From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From July 15, 2016 to July 21, 2016:

- David Stockman On The Coming Global Collapse As One Short Seller Warns “I Have No Idea How Long They Can Keep Pretending”

With continued uncertainty in global markets, David Stockman weighed in on the coming global collapse and one short seller warned, “I have no idea how long they can keep pretending.” – Overnight equity markets were slightly lower, with bonds markets slightly higher in uneventful trading. As for our equity market, Netflix provided some fireworks, as it lost badly at the game of beat-the-number and the stock price was hammered for 14%. IBM, however, managed to win at Wall Street’s favorite game by making enough acquisitions to make the estimates. For those keeping score at home, revenues were down about 3%, making this the seventeenth quarter in a row for that feat. Debt now stands at $42 billion and book value is minus $27… - Governments To Christians: Don’t You Dare Speak Out Against The Sexual Sin In Society

In our upside down world, evil has become good and good has become evil. Once upon a time, everyone in society generally knew what was “right” and what was “wrong” even if they didn’t always abide by the rules. But now the rules have been totally flipped on their head. If you choose to live a lifestyle that is morally wrong, you are celebrated by society, and if you choose to speak out against the sexual sin that is exploding everywhere around us then you are considered to be a “hater” and a “bigot”. In fact, governments all over the world are now passing “hate speech” laws that are making it a crime to speak out against sexual sin. With each passing year it gets even worse, and those pushing this agenda forward are never going to be satisfied until those standing up for Biblical truth are locked away in prison. - Jim Rickards: Dynamics in Place for $10,000 Gold

Jim Rickards has been predicting $10,000 gold. Recently, he appeared on CNBC’s Squawk Box and stuck to that prediction, saying the dynamics are in place for gold to reach that $10,000 mark. Rickards said he thinks we are at the beginning of an extended gold bull market, possibly similar to the late 1990s when the price of the yellow metal went up 615% over a 12-year period. He conceded gold can be volatile, so he doesn’t pay as much attention to short-term fluctuations in price. But he did note an interesting fact in the wake of the recent price jumps after some major world events. - To The Mattress: Fund Manager Cash Levels Highest In 15 Years

Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks. The S&P 500 has jumped about 8.5 percent since the lows hit in the days after Britain’s move to leave the European Union, but that hasn’t assuaged professional investors. Cash levels are now at 5.8 percent of portfolios, up a notch from June and at the highest levels since November 2001, according to the latest Bank of America Merrill Lynch Fund Manager Survey. In addition to putting money under the mattress, investors also are looking for protection, with equity hedging at its highest level in the survey’s history. - The financial system is breaking down at an unimaginable pace

Now it’s $13 trillion. That’s the total amount of government bonds in the world that have negative yields, according to calculations published last week by Bank of America Merrill Lynch. Given that there were almost zero negative-yielding bonds just two years ago, the rise to $13 trillion is incredible. In February 2015, the total amount of negative-yielding debt in the world was ‘only’ $3.6 trillion. A year later in February 2016 it had nearly doubled to $7 trillion. Now, just five months later, it has nearly doubled again to $13 trillion, up from $11.7 trillion just over two weeks ago. - Bubble Finance At Work——65%-70% Of Households Have Lower Real Incomes Than In 2005

A new study from McKinsey looks at the cross-generational distribution of income as a form of new ‘inequality’, in words of the authors: “an aspect of inequality that has received relatively little attention, perhaps because prior to the 2008 financial crisis less than 2 percent of households in advanced economies were worse off than similar households in previous years. That has now changed: two-thirds of households in the United States and Western Europe were in segments of the income distribution whose real market incomes in 2014 were flat or had fallen compared with 2005.”In other words, McKinsey folks are looking at the “proportion of households in advanced economies with flat or falling incomes” – the generational cohorts that are no better than their predecessors. - Erdogan’s Staged Coup Has Resulted In A Purge Of 50,000 Teachers, Judges, Soldiers And Government Officials

Barack Obama’s “friend” in Turkey is a deeply corrupt radical Islamist dictator that has just staged a coup to consolidate his grip on power. As I have reported previously, 1,845 “journalists, writers and critics” have been arrested for “insulting” President Erdogan over just the past two years, and a couple of years ago he had a monstrous 1,100 room presidential palace built for himself that is 30 times larger than the White House. With each passing day, more evidence emerges which seems to indicate that the recent “coup” was a staged event meant to enable Erdogan and his allies to eliminate their enemies and solidify their stranglehold over the nation. At this point the number of victims of “Erdogan’s purge” has hit 50,000, but the final number will not be known for quite some time. - The man who accurately predicted 4 market crashes told us the dates when oil prices will fall again

The man who accurately predicted four market crashes to the exact date recently told Business Insider about his calendar prediction for when oil prices would start to significantly slump again. Sandy Jadeja is a technical analyst and chief market strategist at Core Spreads. Technical analysts look at charts to pinpoint patterns in various markets and asset classes. From that they forecast which direction prices are likely to move. They can't tell you why there will be a big market movement, only that there will be one. He says there is a specific time period to watch out for. - Financial System Held Together with Bailing Wire & Chewing Gum-Craig Hemke

Financial and precious metals expert Craig Hemke contends profits in the stock market, in the past few years, came with extreme hidden risk. Hemke explains, “I know why I own precious metal and am continuing to buy it, and that is what I am telling people to do. I mean the price has fallen for totally uneconomic reasons, manipulation being one . . . but anyway, I have used that weakness the last three or four years to keep buying. So, now with this recovery, all of my metal on a cost basis is less than what the current price is. That’s worked out quite well. I am not going to argue with anybody that says you should have sold all your gold in 2011, with the benefit of hindsight, and you should have bought the S&P. You would have made 100%, and hey, knock yourself out. The reason I didn’t attempt to do that is knowing full well anytime between 2011 and today I could have woken up and the whole system could have blown up. That’s how fragile it is. It’s all held together with bailing wire and chewing gum.” - The Entire Market is Being Driven by a “Once in History” Asset Bubble About to Burst

