From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From April 1, 2016 to April 7, 2016:

- U.S. Oil Rig Count Down by 10

The U.S. oil-rig count fell by 10 to 362 in the latest week, according to Baker Hughes Inc., maintaining a trend of declines. The number of U.S. oil-drilling rigs, viewed as a proxy for activity in the sector, has fallen sharply since oil prices began to fall. But it hasn’t fallen enough to relieve the global glut of crude. There are now about 72% fewer rigs of all kinds since a peak of 1,609 in October 2014. - Automakers post disappointing U.S. sales, still see strong 2016

General Motors Co, Fiat Chrysler Automobiles and other major automakers reported weaker-than-expected U.S. sales for March, hurt by declining demand for sedans and light dealer traffic during the Easter weekend. Sales for the month rose 3 percent to nearly 1.6 million vehicles, or 16.57 million vehicles on an annualized basis, according to industry analyst Autodata Corp. That was well below expectations of a rise of about 7 percent and annualized estimates that ranged from 17 million to 17.5 million by analysts and economists polled by Thomson Reuters. - Where The March Jobs Were: The Minimum Wage Deluge Continues

In March the US economy added a healthy 215K jobs, beating expectations and more importantly, pushing the average hourly earnings up by 0.3% on the month. Which, however, is curious because a cursory look at the job additions in the month reveals that nearly two-third of all jobs, and the three top categories of all job additions, were once again all minimum wages jobs. - Gold Rush by Russia Makes Up for Billions Lost in Currency Rout

Here’s why Governor Elvira Nabiullina is in no haste to resume foreign-currency purchases after an eight-month pause: gold’s biggest quarterly surge since 1986 has all but erased losses the Bank of Russia suffered by mounting a rescue of the ruble more than a year ago. While the ruble’s 9 percent rally this year has raised the prospects that the central bank will start buying currency again, policy makers have instead used 13 months of gold purchases to take reserves over $380 billion for the first time since January 2015. The central bank will wait for the ruble to gain more than 12 percent to 60 against the dollar before it steps back into the foreign-exchange market, according to a Bloomberg survey of economists. - Part-timers might account for labor-force surge

The number of able-bodied Americans entering the labor force has surged since last fall. But in a marked change from earlier in the recovery, more of them are finding jobs right away instead of just looking for work. What’s going on? It’s hard to say for sure, but circumstantial evidence in the latest U.S. jobs report suggests many of these newly employed workers have found part-time work with mediocre pay. The participation rate hit a two-year high of 63% in March, climbing from a 38-year low of 62.4% in September, the government said Friday. A person is considered part of the labor force if he finds or job or is actively searching for one. - Meet the angry American voter

The angry primary voter is the election year manifestation of a 25-year trend gnawing away at American self-confidence. Call it one America, two economies. The S&P 500 is up more than 200% over the past seven years. Home prices rose 11% last year, and a quarter of housing markets are showing record high home prices. Millions of jobs have been added and the unemployment rate is 4.9%, approaching a level many economists consider full employment. - Negative Yields, Opportunity Cost and Gold

Last week, I published an article on the causes and consequences of negative interest rates. In it, I talked briefly about how negative yields hold significant implications for gold as an asset class. In this followup article, I will explain why that is. - U.S. factory data signal further slowdown in GDP growth

New orders for U.S. factory goods fell in February and business spending on capital goods was much weaker than initially thought, the latest indications that economic growth slowed further in the first quarter. The Commerce Department said on Monday new orders for manufactured goods declined 1.7 per cent as demand fell broadly, reversing January’s downwardly revised 1.2 per cent increase. Orders have declined in 14 of the last 19 months. They were previously reported to have increased 1.6 per cent in January. - JOHN McAFEE: A time bomb is hidden beneath the Panama Papers

John McAfee is running for US president as a member of the Libertarian Party. This is an op-ed he wrote and gave us permission to run. The hack of Mossack Fonseca, in terms of the certain fallout that will affect many of the wealthiest and most prominent people on the planet, is by far the largest and most damaging cyberattack on record. I am just one of more than 200,000 people to have downloaded the Panama Papers, a record for hacked documents. It was a gold mine. - Stunning Video the world was never supposed to see…

Pastor Williams shared this video, he has said ‘Every American must see this'. This video is a must watch. US Admiral (Ret) James “Ace” Lyons tells what Islam is like. - Invitation by Pastor Lindsey Williams – From DVD – Elite Plans For 2016

This is an invitation by Pastor Lindsey Williams taken from the DVD ‘Elite Plans For 2016'. Lindsey Williams, an ordained Baptist minister went to Alaska in 1970 as a missionary. For three years Pastor Lindsey Williams had the opportunity to sit, live and rub shoulders with the most powerful, controlling and manipulative men on the face of this planet. - Donald Trump Is Starting To Sound Just Like The Economic Collapse Blog (And That Is A Good Thing)

