february

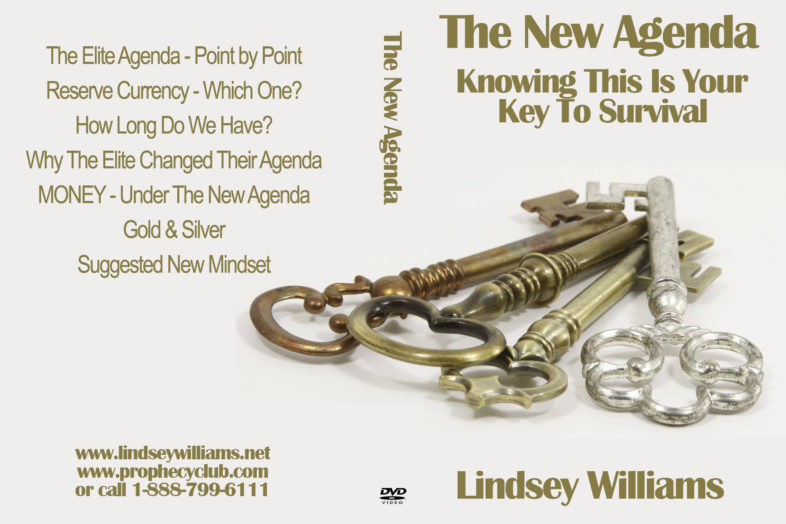

The New Agenda – Knowing This Is Your Key To Survival

Pastor Lindsey Williams explains The New Agenda. Knowing this is your key to survival:

* The Elite Agenda – Point by Point

* Reserve Currency – Which One?

* How Long Do We Have?

* Why the Elite Changed Their Agenda

* MONEY – Under the New Agenda

* Gold and Silver

* Suggested New Mindset

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This DVD was released on February 1st, 2017. It's more poignant now than it ever was. Prepare immediately!

This presentation of The New Agenda from Chaplain Lindsey Williams is required viewing by all Americans. Please share this presentation with everyone you know.

Pastor Lindsey Williams – on RENSE RADIO with Jeff Rense – 5th February 2018 – 7pm PST!

PASTOR LINDSEY WILLIAMS

LIVE ON RENSE RADIO

with Jeff Rense

Monday 5th February 2018

7pm PST

VISIT RENSE RADIO

VISIT RENSE.COM

Latest News Articles – February 9, 2017

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From February 3, 2017 to February 9, 2017:

- Debt Apocalypse Beckons As U.S. Consumer Bankruptcies Do Something They Haven’t Done In Almost 7 Years

When debt grows much faster than GDP for an extended period of time, it is inevitable that a good portion of that debt will start to go bad at some point. We witnessed a perfect example of this in 2008, and now it is starting to happen again. Commercial bankruptcies have been rising on a year-over-year basis since late 2015, and this is something that I have written about previously, but now consumer bankruptcies are also increasing. In fact, we have just witnessed U.S. consumer bankruptcies do something that they haven’t done in nearly 7 years. - Last year, Obama gave $27B to lawless ‘sanctuary’ cities

On January 25, 2017, his third full day on the job in the White House, President Trump fulfilled more of the promises he’d made — those concerning illegal “immigration” — by signing two executive orders: Executive Order: Border Security and Immigration Enforcement Improvements, which authorizes the construction of a wall along the porous U.S.-Mexico border. Executive Order: Enhancing Public Safety in the Interior of United States, which authorizes the denial of federal funds to “sanctuary” states and cities that willfully violate Federal immigration law in an attempt to shield aliens, including criminals, from removal from the United States and, in so doing, “have caused immeasurable harm to the American people and to the very fabric of our Republic.” As White House spokesman Sean Spicer put it, “The American people are no longer going to have to be forced to subsidize this disregard for our laws.” - How George Soros Singlehandedly Created The European Refugee Crisis – And Why

George Soros is trading again. The 85-year-old political activist and philanthropist hit the headlines post-Brexit saying the event had “unleashed” a financial-market crisis. Well, the crisis hasn’t hit Soros just yet. He was once again on the right side of the trade, taking a short position in troubled Deutsche Bank and betting against the S&P via a 2.1-million-share put option on the SPDR S&P 500 ETF. More interestingly, Soros recently took out a $264 million position in Barrick Gold, whose share price has jumped over 14% since Brexit. Along with this trade, Soros has sold his positions in many of his traditional holdings. Soros had recently announced he was coming out of retirement, again. First retiring in 2000, the only other time Soros has publicly re-entered the markets was in 2007, when he placed a number of bearish bets on US housing and ultimately made a profit of over $1 billion from the trades. - Prominent Republicans Pitch Carbon-Tax Plan to Top Trump Aides