Since QE 3 ended in October 2014, stocks have traded in a large range between roughly 2,130 and 1800 on the S&P 500. During this time, whenever stocks began to breakdown in a serious way, a clear intervention was staged in which someone manipulated the markets higher. Regardless of whether you are a bull or a bear, none of those rallies felt normal or sane in any way. No one panic buys every single day at the exact same time for days on end. Which brings us to today. Stocks have broken out of the trading range to the upside hitting new all-time highs. - We’re witnessing a complete breakdown in western values

Two months ago I was with the former President of Colombia, Alvaro Uribe, at his home outside of Medellin. He was telling me some hilarious stories about his interactions in the early 2000s with Hugo Chavez, who had recently seized power in Venezuela. Chavez was a fanatic socialist. He believed so strongly in the idea of redistributing wealth from rich to poor. Yet even when it was clear his policies weren’t working and Venezuela was rapidly sliding into economic chaos, Chavez’s only solution was to double down and redistribute even MORE wealth. It was the classic definition of insanity. Chavez failed to understand what Uribe told me so succinctly: “If there’s no wealth creation, there’s nothing left to redistribute.” - Axe-Wielding Terrorist Attacks Train Passengers In Germany And A Police Car Is Firebombed In Florida

Crazy people committing random acts of senseless violence is rapidly becoming the “new normal” in the western world. On Monday, a police vehicle was firebombed in Daytona, Florida by someone that was enraged by the recent shooting deaths of Alton Sterling and Philando Castile. And over in Europe, an axe-wielding Islamic terrorist shouted “Allahu Akbar” as he started wildly attacking passengers on a train in southern Germany. Authorities say that the young man was originally from Afghanistan, and according to the Mirror he was shot dead before he could flee the scene of the attack… - Baton Rouge, Nice, Dallas, Orlando – A Dark And Distressing Time Has Descended Upon The Civilized World

Does it not seem as though events are starting to accelerate significantly? Since I warned that something “had shifted” and that things had “suddenly become more serious“, we have seen the worst mass shooting in U.S. history in Orlando, we have seen the massacre of five police officers in Dallas, we have seen the horrifying terror rampage in Nice, and now we have seen the brutal murder of three police officers in Baton Rouge. On Sunday morning, the peace and quiet in Baton Rouge were shattered when “dozens of shots” erupted less than one mile from police headquarters. By the end of it, 29-year-old Gavin Eugene Long had killed three officers and seriously wounded three others. It was a crime fueled by pure hatred, and Long specifically waited for his 29th birthday to launch the attack… - End of an Era: The Rise and Fall of the Petrodollar System

The intricate relationship between energy markets and our global financial system, can be traced back to the emergence of the petrodollar system in the 1970s, which was mainly driven by the rise of the United States as an economic and political superpower. For almost twenty years, the U.S. was the world’s only exporter of petroleum. Its relative energy independence helped support its economy and its currency. Until around 1970, the U.S. enjoyed a positive trade balance. Oil expert and author of the book “The Trace of Oil”, Bertram Brökelmann, explains a dramatic change took place in the U.S. economy, as it experienced several transitions: First, it transitioned from being an oil exporter to an oil importer, then a goods importer and finally a money importer. This disastrous downward spiral began gradually, but it ultimately affected the global economy. A petrodollar is defined as a US dollar that is received by an oil producing country in exchange for selling oil. As is shown in the chart below, the gap between US oil consumption and production began to expand in the late 1960s, making the U.S. dependent on oil imports. - The Helicopter Has Already Been Tested – And It Failed Spectacularly

Most of what passes for modern monetary policy is nothing more than one assumption piled upon another (and then another, and so on). Taken for granted for so long, rarely are these unproven precepts ever challenged to justify themselves to the minimal standard of internal consistency, let alone prove discrete validity by parts. The latest is “helicopter money”, another sham in a long line of them proffered by at least one central bank today because it knows, as the others, nothing they have done has worked. The fact that the world is even discussing the helicopter option should instill great skepticism as a first impulse, not more rabid faith. The way this latest scheme is being described is exactly the same as quantitative easing was really not that long ago. Clearly the expectation for it is rising, as Bloomberg reported today that, “Nearly one-third of clients and colleagues surveyed by Citigroup Inc. think that so-called helicopter money could be on its way within a fortnight.” Forty-three percent in the same survey believed that the “market” was expecting it. - The entire financial system is exposed to this junk bond market

Japan got there first. 15 years ago, we met a Japanese equity manager who made an astonishing prediction: “Japan was the dress rehearsal. The rest of the world will be the main event.” That seemed an extraordinary suggestion 15 years ago. Today, not so much. In the aftermath of the late 1980s real estate and stock market bubble, and its subsequent banking crisis, Japan became a giant laboratory experiment for novel insane monetary policies. In 2001 the Bank of Japan tried Quantitative Easing. It was a policy that Richard Koo of the Nomura Research Institute described as the “greatest monetary non-event”. It turned out, not for the first time, that academic economists had it all wrong. - “The World's Central Banks Are Making A Big Mistake”

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments. Because it is relatively free from political considerations, the BIS can speak about economic issues more directly than its member central banks can. And its candor has grown steadily in recent years. When central bankers like Janet Yellen or Mario Draghi speak, we have to discount their statements because they have policy agendas to promote. While the BIS has an agenda, too, the bank isn’t tied to any particular economy or government. Its analysts are paying attention to how the world functions in toto. - Unexpected Gasoline Inventory Build, Production Rise Spark Crude Chaos

Following last week's surprise Distillates build (and bounce in production) and API's overnight surprise Gasoline build, DOE data this morning was mixed confirming the 2.3mm draw in overall crude inventories (9th weekin a row) but surpringly large builds in both Cushing and Gasoline inventories (expectations were for draws). Oil prices were chaotic – running stops high and low – as algos noted crude production also rose (for the 2nd week in a row). - Another Bad Month For Truck Shipping

Truck shipments were up in June from May. So were expenditures. That sounds pretty good, but it really isn’t. Shipments are normally up in June and the Cass Freight Index report from which I get numbers is not seasonally adjusted. The best way to compare June is to prior years, and that picture isn’t pretty. - Brexit: UK economy yet to suffer slowdown following EU vote, says Bank of England