Guess what Donald Trump is saying now? Last week, I discussed how Robert Kiyosaki and Harry Dent are warning that a major crisis is inevitable, but I didn’t expect Donald Trump to come out and say essentially the exact same thing. On Saturday, the Washington Post released a stunning interview with Donald Trump in which he boldly declared that we heading for a “very massive recession”. He also warned that we are currently in “a financial bubble” and that “it’s a terrible time right now” to be investing in stocks. These are things that you may be accustomed to hearing on The Economic Collapse Blog, but to hear them from the frontrunner for the Republican nomination is another thing altogether. - Shots Fired: Wikileaks Accuses Panama Papers' Leaker Of Being “Soros-Funded, Soft-Power Tax Dodge”

Earlier today, for the first time we got a glimpse into some of the American names allegedly contained in the “Panama Papers”, largest ever leak. “Some”, not all, and “allegedly” because as we said yesterday, “one can't help but wonder: why not do a Wikileaks type data dump, one which reveals if not all the 2.6 terabytes of data due to security concerns, then at least the identities of these 441 US-based clients. After all, with the rest of the world has already been extensively shamed, it's only fair to open US books as well.” The exact same question appeared in an interview conducted between Wired magazine and the director of the organization that released the Panama Papers, the International Consortium of Investigative Journalists, or ICIJ, Gerard Ryle. - Trump: America is headed for a ‘very massive recession’

Donald Trump said in an interview that economic conditions are so perilous that the country is headed for a “very massive recession” and that “it's a terrible time right now” to invest in the stock market, embracing a distinctly gloomy view of the economy that counters mainstream economic forecasts. The New York billionaire dismissed concern that his comments – which are exceedingly unusual, if not unprecedented, for a major party front-runner – could potentially affect financial markets. “I know the Wall Street people probably better than anybody knows them,” said Trump, who has misfired on such predictions in the past. “I don't need them.” Trump's go-it-alone instincts were a consistent refrain – “I'm the Lone Ranger,” he said at one point – during a 96-minute interview Thursday in which he talked candidly about his aggressive style of campaigning and offered new details about what he would do as president. - ISM New York Drops To September Lows As All Components Decline; Employment Plunges

While last week's Chicago's PMI staged a strong bounce from its recent contraction and back into expansion, New York did not. ISM New York just printed at 50.4, just barely above the contraction point, and the lowest headline print since mid 2015. The extremely noisy time series continues to swing, this time lower, with every single underlying component deteriorating in the month of March. - Is Trump's “Recession Warning” Really All Wrong?

Over the weekend, Donald Trump, in an interview with the Washington Post, stated that economic conditions are so perilous that the country is headed for a “very massive recession” and that “it’s a terrible time right now” to invest in the stock market. Of course, such a distinctly gloomy view of the economy runs counter to the more mainstream consensus of economic outlooks as witnessed by some of the immediate rebuttals. - Trade deficit balloons in February

The US trade deficit widened to $47.1 billion in February, the Commerce Department said Tuesday. Economists had estimated that the excess of imports over exports — or the trade deficit — increased to $46.2 from a revised, expanded print of $45.9 billion in the prior month. “So far this quarter imports have rebounded more than exports, which is why we expect trade to subtract from Q1 GDP growth,” said BNP Paribas' Laura Rosner in a note. - Employment Numbers an April Snow Job

Donald Trump managed to shove his way into the spotlight again last week, claiming the US is heading for “a massive recession.” Unsurprisingly, the mainstream media scoffed at Trump’s assertion, pointing to the “great jobs report” that came out Friday. - Pfizer Vs. Obama: The Treasury Tries To Stop Pharma's Tax Dodge

Most experts in corporate taxes thought there was little President Barack Obama could do to force Pfizer PFE +5.01%, the largest drug company in the U.S., from moving its corporate address to Dublin, Ireland, in order to escape paying American taxes. Yesterday evening, Jack Lew, Obama’s secretary of the treasury, called Pfizer’s bluff, instituting new rules to make the move as difficult as possible. The punch hit, and investors are reeling. Now the move could intensify an election-year battle over what it means for companies to be American, and the fairness of the U.S. corporate tax code. - China's yuan set for biggest quarterly gain since Sept 2014

China's yuan is poised for its biggest quarterly gain since September 2014, underpinned by firmer central bank guidance as the country's financial markets continue to stabilise and the dollar loses momentum. Federal Reserve Chair Janet Yellen's cautious view on U.S. rate hikes this week, which dampened views of other Fed colleagues suggesting another increase was imminent, continued to take a toll on the greenback on Thursday. - Jobless Claims Surge Most In 2 Years As Challenger Warns Of “Significant” Jump In Retail, Computer Layoffs

