zerohedge.com/news/2015-03-09/de-dollarization-encircles-globe-china-completes-swift-alternative-may-launch-soon-s

A report that the top 1% elite are fragmenting. The statement was made by Robert David Steele while being interviewed on Infowars 2 days ago (1:00:00 mark):

https://www.youtube.com/watch?v=jYRIjhReC8o&index=30&list=WL

China begins to push for a new world reserve currency:

http://www.zerohedge.com/news/2015-03-04/chinese-buy-billboards-announcing-renminbi-new-world-currency

Wrong video,Marguerite!

Can somebody or LW explain this. I am hesitant to invest in silver and gold. The Bible states it will be worthless and witness against you in the last days.

James 5:3

King James Bible

Your gold and silver is cankered; and the rust of them shall be a witness against you, and shall eat your flesh as it were fire. Ye have heaped treasure together for the last days.

I think this is referring to the day of judgement at death when we will all have to stand before the Lord. Gold and silver are of no value then, only our relationship with Jesus Christ.

(ED: In the Bible it says (1 Timothy 6:10) “For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs.” This doesn’t mean that money is the root of all kinds of evil, because money is merely a tool. In this world reality, money allows many freedoms. I found a quote that talks about precious metals: “Gold and Silver, as is all of creation, are from God, and given to man for good use, for a useful purpose. (Genesis 1:28, Gen 2:12.) Gold, silver, seed, and flour, were all used as money. (Lev 27:16, 2 Kings 7:1) The vast majority of the time that gold and silver are mentioned in the Bible, it is in reference to the wealth of the kings of Israel or to the wealth of the temple of the Lord. Gold and sliver were used in the workings and furnishings of the ark of the covenant, and the vessels in the temple. Therefore, gold is definitely the approved by God for men to use as money and as a store of wealth.” However, hoarding the stuff until your death is a totally futile exercise since you cannot take any physical possessions with you when you passover. Using gold as a store of wealth to protect yourself while incarnated makes good financial sense.)

I think it means we are almost all screwed, but if you trust Jesus to have removed your sin you should be ok. The other 99% of human beings, therefore, are screwed (hell, etc).

Unless it means even the believers are gonna get a rebuke from the Lord for buying precious metals? I don’t know. When it comes to the Scriptures we all read it differently else there wouldn’t be so many theological debates, church denominations etc. Just act on how you read it with an honest heart and that’s the best you can say you did on Judgement Day.

What else can be asked of us? We’re only weak humans! Trust Christ and expect to fail in most other departments. That’s my own walk with the Lord summed up!

Thanks Goldfinger. I struggle with this because the verse specifies “the last days” not judgment day. I pray that God will provide. I want to do the right thing. I read Ed’s response and agree that gold and silver has always been acceptable forms of currency in the Bible, but if the “elite” are hoarding it I can see it becoming worthless before Jesus returns as part of his wrath against them.

God is providing for you. He is letting you know ahead of time what is coming and how to make it through these trying time coming ahead! He let Noah know about the flood ahead of time, and he is warning us, for we are the ones who will have to fight the Antichrist and we have been chosen as his warriors. You have free will to act on this info or not.

In this dark hour, however, many will come to know Christ Jesus as Savior. These are the tribulation saints who will face the wrath of Antichrist (Revelation 13:7), yet their eternal salvation is secure (Revelation 14:12-13).

Dude the Zionist Jews distorted the book to fit their agenda’s. They don’t want you to hold it so they can further enslave you. Go buy it. Don’t stop believing but stop reading that manipulative bible crap.

An addition to my previous comment. I’m also trying to determine whether retirement funds for those living in countries outside the U.S. would also be at risk of loss similar to 401K for U.S. citizens.

Marguerite,

I may be able to help you from the Australian perspective. It looks like retirement funds are facing nationalisation. See attached link, and a google search will reveal more information.

http://www.dailyreckoning.com.au/biggest-threat-superannuation-savings-six-years/2015/02/23/

Hopefully James can assist you further.

Regards

Hal

PS: Thanks jj99 for your concise explanation of why interest rates can rise during deflation

Hal

Thank you for the link. Interesting reading.

Researching further online shows a total Australia debt of over $5 trillion according the the Australian debt clock http://www.australiandebtclock.com.au/

It is intriguing as to what could happen with retirement funds currently at $1.8 trillion when they are moved from the private sector to the government.

(ED: Australia is also pushing forward for more surveillance of its residents. Everything is ramping up in the Western world to control its population from birth to death.)