The Bank of England is yet to see any clear evidence of an economic downturn due to Britain's decision to vote in favour of leaving the European Union, although hiring and investments were being put on hold. Business uncertainty has “risen markedly” in the four weeks following the EU referendum, but there was no evidence that consumers had reined in their spending, the BoE's regional agents said on Wednesday (20 July). “A majority of firms spoken with did not expect a near-term impact from the result on their investment or staff-hiring plans,” Britain's central bank said in a statement. - Why Growing Food is The Single Most Impactful Thing You Can Do in a Rigged Political System

The most effective change-makers in our society aren’t waiting around for a new president to make their lives better, they’re planting seeds, quite literally, and through the revolutionary act of gardening, they’re rebuilding their communities while growing their own independence. Every four years when the big election comes around, millions of people put their passion for creating a better world into an increasingly corrupt and absurd political contest. What if that energy was instead invested in something worthwhile, something that directly and immediately improved life, community, and the world at large? The simple act of growing our own food directly challenges the control matrix in many authentic ways, which is why some of the most forward-thinking and strongest-willed people are picking up shovels and defiantly starting gardens. It has become much more of a meaningful political statement than supporting political parties and candidates. - Japan, Helicopter Money, Cold Fusion And The Disastrous Endgame

With continued wild trading this summer in global markets, it’s all about Japan, helicopter money, cold fusion and the disastrous endgame. Overnight markets were all higher and the world was once again a-twitter over the concept of “helicopter money.” But once again, the pundits and the press are getting the descriptions wrong. Just like they talk about minimal inflation rates as “deflation” because they are scared of a depression, which is what they think deflation means, or refer to a 20% move as a bull or bear market, they are now mindlessly labeling the next step in monetary debasement as helicopter money… - Renewable Energy Investment Drops By Nearly A Quarter

As the cost of installing solar panels waned and China pressed pause on its spending, global investment in renewable energy sunk 23 percent in the first half of 2016. According to London-based Bloomberg New Energy Finance, solar, wind, and other clean-energy industries engrossed $116.4 billion in the first two-quarters of the year 2016. This included $61.5 in the second quarter. The research company said it also reviewed up 2015’s total by practically $20 billion to a record of $348.5 billion. - How & by How Much Big Pharma Fools Investors

Yesterday, we were bashing big pharmaceutical companies for jacking up prices of patent-protected drugs at obscene rates. Those double-digit price increases were largely responsible for the sales increases these companies reported. Drugs have become the largest wholesale category, at $54.3 billion in May, or 12.2% of total wholesales. This boom is based on price increases at a great cost to US consumers and taxpayers. It’s cannibalizing the rest of the economy. But it’s made possible by the abuse of the patent system, the increasingly monopolistic structures in the industry after a tsunami of mergers funded by cheap credit and a soaring stock market – as planned by the Fed – along with legislators and regulators that have been compromised by the big money and the revolving door. - Spain’s Banks are Suddenly “Too Broke To Fine”

After eight years of chronic crisis mismanagement, moral hazard and perverse incentives have infected just about every part of the financial system. Earlier this week, the U.S. Congress published the findings of a three-year investigation into why the Department of Justice chose not to punish HSBC and its executives for their violations of US anti-money laundering laws and related offenses – because doing so would have had “serious adverse consequences” for the financial system – the “Too Big To Jail” phenomenon, a perfect, all-purpose, real-world Get-Out-of-Jail-Free card. But now there’s “Too Broke to Fine.” Today over a dozen Spanish banks were given a life-line by the EU’s advocate general, Paolo Mengozzi, that could be worth billions of euros in savings for the banks. For millions of Spanish mortgage holders, it could mean billions of euros in lost compensation. - Is Pokemon Go Evil, Dangerous Or Demonic?

One week ago, a game called Pokemon Go was launched, and over the last seven days it has become an international phenomenon. It is the first mass market video game to successfully blend the real world and the digital world together in a way that the public truly embraces, and it is making headlines all over the planet. At this point it has almost as many daily active users as Twitter does, and Nintendo’s stock price is going crazy as a result. On Monday it shot up 25 percent, and on Tuesday it surged another 13 percent. In other words, Nintendo is now worth billions of dollars more than it used to be. But is there a dark side to Pokemon Go? Is it potentially evil, dangerous or demonic? - 2067: The end of the oil age

The fear of losing a market share makes the oil countries play the oil price wars, glut the market while the low prices reducing investments in the new oil reserves exploration for the second year. The world proved oil reserves increased by only 2.5 times up to 1.7 trillion barrels during active crude oil production for the past 35 years. It seems that the major crude oil producing countries, which are so keen on a price war, forgot that in reality the oil runs out very quickly. For better understanding: 1.7 trillion barrels of oil with a production of 90 million barrels per day are approximately as the Indian Ocean from which two Gulfs of Mexico are scooped out every year. According to the simplest calculations, it seems the current world’s oil proved reserves at a current production level will suffice for 50 years. By that time it will be possible to find industrial raw commodity to replace the oil in the cycle of production of goods, find and widely implement a cost-effective energy analogue. But in reality it is not so smooth. - The Energy “Death List”: Who’s On It and Who’s Next?

In June, Warren Resources filed for Chapter 11 bankruptcy. The Houston-based company was just another one added to the group of 150 North American industry filings over the last year and a half since the oil decline started. Warren Resources could also be found in the 2015 publication of an “oil company death list” put out by Oxford Club investors’ network out of Baltimore. 19 companies were accused of “toxic” debt-to-equity ratios on the list. Since it was published, eight of the companies on the list have filed for protection, another was purchased at a low price, and few still are trying to keep their head above water. - EU Looks To Break Baltic Dependence on Russian Energy

After EU-member states agreed on a Commission proposal, the EU will invest €263 million in key gas and electricity projects across the Union with primary focus on the Baltic Sea region. The European Commission announced on Friday (15 July) in a press release that the 28 member states agreed to invest €263 million in trans-European energy infrastructure projects. The biggest share of the support will be destined to the Baltic Sea region to help the expansion of the gas infrastructure, meanwhile the other part of the investment will support the electricity sector across the European Union. - The Global Oil Glut Gets Uglier – Forget the Recovery and “Rebalancing” Hype

Deal makers in the oil patch of the US and Canada are smelling the fees, and they’re firing up the machinery. In the first half of the year, there were 52 pending and completed acquisitions of oil & gas exploration & production companies valued at $100 million or more, for a total of $30 billion, Fitch Ratings reported today: “The rise in transaction volume seems to be largely due to the improvement in hydrocarbon prices, including the tightening of bid/ask spreads, and access to capital markets.” The global oil market is “rebalancing” with production falling and demand rising, the meme goes. In anticipation, prices have bounced off the lows in February, with WTI soaring from $26.19 a barrel to $51.23 by June 8. So this would be the great oil price recovery. - Great American Oil Bust Rages on; Defaults, Bankruptcies Soar – How much worse is 2016 than 2015?