With both ISM Manufacturing and Services employment indices collapsing, endless headlines of layoffs, Challenger-Grey noting Q1 as the worst since 2009, and NFIB small business hiring weak, it is no surprise that initial jobless claims is finally waking up. For the 3rd week in a row – the longest streak since July 2015. The last 3 weeks have seen a 9.1% surge in jobless claims – the biggest such rise since April 2014. - Russia on a Gold Buying Spree

The Russians have launched into a gold buying spree. Based on recently released International Monetary Fund numbers reported at Mining.com., the Russian central bank ranked as the world’s leading gold buyer in February, adding 356,000 ounces to its reserves. - Gold Soars 16% In Q1 – Best Start To A Year In 42 Years

Gold's 16.1% surge in Q1 2016 ias the best start to a year since 1974. Overall, this is the best quarter since Q3 1986 and is the best performing major commodity of the year. Gold rallied this year as it cemented its status as a store of value amid financial market turbulence and concern about the global economy, which led to speculation that the Federal Reserve would pause on tightening monetary policy in the U.S. Having seen BlackRock's gold ETF halted due to inability to meet physical demand, it appears pet rocks and barbarous relics are ‘worth' something after all. - NY Senate OKs Budget Bill To Boost State Minimum Wage To $15

The Republican-controlled chamber voted 61-1 for the final bill after working through the night to pass other parts of the $156 billion spending plan for the fiscal year that began Friday. “We knew we could lift millions out of poverty if we just stayed focused,” said Sen. Andrea Stewart-Cousins, leader of the Senate’s Democratic minority. “It’s a good day, even if it is a very, very long day.” The Democrat-controlled Assembly, which adjourned early Friday, was set to meet following Friday afternoon briefings to begin debate on the wage bill. - Dollar logs worst quarter since 2010; buck hits 5-month low vs. euro

The dollar logged its worst quarterly performance in years as the Federal Reserve slowed the expected pace of interest rate hikes, citing worries about the potential domestic impact of anemic growth abroad. As measured by one gauge, the buck is about to register its worst performance during the first quarter of a year since 2008, when the index fell 6.4%, and its worst overall calendar-quarter performance since Sept. 30, 2010, when the gauge dropped about 8.5%. - “The Cat Is Out Of The Bag” – In Interview Mossack Fonseca Founders Admit It's Over… To Rothschild's Delight

Days before the ICIJ released this weekend's trove of “Panama Papers” international tax haven data involving Panamaian law firm Mossack Fonseca, Bloomberg conducted an interview on March 29 with the two founding lawyers. In it, it found that even before the full leak was about to be made semi-public (any of the at least 441 US clients are still to be disclosed), the Panama law firm knew that the game was already largely over. - Here Are Some Of The Americans In The “Panama Papers”

With media attention squarely falling on the foreigners exposed by the Panama Papers offshore tax haven scandal, everyone has been asking for more information on who are the Americans involved in this biggest data leak in history. After all, as we showed, Mossack Fonseca had over 400 American clients. But who are they? Today, courtesy of McClatchy, we get some answers: while there are no politicians of note are in files but plenty of others. Among them: Retirees, scammers, and tax evaders, all of whom found a use for secrecy of offshore companies. As the news paper reports, “the passports of at least 200 Americans show up in this week’s massive leak of secret data on secretive offshore shell companies.” - 2007 All Over Again: “We Are Outsourcing Our Monetary Policy”

Last night we noted the odd “messaging” that was apparent in The PBOC's Yuan fix shifts into and after The Fed and Janet Yellen spoke… Almost as if The Fed had “outsourced its monetary policy” to China once again. But as DollarCollapse.com's John Rubino notes, it appears Janet Yellen has instead outsoured US monetary policy to the financial markets… - Waiters And Bartenders Rise To Record, As Manufacturing Workers Drop Most Since 2009

On the surface, the March jobs reported was better than expected… except for manufacturing workers. As shown in the chart below, in the past month, a disturbing 29,000 manufacturing jobs were lost. This was the single biggest monthly drop in the series going back to December 2009. - Global Data: A New Scapegoat for the Federal Reserve

During March 16th’s FOMC meeting, the Fed announced that it would leave interest rates unchanged and scaled back its December projections for higher rates in 2016, 2017, and 2018. The Fed’s backtracking comes just three months after raising interest rates 25 basis points, its first hike since June 2006. - GAO Has Been Telling Congress that Financial Regulation Is in Disarray for 20 Years

Who could blame the researchers at the Government Accountability Office (GAO) for thinking that responding to Congressional requests for studies on how to repair the nation’s ineffective maze of financial regulation is an exercise in futility. GAO has been spending boatloads of taxpayer money for the past two decades to define the problems for Congress as our legislative branch has not only failed to take meaningful corrective measures but actually made the system exponentially worse through the repeal of the Glass-Steagall Act in 1999. - EU admits plot for FEDERAL superstate and describes Brussels attacks as an ‘opportunity'