James, I recall hearing or reading from you or Pastor Williams that you reside outside the U.S. I was wondering if you could comment on a query I have. All the material I watch and read on economic collapse talks about the U.S. which is understandable because of crashing the USD. When the elite crash the banking system in the U.S. as Pastor has advised us, will it take down the whole global system immediately? I’ve understood it to be that way because of the derivatives network, and also Pastor has mentioned on earlier material the elite want to collapse all world currencies and I’ve presumed in one go. I don’t live the U.S. either (though I love the people there) and am trying to determine what may happen in countries outside the U.S. I’ve been playing my cards as though what will occur in the U.S. will occur in the country I live in which is one of the G20 nations and an ally to the U.S. Do you think taking precautions like those required by U.S. residents is the right way to be going about things? Having taken on board the Pastor’s information, I decided to do things I wouldn’t have otherwise done. I’ve also been alerting friends in other parts of the world about cash in banks and survival prepping. Do you think anyone anywhere in the world ought to be taking the same precautions as residents in the U.S.? Your view or comment would help.

Blessings and thanks to you and Pastor Williams.

(ED: The entire financial system will fall like dominoes once this gets started. It is likely the currencies will be reset as shown by Pastor Williams’ Global Currency Reset’ DVD, only if the IMF can achieve this. As far as I am aware the US still has veto powers over any decision made by the IMF. We will see what happens. The currencies will be revalued based on assets/debt ratio and the world reserve currency, which International trade between nations will be in a single currency, most probably the current SDR. The out of control derivatives market has skewed traditional economics so instead of perpetual recession we have fake growth in the stock market. In order to collapse the global financial system they will raise interest rates and this will hit interest-rate derivatives. As of June 2014 according to the Bank of International Settlements JUST the notional amounts outstanding of OTC single-currency interest rate derivatives by instrument and counterparty stand at USD 563,290 Billion. I am not sure what that means since I find derivatives a complicated topic, but these derivatives are very sensitive to interest rate changes. The banks have been borrowing money at zero percent interest and buying government bonds. The banks are insolvent and all of them are involved in fraud. Just look at the amount of fraud committed by HSBC and they are still allowed a licence to trade as a bank. Legislation has been passed to declare that money in the bank is no longer yours, it is now assets of the bank. Therefore, any depositor is not paid out first if a bank is declared insolvent. Additionally there is legislation that forbids any bank to become bankrupt. Banks can be refinanced using depositors money or bought by another bank. The governments are limiting exposure to bail-ins with taxpayer money. FDIC is currently only securing 2% of all deposits held in banks in the US. This means that if one large bank defaults on its obligations and FDIC has to pay out, its likely the FDIC will collapse. With regards to retirement accounts, they are all at risk of failure since they are all tied into the stock market. The only hedge against all of this carnage is physical gold and silver. If gold and silver were to fall below extraction and refinement costs, then scarcity should raise the price back up. There’s not much gold and silver around. Even the best gold dealers have at least a two-three week lead time for delivery. With governments around the world buying tons of gold and other precious metals, its really time to actually do as they are doing instead of doing as they say. Get Gold. Secure yourself for when the dust settles.)

James, thank you for your indepth response. It was better than any financial column or economics reporter anywhere. From reading it I realize the steps I’ve taken will mitigate wipe-out of what I have so I can survive. The alarming factor is retirement funds and the clarification you gave of them all being tied to the stockmarket. I suggested to people I know to withdraw their funds now in the event of global economic collapse but they’re somewhat complacent or not too convinced their funds are at risk because the financial sector here has generally been sound. The aspect of having retirement funds wiped out without warning will horrify people. You laid out the reality of bail-ins clearly as well which highlights people are being blinded by the FIDC element. Your perspective and comments are valued.

(ED: Thank you for your kind words. I am currently writing a guide on how people can liquidate their IRA’s and explaining the benefits and drawbacks of keeping an IRA. It will include examples and ideas of what people can do for their retirement years. As well as exposing schemes that the governments are trying to roll out to keep people in work longer to extract more tax revenue.)

James, that’s a worthwhile guide to create and everyone would be keenly interested in it I would say. I certainly would. Most people find it daunting trying to understand how the complex system works, then what to do as a safeguard from the ‘chains of slavery’ which mankind has consistently been victim to. So many of us know the world doesn’t need to be set up this way – there’s more than enough for each person on the planet to live with all the requirements that a human needs to be here and more.

James does Lindsey think Gold will do better than Silver then?