Junk bonds, trading like stocks since February, have skyrocketed and yields have plunged. But that doesn’t mean the bloodletting is over. The trailing 12-month US high-yield bond default rate jumped to 4.9% at the end of June, the highest since May 2010 as the Financial Crisis was winding down, Fitch Ratings reported today. The first-half total of $50.2 billion of defaults already exceeds the $48.3 billion for the entire year 2015. Energy companies accounted for 56% of those defaults. The energy sector default rate shot up to 15%. Within it, the default rate of the Exploration & Production (E&P) sub-sector soared to 29%! And the default party isn’t over: “Despite the run-up in prices since the February trough, there will be additional sector defaults, with Halcon Resources expected to file imminently,” Fitch reported. - Stocks Will Crash – and Crush (California’s) Pension Funds & Taxpayers: Report

The California Policy Center published an interesting study – “interesting” in all kinds of ways, including its outline of the doom-and-gloom future of California’s state and local pension plans if stocks turn down sharply, preceded by its prediction that stocks will turn down sharply because valuations are totally unsustainable. The huge, simultaneous, Fed-engineered rallies in stocks, bonds, and real estate – typically the three biggest holdings of state and local pension funds in the US – have inflated the balance sheets of these funds, thus elegantly, if only partially, papering over their fundamental problems. Most of these funds have a similar doom-and-gloom future when the asset bubbles get pulled out from under them. Plenty of pension funds don’t even need a market correction: they’re already in serious trouble despite the asset bubbles. - China Is About To Shock The World And The Global Financial System

On the heels of the Dow hitting new all-time highs and the U.S. dollar surging, China is about to shock the world and the global financial system. Stephen Leeb: “Global turmoil keeps ratcheting up. Just when you think it couldn’t get any worse, it does. The attempted military coup in Turkey is the latest eruption, following on the heels of yet another massacre in France. Syria remains an ongoing nightmare while terrorist bombings in Iraq are so commonplace they barely register… - End Time Persecution Is Here: Russia Just Banned Evangelism And China Has Torn Down 1000s Of Crosses

We always knew that this was coming. For years, the horrifying persecution of Christians in the Middle East has made headlines all over the globe, but now we are seeing very disturbing examples of government-sanctioned persecution literally all over the planet. As you will read about below, Russia just banned virtually all types of evangelism outside of a church or religious site. And China has been tearing down thousands of crosses and has been demolishing dozens of churches in a renewed crackdown on the growth of Christianity in that nation. Overall, there are 53 countries that now have laws that restrict the Christian faith according to one recent report. When are we going to wake up and realize what is happening? - America Wastes About HALF The Food That It Produces While Hunger Runs Rampant Around The Globe

Is the United States the most wasteful nation on the entire planet? We are all certainly guilty of wasting food. Whether it is that little bit that you don’t want to eat at the end of a meal, or that produce that you forgot about in the back of the refrigerator that went moldy, the truth is that we could all do better at making sure that good food does not get wasted. It can be tempting to think that wasting food is not a big deal because we have so much of it, but an increasing number of people around the world are really hurting these days. In fact, it has been estimated that there are more than a billion hungry people around the globe right now. So as a society we need to figure out how to waste a whole lot less food and how to get it into the mouths of those that really need it. - US & Clinton Beyond the Law-Catherine Austin Fitts

Financial expert and former Assistant Secretary of Housing, Catherine Austin Fitts, says the U.S. government’s actions with Hillary Clinton means it is more lawless than ever. Fitts explains, “The entire country now looks like Arkansas . . . we’ve all turned into Mena, Arkansas, now. It’s pretty tragic. I have watched for two decades while 80% of the federal budget and federal credit has been run outside the Constitution and the laws related to financial management. I have never seen anything as blatant and outrageous as Loretta Lynch, prior to Hillary Clinton’s interview with the FBI, meeting with her disbarred husband, who is either the husband of or the target of a criminal investigation, and basically briefing him, I am assuming and what I believe on what Hillary needs to know, so she can skate the (FBI) interview. What the President, Lynch and Comey don’t want is the investigative team recommending to indict. . . . If you know anything about civil or criminal procedures, this is so beyond the law. This is so over the top that I have never seen anything more outrageous. It’s beginning to look like Mena, Arkansas, during the Mena drug running.” - Those That Wanted To Get Prepared Have Already Gotten Prepared By Now

Is the time for warning people to prepare for what is ahead coming to an end? For years, bold men and women all over America have been sounding the alarm and warning people to get prepared physically, financially, mentally, emotionally and spiritually for the great storm that is rapidly approaching. Personally, I have written more than 2,500 articles on my primary two websites combined, and so nobody can accuse me of not blowing the trumpet. It has gotten to the point that sometimes I am even tired of listening to myself warn the people. But now we are shifting into a new phase. - The Dow And The S&P 500 Soar To Brand New All-Time Record Highs – How Is This Possible?