Gianni Pitella, leader of the socialist group in the European Parliament, claimed the attack's on the Belgian capital's metro system and airport showed the need for even closer intergration of the 28 member nations of the bloc. He also called for a “European Intelligence Agency” to be set up to strengthen the EU's defences against extremists. Critics warned that his outburst laid bare the ambitions for an European super-state held by many EU supporters and highlighted the long-term dangers of Britain staying tied to Brussels. Mr Pitella's remarks came in an interview with the EU news website Euractiv. - Big Brother Rising: US Turns Into Full-Blown ‘Surveillance State'

The recent revelation that the NSA has plans to share intercepted private communications with other domestic intelligence agencies has caused a massive backlash, with many viewing the shift as “unconstitutional.” Two experts join Radio Sputnik’s Brian Becker to discuss if the policy is just a “giant fishing expedition for law enforcement.” - This is how World War III starts—it will be financial

In his History of the Peloponnesian War, ancient Greek historian Thucydides told us the tale of a dominant regional power (Sparta) that felt threatened by the rise of a competing power (Athens). Sparta felt so threatened, in fact, that all the moves they made to keep the Athenian rise in check eventually escalated the power struggle into an all out war. Modern political scientists call this the Thucydides Trap. - Trend Forecaster’s Dire Warning: Massive Crash Will Wipe 12,000 Points Off Dow Jones By Late 2017

Trend forecaster and demographic researcher Harry Dent says we are in a massive bubble. And as he explains in his latest interview with Future Money Trends, central banks around the world continue to fuel this bubble with unlimited fiat money printing. The end result according to Dent? The biggest bubble burst in history… and it’s coming soon. - Corporate Media Gatekeepers Protect Western 1% From Panama Leak

Whoever leaked the Mossack Fonseca papers appears motivated by a genuine desire to expose the system that enables the ultra wealthy to hide their massive stashes, often corruptly obtained and all involved in tax avoidance. These Panamanian lawyers hide the wealth of a significant proportion of the 1%, and the massive leak of their documents ought to be a wonderful thing. Unfortunately the leaker has made the dreadful mistake of turning to the western corporate media to publicise the results. In consequence the first major story, published today by the Guardian, is all about Vladimir Putin and a cellist on the fiddle. As it happens I believe the story and have no doubt Putin is bent. - Panama Papers: Revelations show sheer scale of UK links to off-shore tax havens

The UK government’s pledge to crack down on off-shore tax schemes and money laundering has been laid bare after the majority of firms implicated in a huge leak were shown to be registered in British-administered tax havens. Dubbed the Panama Papers, the unprecedented release maps how a global elite of one-percenters has hidden assets, dodged sanctions and evaded taxes over the last 40 years. More than half of the 300,000 firms, believed to have used a single, secretive Panama-based law firm, are registered in British-administered tax havens. Second only to Hong Kong, 1,900 British firms, including banks, law firms, and company incorporators, feature as “intermediaries” between Mossack Fonesca and its clients. - Putin and the ‘Dirty Dozen': 11million leaked documents reveal how TWELVE world leaders – plus Russian leader's inner circle, British politicians and Lords – hide their millions in tax havens

The biggest financial data leak in history has revealed how Vladimir Putin's inner circle and a ‘dirty dozen' list of world leaders are using offshore tax havens to hide their wealth. A host of celebrities, sports stars, British politicians and the global rich are all implicated in the so-called Panama Papers – a leak of 11million files which contain more data than the amount stolen by former CIA contractor Edward Snowden in 2013. Documents were leaked from one of the world's most secretive companies, Panamanian law firm Mossack Fonseca, and show how the company has allegedly helped clients launder money, dodge sanctions and evade tax. Megastars Jackie Chan and Lionel Messi are among the big names accused of using Mossack Fonseca to invest their millions offshore. And the Panama Papers also reveal that the £26million stolen during the Brink's Mat robbery in 1983 may have been channelled into an offshore company set up by the controversial law firm. - Panama Papers: David Cameron's father ‘ran offshore fund that paid zero UK tax for 30 years'

David Cameron’s father was allegedly involved in hiring what has been called a small army of Bahamas residents – including a part-time bishop – to sign paperwork for an offshore fund in what may have been an effort to avoid paying UK tax. - ‘Panama Papers' leak of 11m documents reveals how the super rich hide their money

The largest ever leak of documents has revealed how an offshore law firm has helped its clients to hide their money in tax havens. Dubbed the “Panama Papers”, the 11 million confidential documents from Mossack Fonseca show how the Panama-based firm has used shell companies to benefit the world’s rich and powerful. Some clients have laundered money, dodged sanctions and evaded tax. - Corporate Debt Defaults Explode To Catastrophic Levels Not Seen Since The Last Financial Crisis