(ED: Silver and gold are both important tangible investments. The price has fallen to close to cost price, so now is the time to buy. I say purchase with haste, because if the price falls below extraction and refinement costs we’ll see mines shut down until prices rise. The price is not an indication of supply and demand. Demand is huge globally with many countries buying by the ton on a monthly basis. If people leave buying physical precious metals too late, there may not be a supply other than what is already in circulation.)

Well, I listened to Lindseys new dvd and found it quite interesting.

However, I was hoping someone could explain what he said about deflation.

Evidently, deflation (ie decrease in the money supply) is going to happen. However he also said the interest rates were going to rise.

I thought interests rates were raised to slow down the economy when inflation was also rising?

Any economic experts able to help?

Thanks

Hal

I’m not an expert, but I would not imagine deflation strictly as a “decrease in the money supply”. The problem is that a debt based economic model requires exponential growth of the money supply. This is done via the fractional reserve banking which must lend more and more money into existence. However, there are still two important points:

– there are still rules how much can be lent, i.e. the leverage

– somewhat must want to take and spend the money, i.e. the money velocity.

Both of these two are flashing red now. Banks are over-leveraged and nobody wants to spend and go deeper into debt. Interest rates were made artificially low using derivatives, in order to achieve such dire situation (the public was told this is “stimulus”). In a free market, interest rates are the risk of lending + inflation. The risk of lending grew extraordinary, so even in this so called deflationary period, the rates should be a lot higher. And they will be, when the central banks stop printing money (i.e. monetizing the debt) and search for real investors. AFAIK, the food prices are supposed to continue to go up. So basically the main factor here will be the shrinking economy and people who just try to feed themselves and keep up with their debt payments (if they can). They will not be able to spend like before for non-essential products and their prices will drop down. We can expect a lot of bankruptcies, since many products will not have market any more.

Basically, this is a mega-bust cycle, because the central bank interventions all around the globe make it in this way. Instead of a small, localized economic slow down, we will have a deep and world-wide recession. They can twist it however they want for the public though. It was caused by no one else but the western central banks, pretending they understand economy better then everyone else… Many people think that the governments are on top of this, and for them, it’s better to use inflation (they want to run deficits and spend). But in terms of control, it’s probably better to use deflation. And it’s a perfect excuse for the Fed, since on the surface, it seems they tried to prevent the deflation, but they didn’t quite succeed (but didn’t cause hyperinflation either). In case of deflation though, governments will fail on their obligations to the public and lose credibility.

More comments from David Stockman:

http://www.zerohedge.com/news/2015-03-01/david-stockman-warns-its-one-scariest-moments-history

Italian Central Banker gives an interesting speech posted on the web site of the Bank for International Settlements. It talks about a future potential financial crisis and how the IMF will need to be strengthened to deal with it. A review of this speech is available here:

http://lonestarwhitehouse.blogspot.com/2015/03/bis-speech-former-italian-minister-of.html

James

can Lindsey address the following…

1.will there be a peace agreement soon between Israel and Palestine?

2. when will the Jews rebuild the temple?

3. Is there such a thing as planet X or nibiru? and does it have biblical significance?

Thanks

Thanks

Who are the 5 big banks that will stand?

Hugo Salinas Price (February 2015) Sprott Money News

https://www.youtube.com/watch?v=BE6wS4IlqgE

When is LW coming back on any radio shows? I miss hearing him. We want you back Pastor!!!

Thank you Pastor williams for all that great info. i hope i will be able so save my family for whats coming. i love father god so much. thank you again

A great video…what do you all think?

http://pro.moneymappress.com/MMRBS495LG/PMMRR2BU/?iris=335066&h=true

Existing food supplies three times higher worldwide, Write everything down, water corruption alliws us to forget, eat yeast and incorporate it into diet.

Existing food supplies costs three times higher worldwide! Write everything down! You will forget, the water supply is corrupted, intended to make us all, worldwide, forget. Incorporate real yeast products into diet.

Existing food costs three times more worldwide

Did LW say if the collapse will still happen in September? What did he say about ISI -L verse ISI-S?

Did he mention Holy Bible prophecy?

Here is a possible example of the chaos in the derivative market that LW speaks of in, “The New Elite In 2015” DVD:

http://www.zerohedge.com/news/2015-02-19/central-bankers-worst-nightmares-are-unfolding-greece

About that internet, BIG SCREEN, television, phone, regulation. The criminal elite can transport items from your house, home, make them disappear in a moment and you think you’re going out of your mind, so there may be fights amoung your people. The CRIMINAL ELITE listen to every word that you speak, at home, on vacation, in your car, at your school, at your work,even when your phone is off, now they have tge ability to control the whole WURLD, the Wurld, the wurld, at their fingertips…