The Dow and the S&P 500 both closed at all-time record highs on Tuesday, and that is very good news. You might think that is an odd statement coming from the publisher of The Economic Collapse Blog, but the truth is that I am not at all eager to see the financial system crash and burn. We all saw what took place when it happened in 2008 – millions of people lost their jobs, millions of people lost their homes, and economic suffering was off the charts. So no, I don’t want to see that happen again any time soon. All of our lives will be a lot more comfortable if the financial markets are stable and stocks continue to go up. If the Dow and the S&P 500 can keep on soaring, that will suit me just fine. Unfortunately, I don’t think that is going to be what happens. - More Islamic Terror in France, Black Lives Matter is False Narrative, Phony Stock Market Highs

France has been hit once again by Islamic terror–this time in Nice. The French Riviera town was struck during Bastille Day celebrations by a terrorist who used a truck to mow down dozens of people. French media says ISIS is claiming responsibility for the heinous crime. The USA Today keeps propelling false narratives with the “Black Lives Matter” (BLM) movement and helping out the Democratic presumptive nominee Hillary Clinton with what can only be described as biased one-sided reporting. “Black Lives Matter” has been described as “racist” by former NYC Mayor Rudolph Giuliani. This week, the USA Today staff put a picture on the front page with a BLM protester that read “Killer cops make cop Killers.” BLM basically claims white police officers are hunting down black men and murdering them on purpose. This is a total lie, and is refuted by a brand new study from Harvard. USA Today would not comment on the editorial decision of the newspaper to put forth a totally false narrative. - War Is Coming And The Global Financial Situation Is A Lot Worse Than You May Think

On the surface, things seem pretty quiet in mid-July 2016. The biggest news stories are about the speculation surrounding Donald Trump’s choice of running mate, the stock market in the U.S. keeps setting new all-time record highs, and the media seems completely obsessed with Taylor Swift’s love life. But underneath the surface, it is a very different story. As you will see below, the conditions for a “perfect storm” are coming together very rapidly, and the rest of 2016 promises to be much more chaotic than what we have seen so far. - Defence giant says UK could be more attractive to invest post-Brexit vote

One of the world’s largest defence contractors has said that the UK could become a more attractive place to invest, after Brits voted to leave the European Union. Marillyn Hewson, the chief executive of Lockheed Martin, told the Sunday Times that the weaker pound could make exporting from Britain more lucrative. Lockheed builds gun turrets for the UK’s Ajax and Warrior tanks at its factory in Bedfordshire, which it hopes to export to other countries. It’s also the main contractor for Britain’s plans to buy 138 F-35 fighter jets for the Royal Air Force and the Royal Navy. Hewson added that the UK’s attractiveness as a place to invest post-Brexit vote would depend “”on the government and the policies its puts in place”. - Why Italy's banking crisis will shake the eurozone to its core

They call them le sofferenze – the suffering. The imagery is striking, the thousands of sofferenze across Italy, unwanted and ignored, a problem unsolved. But despite the emotional name, these are not people. They are loans. Bad debts, draining banks of profits and undermining economic growth. The name is less clinical than the English term “non-performing loans”, a reflection of the Italian authorities’ emotional rather than business-like approach to the problem. None the less, the loans are indeed causing real suffering. The €360bn (£300bn) of sofferenze from Italian banks show borrowers are weighed down with debts they cannot afford, while the banks are struggling to offer new credit to the households and firms that need them. - UK Opens ‘Very Fruitful’ Trade Talks With Canada

Britain opened “very fruitful” trade talks with Canada on Friday, International Trade Secretary Liam Fox told the Sunday Times newspaper as he prepares to renegotiate Britain's commercial ties following its vote last month to leave the European Union. In limited extracts of his interview, Fox said he would soon travel to the United States to ensure that Britain was not at the back of the queue in trade talks as President Barack Obama had suggested before the June 23 vote. He said was “scoping” about a dozen free trade deals outside the EU to be ready for when Britain leaves, some with countries that had indicated they wanted a quick deal and others with some of the world's major economies. - Middle East: The Rest of the Story

Want to know what is really happening in the Middle East? Pastor Lindsey Williams created a 3-DVD set entitled “Middle East: The rest of the Story” and it includes topics: “Future Price of Crude Oil”, “Future Price of Gasoline and Diesel”, “Future Grocery Prices”, “Explosive Growth to US Crude Production”, “China and the US”, “The Future of Islam”, “Riots in the Middle East”. This 3-DVD set is very important if you want to know what is happening right now in the Middle East. - “This Is Going To Get Very Ugly” – Former Top CIA Officer Says “Obama Has Lost Control Of The Middle East”

With Thursday's tragic mass killing by a resclusive, truck-driving Tunisian maniac in Nice having been violently drowned out by the frentic late Friday news of a failed (and perhaps staged) coup in Turkey, the news cycle has once again shifted its attention away from a far greater threat to the global economy than whether Erdogan can concentrate even more power in his grasp. Namely, both lone-wolf and organized terrorism in Europe (and elsewhere). And according to at least one CIA field commander, Gary Bernsten, it is all Obama's fault. As the Hill reports, the decorated former CIA career officer who served in the Directorate of Operations between October 1982 and June 2005, said on Friday that Obama has lost control of the Middle East following attacks in France that left at least 84 dead. “This is going to get very, very ugly,” Gary Bernsten said on Fox & Friends Friday. - Turkish Central Bank Pledges “Unlimited Liquidity” On Bank Run Fears: Wall Street's Take

Late on Friday afternoon, just as the market was closing and news of the Turkish coup spread, Turkish ETFs tumbled and the Lira dropped the most in 8 years on investor concerns about the future of the country, and a spike in social media reports that local depositors were – understandably – pulling their money from banks, potentially sparking a bank run. The Turkish Lira losses added to its woes after having slid 20% last year; the currency has now lost more than 40% of its value since the end of 2012. And while the (allegedly staged) coup has been put down, questions remained about the stability of the Turkish financial system. Which is why early today, Turkey’s central bank held an extraordinary meeting with bank executives to discuss ways to minimize the market impact of the coup attempt. The bank convened members of the Banks Association of Turkey, and shortly after announced a series of steps which, comparable to the post-Brexit reaction, sought to stabilize risk assets. - Morgan Stanley: “To Make Up For A 10% Drop In The S&P, Treasury Yields Would Need To Go… Negative”