If a new financial crisis had already begun, we would expect to see corporate debt defaults skyrocket, and that is precisely what is happening. As you will see below, corporate defaults are currently at the highest level that we have seen since 2009. A wave of bankruptcies is sweeping the energy industry, but it isn’t just the energy industry that is in trouble. In fact, the average credit rating for U.S. corporations is now lower than it was at any point during the last recession. This is yet another sign that we are in the early chapters of a major league economic crisis. Yesterday I talked about how 23.2 percent of all Americans in their prime working years do not have a job right now, but today I am going to focus on the employers. Big corporate giants all over America are in deep, deep financial trouble, and this is going to result in a tremendous wave of layoffs in the coming months. - The New Part-Time Job: “Get Paid $15 An Hour To Protest At The Trump Rally”

For those wondering why Trump rallies tend to devolve to pugilistic matches, where even belligerent 15-year-old protesting (or perhaps “provocative” is a better word) girls end up getting pepper sprayed much to the media's fascination, the answer is Craig's List ads such as the one below, in which allegedly “I'm feelin' the Bern”-affiliated organizers provide paid positions for protesters at Trump rallies, and which provide not only shuttle buses, parking, and signs (as well as time cards) but also hand out $15/hour (as a “part-time employment”) for said protest activity “due to the economic inequality.” - Japan Goes Neocon – Dumps Antiwar Constitution

Last September the Japanese Diet (parliament) passed legislation “reinterpreting” the nearly 70 year old strictly antiwar constitution to allow for the Japanese military to take part in overseas military operations not directly tied to the defense of Japan. Tens of thousands of Japanese took to the streets this week to protest the enactment of this new law. Will Japanese Prime Minister Shinzo Abe's desire to be part of Washington's “pivot to Asia” lead to a fundamental change in Japan's position in the region? - Does The United States Still Exist? — Paul Craig Roberts

To answer the question that is the title, we have to know of what the US consists. Is it an ethnic group, a collection of buildings and resources, a land mass with boundaries, or is it the Constitution. Clearly what differentiates the US from other countries is the US Constitution. The Constitution defines us as a people. Without the Constitution we would be a different country. Therefore, to lose the Constitution is to lose the country. Does the Constitution still exist? Let us examine the document and come to a conclusion. - Bernanke on the Fed’s Next Move

When it comes to anticipating Federal Reserve policy, there’s no better place to turn than former Fed Chair Ben Bernanke. No longer bound by an office, Mr. Bernanke is now free to write about monetary policy as an outsider. In a recent two-part post, the former Fed Chair took some time to explain what tools the Fed has left, and where they might turn in the case of another economic downturn. Why is this important? Because many believe the Fed’s hands are now tied as a result of short-term rates being near zero, and the Fed’s balance sheet sitting at over $4 trillion. - CITI: The ‘Uber moment' for banks is coming — and more than a million people could lose their jobs

Banks are quickly approaching their “automation tipping point,” and they could soon reduce headcount by as much as 30%. That's according to a new Citi Global Perspectives & Solutions (GPS) report on how financial technology is disrupting banks. “Banks' Uber moment will mean a disintermediation of bank branches rather than the banks themselves,” the report said. - Deflation Welcome! Lower Third of Population Goes Deeper in Debt, Cannot Afford Any Price Increases

A new PEW study on Household Incomes and Expenditures goes a long ways towards explaining why economists who expected a big jump in consumer spending based on falling gasoline prices were dead wrong. The study shows that although expenditures recovered from the downturn, income did not. Also, low-income families spent a far greater share of their income on core needs, such as housing, transportation, and food, than did upper-income families. Households in the lower third spent 40 percent of their income on housing, while renters in that third spent nearly half of their income on housing, as of 2014. - The Eurogroup Made Simple

The Eurozone is the largest and most important macro-economy in the world. And yet, this gigantic macro-economy features only one institution that has legal status: the European Central Bank, whose charter specifies what powers the Frankfurt-based institution has in its pursuit of a single objective: price stability. Which leaves the question begging: “What about economic goals, beyond price stability, like development, investment, unemployment, poverty, internal imbalances, trade, productivity?” “Which EU body decides the Eurozone’s policies on these?” - 7 Million at Risk from Man-made Quakes

Interesting Vox article on natural and manmade earthquakes my fellow Vet and cohort in writing Mark Jamison sent me. This year for the first time ever the USGS is including a map of areas in the US which may be prone to human-induced earthquakes” in addition to areas which are prone to natural earthquakes. - “Spike in Defaults”: Standard & Poor’s Gets Gloomy, Blames Fed