With both the S&P500 and Treasury prices hitting record highs as recently as one week ago, many have been confused (perhaps none more so than Goldman's clients as we reported yesterday), although the conventional fallback explanation that has again emerged, is a reversion back to the “Fed Model” according to which the lower yields go, the highest equity multiples should (and may) rise. As a bearish Goldman explained, “bullish investors argue that sustained low rates will support P/E multiples of 20x or more. The Fed Model relates the earnings yield (5.7%) to the Treasury yield (1.5%). The current 420 bp yield gap is near the 10-year average. Exhibit 2 shows the sensitivity of this model. Assuming a steady bond yield, reversion to the 35-year average gap of 250 bp implies a S&P 500 year-end level of 3075 while the 5-year average gap implies 1900.” For the record, Goldman is not a fan of a 3,000+ S&P target, and instead expects the market to drop in the coming months. - “The Credit Ponzi Is Dead” – Brexit Or Not, The Pound Will Crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something more fundamental about the world. When the 1945 new world order came into existence, its architects built it on a shaky foundation based on statists Keynesian principles. It was clearly unsustainable from the get-go, but as long as living standards rose, no one seemed to notice or care. The global elite managed to resurrect a dying system in the 1970s by giving its people something for nothing. Debt accumulation collateralized by rising asset values became a substitute for productivity and wage increases. While people could no longer afford to pay for their health care, education, house or car through savings they kept on voting for the incumbents (no, there is no difference between center left and right) since friendly bankers were more than willing to make up the difference. - Why the Gold Price is Rising, and Why it will Continue to do so

Do you remember last year, when an opinion piece in the Wall Street Journal referred to gold as nothing more than a ‘pet rock’? At the time, gold was trading for around US$1,130 an ounce. A year later, gold is trading around US$1,350 an ounce (up around 20%), while the S&P 500 is up only a few percent, despite closing at another record high today, at 2137 points. The author of that article, Jason Zweig, returned last week in his regular Intelligent Investor column to defend his pet rock call. While he acknowledged some important reasons for gold’s enduring allure, he trotted out some pretty lame reasons for sticking with his 2015 call that gold is basically just a rock. - Gold Has Important Place in Investment Portfolio as Paper Currency Wanes

On Tuesday we got not especially coherent statements from three Federal Reserve bank Presidents. St. Louis Fed President James Bullard was dismissive of the impact of the UK referendum on the U.S. and yes, directly, the UK doesn’t matter that much. What will matter will be the impact on the U.S. of slowing growth in the Eurozone. According to the IMF, growth will slow down as a consequence of the Referendum to 1.6 percent this year and 1.4 percent in 2017. Both years were revised down from 1.7 percent. - New Stock Market Highs Correlate to $57 Trillion in Printed Global Currency Units

When people use the term “money,” it usually refers to a unit of currency used in the transacting of business and commerce. A woman works cleaning houses for a week and gets paid in a number of currency units and then goes to the supermarket and exchanges those units for food or diapers or medicine. What is left over at the end of the pay period is called “savings,” which are allowed to accumulate receiving a modest rate of interest. Around the globe this weekend, a vast number of banks are offering negative returns on savings, such that keeping one's accumulated units of currency in the bank is penalized. The objective of this monetary experiment is to combat the global problem of deflation. Despite $57 trillion of new currency units having been printed since the 2009 financial crisis, global growth has been tepid at best because the velocity of “money” has remained moribund and since all collateral underpinning this massive global debt must not be allowed to depreciate, the central banks have been allowed to engage in a massive, coordinated reflation designed to jumpstart “money” velocity. - Ignore Pullbacks As Top Analyst Says Gold To Hit New All-Time Highs, Plus A Shocking Chart

With continued wild trading in global markets, one of the top analysts in the world says ignore pullbacks as price of gold to smash through all-time highs. There is also a shocking chart included in this fantastic piece. “Markets say the ECB is done, their box is empty… But we are magic people. Each time we take something and give to the markets – a rabbit out of the hat.” — Vitas Vasiliasukas, member of the ECB’s Governing Council. Today King World News is featuring a piece by a man whose recently released masterpiece has been praised around the world, and also recognized as some of the most unique work in the gold market. Below is the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum AG out of Liechtenstein. - Gold Price of $1,400 is just the Start – Vaneck

Although gold prices are down from last week’s two-year high, one investment firm sees $1,400 an ounce as just the start as the market remains in a new bull uptrend. In a report released Tuesday, Joe Foster, gold strategist at VanEck, said that the firm is expecting gold prices to reach $1,400 an ounce in the second half of the year, adding “and we do not believe it will end there.” Tuesday, August gold futures have seen renewed selling pressure with prices last trading at $1,336.50 an ounce, down almost 1.5% on the day. What is the driving the next leg of the renewed secular bull market is the fact that investors are being more proactive, he said. He added that inflows into gold-backed exchange-traded products are at their highest level since 2009, when investors sought out safe-haven assets during the sub-prime credit crisis. - The IRS wants a Piece of Your Gold and Silver Profits: Here's what You Need to Tell Them… And What You Don't

With gold and silver gaining popularity as safe haven assets during economic crisis there is a strong possibility that we’ll see prices go to all-time highs in the future. With those price increases will come windfall profits for investors. And, as you already know, where there’s profit, there’s a government with its hands in your pocket trying to get a piece of the action. - Did Citi Just Confiscate $1 Billion In Venezuela Gold

Just over a year ago, cash-strapped Venezuela quietly conducted a little-noticed gold-for-cash swap with Citigroup as part of which Maduro converted part of his nation's gold reserves into at least $1 billion in cash through a swap with Citibank. As Reuters reported then, the deal would make more foreign currency available to President Nicolas Maduro's socialist government as the OPEC nation struggles with soaring consumer prices, chronic shortages and a shrinking economy worsened by low oil prices. Needless to say, the socialist country's economic situation is orders of magnitude worse now. According to El Nacional, “the deal was for $1 billion and was struck with Citibank, which is owned by Citigroup.” - Venezuela army deployed to control food production and distribution

Venezuela's military has taken control of five ports in an effort to guarantee supplies of food and medicine. In a decree, President Nicolas Maduro has ordered the army to monitor food processing plants, and co-ordinate the production and distribution of items. Venezuela is going through a deep economic crisis despite having the world's largest oil reserves. Basic products are increasingly hard to find and many say they struggle to feed their families. The Venezuelan Bishops Conference said the rise of the military is a “threat to tranquillity and peace”. Mr Maduro says the measure is to fight the “economic war” he claims is being waged against his government by political foes and businessmen, with US backing. But the opposition says the government has mismanaged the economy, and has called for a referendum to oust the president. - Energy Failures Push U.S. High-Yield Default Rate to 6-Year High

U.S. high-yield bonds in default reached the highest levels in at least six years as more energy companies buckled under pressure from stagnant oil prices. Speculative-grade U.S. defaults spiked to 5.1 percent of the total outstanding in the second quarter from 4.4 percent in the first, according to a July 12 report from Moody’s Investors Service. The global high-yield default rate could finish the year at 4.9 percent, with the U.S. as much as 6.4 percent, Moody’s said. - There’s a war on its way, and it will make Iraq look like child’s play

War is on many people’s minds at the moment. But whilst most of the public are focused on wars of the past after the release of the Chilcot report, our leaders are plotting one for the future. And, if their rhetoric is anything to go by, it’s going to be on a scale we have never seen before. So, where’s the media flurry? Or the political fire being shot across the Commons over the issue? It’s nowhere to be seen. And that glaring oversight, or purposeful omission, could be what lets us sleepwalk into World War III. - Theresa May’s husband is a senior executive at a $1.4tn investment fund that profits from tax avoiding companies

The relatively unknown investment fund where Theresa May’s husband Philip works as a senior executive is one of the world’s largest and most powerful financial institutions, controlling $1.4 trillion in assets. Its portfolio also includes $20 billion of shares in Amazon and Starbucks, both of which were cited by the Prime Minister-designate in her pledge to crack down on tax avoidance yesterday. Latest filings to US authorities show that Los Angeles based Capital Group owns huge stakes in a variety of companies, including investment bank JP Morgan Chase, defence giant Lockheed Martin, tobacco company Philip Morris International, the pharmaceutical sector’s Merck & Co, and also Ryanair. - Russian leader sacks EVERY commander in his Baltic fleet after ‘they refused to confront Western ships’

RUSSIAN President Vladimir Putin has taken a page out of Joseph Stalin’s book — and sacked every commander in his Baltic fleet. As many as 50 senior officers including a Vice Admiral have been purged by Vladimir Putin amid reports they refused to confront Western ships. Other Russian news sites also speculated that attempts to cover up a crash between a Russian sub and a Polish boat may have been behind the bloodletting. But given the endemic nature of corruption and incompetence across the Russian military, Western analysts are scratching their heads as to the real reason behind the purge. - Gestapo America — Paul Craig Roberts

FBI Director James Comey got Hillary off the hook but wants to put you on it. He is pushing hard for warrantless access to all of your Internet activity. Comey, who would have fit in perfectly with Hitler’s Gestapo, tells Congress that the United States is not safe unless the FBI knows when every American goes online, to whom they are sending emails and from whom they are receiving emails, and knows every website visited by every American. In other words, Comey wants to render null and void the Fourth Amendment of the US Constitution and completely destroy your privacy rights. The reason Washington wants to know everything about everyone is so that Washington can embarrass, blackmail, and frame on felony charges patriots who stand up in defense of the US Constitution and the rule of law, and dissidents who criticize Washington’s illegal wars, reckless foreign policies, and oppression of American citizens. - Millions Wiped Off Commercial Property Market

The scale of damage to Britain's commercial property market by Brexit has been laid bare by new figures showing prices have fallen and millions of pounds of deals have collapsed. According to industry insiders, one in three major property investment deals has fallen through in the wake of Britain's vote to leave the EU. Prices across Britain's commercial property market, which includes office blocks, shopping centres and workplaces, are estimated to have fallen by 10-15% in the days after the vote. And an estimated £500m worth of so-called “Brexit clauses” have been triggered, meaning ongoing deals to buy and sell buildings have been cancelled or renegotiated. - Some disturbing figures about the upcoming banking crisis

In early 1870, the Kingdom of Prussia and French Empire were about to go to war. It was one of countless conflicts between the dozens of European kingdoms and empires throughout the 18th and 19th centuries, and this one was over before it even started. Prussia’s military might was legendary. They had recently beaten the pants off of Austria and Denmark, and they’d go on to neutralize or capture over 80% of French soldiers within a matter of months, while losing just 2% of their own. Very few wars have been so one-sided. And yet despite its nearly unparalleled military successes and clear dominance in European politics, Prussia lacked something critical: financial power. - Russia passes ‘Big Brother' anti-terror laws

Russia’s parliament has passed harsh anti-terrorism measures that human rights campaigners including the NSA whistleblower Edward Snowden say will roll back personal freedoms and privacy. The lower house of parliament voted 325 to 1 on Friday to adopt the “Yarovaya law”, a package of amendments authored by the ruling United Russia party member Irina Yarovaya, who is known for previous legislative crackdowns on protesters and non-governmental organisations. Snowden, who has lived in Russia since receiving asylum in 2013, tweeted on Saturday that the “Big Brother law” was an “unworkable, unjustifiable violation of rights” that would “take money and liberty from every Russian without improving safety”. - Robots will replace a quarter of business services workers by 2035, says Deloitte

A quarter of jobs in Britain’s business services sector are at “high risk” of automation within the next two decades, according to a new report. Accountancy firm Deloitte warned that robots could replace a fifth of jobs in administrative roles such as telecoms and IT by 2035 as falling technology costs and rising wages make automation increasingly attractive. Deloitte said that around 3.3 million jobs could be classified as business services roles, and that of those, there was a “high chance” that 800,000 to one million jobs would no longer be performed by humans over the period. - 90% Of June Job Gains Went To Workers 55 And Older

While the algos have long forgotten about today's job report whose headline was good enough to unleash an epic buying spree which has pushed the S&P to the highest level since July 2015, a quick read between the lines reveals a continuation of some recent troubling trends, namely that all job gains in recent years have gone exclusively to the oldest segment of the population, those 55 and older. First, as the chart below shows, when breaking down the job additions by age group as per the Household Survey, of the 180K jobs added in this particular survey, 259,000 were in the 55 and over age group, while only 28,000 were added in the critical 25-54 age group. Young workers, those under 24, lost a collective 107,000 in June. In other words, 90% of all job gains in the month went to workers 55 and over. - NRA: Restaurant performance weakens in May