Credit rating agencies, such as Standard & Poor’s, are not known for early warnings. They’re mired in conflicts of interest and reluctant to cut ratings for fear of losing clients. When they finally do warn, it’s late and it’s feeble, and the problem is already here and it’s big. So Standard & Poor’s, via a report by S&P Capital IQ, just warned about US corporate borrowers’ average credit rating, which at “BB,” and thus in junk territory, hit a record low, even “below the average we recorded in the aftermath of the 2008-2009 credit crisis.” - IBM Laying Off 1000 Workers In Germany

In recent weeks, the stock of IBM has staged a dramatic rebound surging from a February 11 low of $118 to $150 today, on what we previously assumed had to be another long-overdue bout of stock buybacks. However, for that to make sense, the company – already at risk of being downgraded if it did not take further cost-cutting measures to offset the additional debt interest expense – would need to engage in another round of mass layoffs. This is precisely what happened moments ago when Germany press reported that Big Blue is cutting some 1000 jobs in Germany. - U.S. Home Prices Are 14% Overvalued According To Bank of America

There has been an odd shift when it comes to US sentiment toward home ownership: while in the past, the higher home prices rose the greater the demand was for housing (leading ultimately to the housing debt bubble of 2006), this time around we are getting increasingly more frequent indications of just the opposite. Some have started to notice: as we noted one week ago, in its traditionally cheerful assessment of the US housing market, the NAR's Larry Yun snuck in an unexpected warning. - First Ocean Freight Rates Collapse to “Zero,” China Freight Index Plunges to Record Low, Bailouts Loom

The amount it costs to ship containers from China to ports around the world has plunged to historic lows. As container carriers are sinking deeper into trouble, whipped by lackluster global demand and rampant oversupply of container ships, they’re escalating a brutal price war with absurd consequences. - This Shows Financial Reality Has No Place in Today’s Markets

The shares of OHL Mexico, the Mexican subsidiary of Spanish construction behemoth OHL, soared over 10% to 26.72 pesos on Monday morning. It was the stock’s biggest climb in over 8 months. The reason for the market’s new-found enthusiasm for the shares was somewhat counter intuitive: the company had just announced that it had been hit by the biggest fine ever imposed by Mexico’s securities authority, the CNBV. The company had been penalized for irregular accounting practices and was forced to pay 71.7 million pesos in damages — a $4-million slap on the wrist. - Peter Boockvar Warns Western Central Planners Are In Now Deep Trouble

Outside of another round of Pavlov’s (Yellen’s) panting dog (markets) getting more food, a few things were firmly established yesterday. Firstly, it really doesn’t matter what any regional Fed President says, especially those that don’t vote as Yellen is clearly the boss and what she wants is what she’ll get… - Solid Sale Of 7 Year Paper Ends Streak Of Poor Treasury Auctions

Following two disappointing auctions earlier this week when first the 2Y and then the 5Y auctions either demonstrated a substantial drop off in bid-side interest or priced wildly through the when issued, we said to await today's 7Y auction for the true picture of demand for primary paper, as the first auction took place when Europe was out for Easter vacation, and the second one took place just as Yellen speaking at the Economic Club yesterday. - Attention President Obama: One Third Of U.S. Households Can No Longer Afford Food, Rent And Transportation

While the Fed has long been focusing on the revenue part of the household income statement (which unfortunately has not been rising nearly fast enough to stimulate benign inflation in the form of nominal wages rising at the Fed's preferred clip of 3.5% or higher), one largely ignored aspect of said balance sheet has been the expense side: after all, for any money to be left over and saved, income has to surpass expenses. However, according to a striking new Pew study while household spending has returned to pre-recession levels (the average household spent $36,800 in 2014) incomes have not. - Doug Casey and the War on Cash: “We Are Truly on the Edge of a Precipice”

Recently, my friend and colleague Louis James, editor of International Speculator, sat down with Doug Casey to discuss the ongoing “War on Cash.” Doug reveals what people looking to protect their money should do. As the War on Cash has gone into overdrive lately, this is a timely discussion that you’ll find below. - How Have Hedge Funds Been Affected By Oil Prices?

After suffering large losses in 2014, trying to find a bottom in crude oil, the hedge fund industry wizened up: In 2015, it reduced its weightage to the energy sector to the lowest levels since 2008, saving themselves from profound losses when crude hit new 12-year lows—levels not seen since 2004. It was a short-lived euphoria, however, as most missed the stellar run in crude from the lows and are scrambling to enter after the rebound. - Job Growth Doesn’t Mean We’re Getting Richer

In response to recent claims by the Obama administration and others that “millions of jobs” have recently been created, I examined the data here at mises.org to see if the claims were true. It turns out that job growth since the 2008 recession has actually been quite weak, and hardly something to boast about. Nevertheless, our conclusions from these analyses tend to rest on the idea that job growth is synonymous with gains in wealth and economic prosperity. But is that a good assumption? In an unhampered market, the answer would be no, for several reasons. - Greece Demands Explanation From IMF Over Leaked Transcript

Greek politicians wasted no time in seeking a response from the IMF over the leaked transcript released earlier today by Wikileaks suggesting the IMF may threaten to pull out of the country's bailout as a tactic to force European lenders to more offer debt relief, and which according to the Greek government was “interpreted as revealing an IMF effort to blackmail Athens with a possible credit event to force it to give in on pension cuts which it has rejected.” According to Reuters, “Greece demanded an explanation from the International Monetary Fund on Saturday after an apparent leaked transcript suggested the IMF may threaten to pull out of the country's bailout as a tactic to force European lenders to more offer debt relief.” - Wikileaks Reveals IMF Plan To “Cause A Credit Event In Greece And Destabilize Europe”

One of the recurring concerns involving Europe's seemingly perpetual economic, financial and social crises, is that these have been largely predetermined, “scripted” and deliberate acts. This is something the former head of the Bank of England admitted one month ago when Mervyn King said that Europe's economic depression “is the result of “deliberate” policy choices made by EU elites. It is also what AIG Banque strategist Bernard Connolly said back in 2008 when laying out “What Europe Wants” - Price Controls May Be On the Way

If you thought negative interest rates were as bad as it could get with central banks, you might be in for a surprise. Central banks have been so spectacularly unsuccessful with their accommodative monetary policies that they are discussing pulling out all the stops to get the results they want. They fail to realize that the reason prices aren’t rising is because they really want and need to fall. Bad debts weren’t liquidated during the last financial crisis, the debtors were merely bailed out. Overpriced assets weren’t allowed to be reduced in price. Central banks pumped trillions of dollars into the economy to attempt to paper over the recession. Market forces want to drive prices down, while central banks attempt to prop them up. So what to do when central banks aren’t getting their way? - Relative Strength in Silver

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up. Why do we keep reiterating that gold goes nowhere, that it’s the dollar which mostly goes down over long periods of time and sometimes up as in 2011-2015? Why do we insist that the dollar be measured in gold, and that gold cannot be measured in dollars the way a steel meter stick cannot be measured in rubber bands? Some ideas that are impossible to understand using the dollar paradigm. For example, gold is in the process of withdrawing its bid on the dollar. This will have devastating consequences, which the word “reset” does not begin suggest. If the dollar is money, then this assertion — gold bids on the dollar — is incomprehensible. However, if gold is money then that makes the dollar just the irredeemable scrip issued by the Fed in order to finance its purchase of Treasury bonds. Who would be eager to trade his money to buy such scrip? - The Pitfalls of Currency Manipulation – A History of Interventionist Failure

Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 plans” which were supposedly going to create “economic growth” by government decree seemed to have disappeared into the memory hole. These busybodies deciding to do nothing, is obviously the best thing that can possibly happen. - Gerald Celente Issues Trend Forecast For Gold As Global Economy Falters

For several days, gold prices fell on hawkish comments from a number of regional Federal Reserve Bank presidents signaling support for an interest-rate rise, pointing to a possible increase at the upcoming Federal Open Market Committee meeting in late April. They reasoned, as has President Obama and the establishment business media, that anyone questioning the strength of the US economy was “peddling fiction,” and that a Fed rate hike, the second since 2006, was in order… - ALERT: Important Update On The War That Is Raging In The Gold & Silver Markets

The commercial shorts are now at a level (real-time) that raises serious concern. In fact, the commercials are close to one of their largest short positions in history. The last time the commercials held this large of a short position in silver was in 2008. Again, that does not mean that the price of silver cannot head significantly higher in the short-term. - Americans Have Been Turned Into Peasants – Time To Fight Back?

In the 1970’s, Goldman Sachs CEO Gus Levy famously encouraged his employees to be “long-term greedy.” In order to understand how far we have fallen as an economy and culture, it’s important to understand the meaning of the phrase and reflect upon it. “Long-term greedy” implies two very important principles that define a well functioning and ethical free market economy. First, is the unrepentant belief that earning a good profit and striving for financial success is a reasonable and admirable goal for both individuals and corporations. Second, is the understanding that such financial success should be earned, not stolen. If one’s focus is the long-term, the implication is that you’re committing yourself to building something real, and that the marketplace will ultimately reward you handsomely for your product or service. - Is A Gas War Between The U.S. And Canada About To Start?