Restaurant sales softened in May, along with operator expectations, as the industry continued its choppy 2016, according to the latest Restaurant Performance Index from the National Restaurant Association. The monthly indication of the health of the industry fell 0.9 percent to 100.6 in May, from 101.6 in April. The NRA considers the industry to be in expansion mode if the index is above 100. “The RPI continued along a choppy trend line in May, with the index bouncing between moderate gains and losses in recent months,” Hudson Riehle, senior vice president of research for the NRA, said in a statement. - Bill Gates And Other Billionaires Backing A Nuclear Renaissance

Let’s for a second imagine a world without nuclear energy. That’s a tough one but let’s try. No nuclear bombs, of course, no Chernobyl and Fukushima, no worries about Iran and North Korea. A wonderful world, maybe? Probably not, because without nuclear energy we would have burned millions more tons of coal and billions more barrels of oil. This would have brought about climate change of such proportions that what we have today would have seemed negligible. Nuclear energy and uranium, which feeds it, are controversial enough even without any actual accident happening. Radioactivity is dangerous. Nobody is arguing against it. When an accident does take place, the public backlash is understandably huge. What many opponents of uranium forget to mention, however, are the benefits of nuclear energy and the fact that the statistical probability of serious accidents is pretty low. They focus on the “What if?” and neglect the other side of the coin. But let’s try to see both sides of the issue. - Malls Push Out Department Stores

At the Florida Mall in Orlando, Nordstrom was torn down and replaced with a Dick’s Sporting Goods store and a crayon-based family attraction called the Crayola Experience. The Saks Fifth Avenue was demolished, too, to make way for a dining pavilion with 23 restaurants. And Lord & Taylor was carved into space for American Girl, H&M, Forever 21 and Zara. Once the linchpin of American shopping malls, department stores are being displaced by newer types of retailers that do a better job of driving shoppers to the centers and lifting overall mall sales. Landlords are nudging out the once-coveted big box chains in favor of sporting-goods retailers, fast-fashion chains, supermarkets, gyms, restaurants, movies theaters and other types of entertainment as they seek to keep their properties relevant in an age increasingly dominated by online shopping. - Who’s Most Afraid of Contagion from Italy’s Bank Meltdown? French and German banks

Contagion is the reason Italy’s banking crisis is all of a sudden Europe’s biggest existential threat. Greece’s intractable problems are out of sight, out of mind; Brexit momentarily spooked investors and bankers; but Italy’s banking woes have the potential to wipe out investors and undo over 60 years of supranational state-building in Europe. The last few days have seen growing calls for taxpayer-funded state intervention, a practice that was supposed to have been consigned to the annals of history by Europe’s enactment of new bail-in rules on Jan 1, 2016. The idea behind the new legislation was simple: never again would taxpayers be left exclusively holding the tab for European banks’ insolvency issues while bondholders were getting bailed out. But even before the new rules have been tried out, they are about to be broken, or at least bent beyond all recognition. - Congress: “Too Big to Jail: Inside the Obama Justice Department’s Decision Not to Hold Wall Street Accountable”

The US House of Representatives today released the results of its three-year investigation – hampered along the way by the Department of Justice and the Department of the Treasury – into why HSBC and its executives weren’t prosecuted. Empirical evidence has told us for years that in the US a bank and its executives cannot be prosecuted if the bank is big enough. We’ve come to call this type of bank “Too Big to Jail.” Empirical evidence has also told us that a bank can do essentially whatever it wants to, given that, if caught, it may have to pay a fine that then becomes just part of the cost of doing business. Wall Street doesn’t care about fines. They’re “extraordinary items” that banks and analysts systematically exclude from their “ex-items” per-share earnings. Fines matter under GAAP reporting. But they don’t matter in the rosy picture that Wall Street paints of the banks. And so they don’t matter. - Merchants Of War: U.S. Arms Export Reaches All-Time High At $47 Billion in FY 2015

International demand for U.S. weapons systems is expected to continue growing in coming years, a senior U.S. Air Force official said on Sunday, citing strong interest in unmanned systems, munitions and fighter jets. “The appetite just keeps getting bigger and bigger,” U.S. Air Force Deputy Undersecretary Heidi Grant told Reuters in an interview on the eve of the Farnborough International Airshow. U.S. arms sales approved by the Pentagon’s Defense Security Cooperation Agency rose 36 percent to $46.6 billion in the fiscal year ended Sept. 30, 2015, and are likely to remain strong this year, Grant said. Grant, the Air Force’s top international arms sales official, said she was working with many countries in eastern Europe and others that wanted to increase their defenses following Russia’s annexation of the Crimea region of Ukraine, but faced tough budget constraints.

In the year 1971 Lindsey Williams went to the state of Alaska to become an aviation missionary. Shortly after arriving in Alaska, Mr. Williams heard the oil companies were going to build the Trans-Alaska Oil pipeline and that 25,000 pipeliners were going to converge on the state to build it. Mr. Williams consequently volunteered his services as chaplain on the pipeline. Shortly after becoming chaplain, Alyeska Pipeline Service Company offered him executive status and invited him to sit in on their board meetings in an advisory capacity to help the relationship between management and labor. What he heard over the next three years time would change his life. He learned that OPEC had nothing to do with the price of oil but that the elite of the world controlled it. Mr. Williams knew he had to put into print what he saw and heard in order to inform the American people. His story is documented in The Energy Non Crisis.

TRUMP OR HARRIS – The war for the US and the World…

CONGRATULATIONS PRESIDENT TRUMP! Hi. I am James Harkin, and I am the webmaster of LindseyWilliams.net. I sent this as an email on Monday, November 4th, 2024, to all of the current subscribers to LindseyWilliams.net. I think a lot of the emails got blocked. So, I am creating this blog post that includes the entire email. […]

Finding Healing and Hope: Joanna Williams’ Heartfelt Journey at IBC Hospital

Discover Healing Beyond Medicine: Joanna Williams’ Journey at IBC Hospital Finding the right healthcare provider can often feel like searching for a needle in a haystack. Joanna Williams, the widow of the esteemed Pastor Lindsey Williams, knows this journey all too well. Since 2011, she and her late husband sought quality care, eventually discovering BioCare. […]

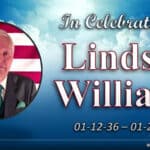

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams In Celebration of LINDSEY WILLIAMS January 12, 1936 – January 23, 2023 On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of […]