The United States and Canada work well together. The countries share the world’s largest and most comprehensive trade relationship, exchanging more than $2 billion per day in goods and services; the U.S. is Canada’s largest foreign investor and Canada is the third-largest foreign investor in the U.S. The partnership clearly isn’t broken, but it may need some mending as bilateral and international gas trade stands to complicate matters in short order. - Why the Fed rate talk was ‘a bunch of nonsense'

The Federal Reserve was never hiking rates four times this year. Investors didn't believe it, and now Fed Chair Janet Yellen has all but explicitly acknowledged it. Indeed, Yellen's blockbuster speech Tuesday assuring that the central bank would go slowly on future adjustments to monetary policy only caught some of the market by surprise. Others realized there was virtually no chance of a hawkish Fed in 2016. “Central bankers at the Fed bark but they won't bite,” Peter Schiff, frequent Fed critic and founder of Euro Pacific Capital, told CNBC.com. “I knew all that talk was a bunch of nonsense.” - Emerging-Market Currencies Set for Best Month in 18 Years on Fed

It’s been at least 18 years since emerging-market currencies had it this good as the Federal Reserve adopted a gradual approach to its rate-increase cycle, fueling optimism that capital inflows can be sustained. A Bloomberg gauge of 20 currencies gained for a fourth day after Fed Chair Janet Yellen said that policy makers would act “cautiously” as they look to raise borrowing costs. Stocks rallied, sending shares in Shanghai up the most in a month, while South African equities rebounded from a two-week low and Russia ended the longest run of losses since 2011. The premium investors demand to hold emerging-market debt dropped from the highest since March 16. - Central Bank Policy Sparking Gold Demand in Europe

When we talk about increasing gold demand, the focus tends to fall on Asia. Earlier this week, we reported surging investor demand for the yellow metal in China. The Japanese have also gone on a gold buying spree since that country’s central bank plunged interest rates into negative territory. But it isn’t just Asians who are bullish on gold. Analysts say they see signs of growing demand for the metal in Europe as well. - Boeing to Cut More Than 4,500 Jobs

Boeing Co. on Tuesday said it planned to cut more than 4,500 jobs by June, as the company accelerates cost-cutting efforts to keep pace with customers demanding less expensive jetliners. The cuts come even as Boeing has booked record orders for its jets and is increasing production of its single-aisle and twin-aisle aircraft. But the company has been losing market share to rival Airbus Group SE. Boeing’s commercial unit expects to cut about 2,400 positions by attrition and around 1,600 through voluntary layoffs, a company spokesman said. This includes the culling of “hundreds” of managers and executives, some through involuntary layoffs. - Dollar Falls to Five-Month Low on Slower Fed Rate Path Outlook

The dollar fell to a five-month low against the euro on speculation the Federal Reserve will take a slower path to higher interest rates as the central bank factors in headwinds from slowing global economic growth. A gauge of the U.S. currency headed for the biggest quarterly loss since 2010 after Fed Chair Janet Yellen said Tuesday the central bank will act “cautiously” as it looks to withdraw monetary stimulus. The greenback has fallen against all of its 31 major peers in March with Russia’s ruble and Brazil’s real posting the biggest gains, helping emerging-market currencies to their best month in 18 years.

Precious Metals Are The Only Lifeboat! I have persistently WARNED you what was happening in the gold market and why you needed to convert your paper assets to physical gold and silver by the middle of September 2015. You need to hedge against the financial instability with physical gold and silver. Call the experts to help you convert your IRA or 401k into Gold, Silver and Other Precious Metals. Contact Birch Gold NOW before it's too late!

TRUMP OR HARRIS – The war for the US and the World…

CONGRATULATIONS PRESIDENT TRUMP! Hi. I am James Harkin, and I am the webmaster of LindseyWilliams.net. I sent this as an email on Monday, November 4th, 2024, to all of the current subscribers to LindseyWilliams.net. I think a lot of the emails got blocked. So, I am creating this blog post that includes the entire email. […]

Finding Healing and Hope: Joanna Williams’ Heartfelt Journey at IBC Hospital

Discover Healing Beyond Medicine: Joanna Williams’ Journey at IBC Hospital Finding the right healthcare provider can often feel like searching for a needle in a haystack. Joanna Williams, the widow of the esteemed Pastor Lindsey Williams, knows this journey all too well. Since 2011, she and her late husband sought quality care, eventually discovering BioCare. […]

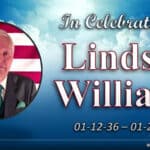

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams In Celebration of LINDSEY WILLIAMS January 12, 1936 – January 23, 2023 On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of […]

http://www.bloomberg.com/news/articles/2016-04-04/puerto-rico-investors-sue-to-stop-payments-by-development-bank

PR to stop payment on debt

Here are 2 articles flying under the radar that could have a profound effect on USA- Puerto Rico going bankrupt.

http://finance.yahoo.com/news/puerto-ricos-development-bank-brink-090100252.html;_ylt=AwrC1C0SewdXeSAAZJfQtDMD;_ylu=X3oDMTBybGY3bmpvBGNvbG8DYmYxBHBvcwMyBHZ0aWQDBHNlYwNzcg–

https://www.yahoo.com/news/special-report-puerto-ricos-other-crisis-impoverished-pensions-154246507.html