A group of prominent Republicans and business leaders pitched a tax on carbon dioxide to top White House aides Wednesday, selling the plan as an economic win that could drive job growth and yield environmental dividends too. Former Secretary of State James Baker and other members of the new “Climate Leadership Council” pressed the case in a 45-minute meeting in the Roosevelt Room that included President Donald Trump’s top economic adviser Gary Cohn, Chief of Staff Reince Priebus and senior aide Kellyanne Conway. “The signs were very encouraging,” Ted Halstead, who founded the council, said after the meeting. “Two weeks into this new administration, we have positioned our solution as the most promising climate solution — if they want to go there.” - Millennials are struggling at work because their parents ‘gave them medals for coming last'

Bosses the world over are struggling with their millennial employees – they say we confound leadership, are self-entitled, narcissistic, lazy and tough to manage. But according to motivational speaker and author Simon Sinek, this is the result of our parents’ “failed parenting strategies.” After the astounding success of his video on millennials in the workplace, which has had over 56 million views on Facebook alone, Sinek spoke to The Independent about how our parenting, combined with social media, working environments and our impatience have created a generation plagued by low self-esteem, and what we can do about it. - Which Assets Are Most Likely To Survive The “System Reset”?

Your skills, knowledge and and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not. Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the “system re-set” that is now inevitable? It's a question of great import because not all assets are equal in terms of survivability in crisis, when the rules change without advance notice. If you doubt the inevitability of a system implosion/re-set, please read Is America In A Bubble (And Can It Ever Return To “Normal”)? This brief essay presents charts that reveal a sobering economic reality: America is now dependent on multiple asset bubbles never popping–something history suggests is not possible. - Dirty Vaccines: Every Human Vaccine Tested Was Contaminated With Metals and Debris in New Study

Researchers examining 44 samples of 30 different vaccines found dangerous contaminants, including red blood cells in one vaccine and metal toxicants in every single sample tested – except in one animal vaccine. Using extremely sensitive new technologies not used in vaccine manufacturing, Italian scientists reported they were “baffled” by their discoveries which included single particles and aggregates of organic debris including red cells of human or possibly animal origin and metals including lead, tungsten, gold, and chromium, that have been linked to autoimmune disease and leukemia. - FDA finally admits chicken meat contains cancer-causing arsenic

After years of sweeping the issue under the rug and hoping no one would notice, the FDA has now finally admitted that chicken meat sold in the USA contains arsenic, a cancer-causing toxic chemical that’s fatal in high doses. But the real story is where this arsenic comes from: It’s added to the chicken feed on purpose! Even worse, the FDA says its own research shows that the arsenic added to the chicken feed ends up in the chicken meat where it is consumed by humans. So for the last sixty years, American consumers who eat conventional chicken have been swallowing arsenic, a known cancer-causing chemical. - Records: Soros Fund Execs Funded Paul Ryan, Marco Rubio, Jeb Bush, John McCain, John Kasich, Lindsey Graham in 2016

Employees of a hedge fund founded by the king of the Institutional Left, billionaire and Democratic Party mega-donor George Soros, donated tens of thousands of dollars to top Republicans who fought against President Donald Trump in 2016, donation records compiled by the Center for Responsive Politics show. Soros Fund Management, a former hedge fund that serves now as an investment management firm, was founded by progressive billionaire George Soros in 1969. It has risen to become one of the most profitable hedge funds in the industry. Employees of the firm are heavily involved in backing political candidates giving millions upon millions to groups that were supporting failed 2016 Democratic presidential nominee Hillary Rodham Clinton for the presidency. - White House Releases List Of Terror Attacks It Considers Underreported By The Media

The White House released a list Monday night of the terror attacks it believes were underreported by the media. CNN’s Jim Acosta said his producer was given the list of the 78 attacks outside of the White House. Though he did not read the list in full on air, Acosta said it included attacks like Paris, Brussels, Nice, Istanbul and San Bernardino. Dan Merica said a White House official told him that “most of these attacks did not receive adequate attention from Western media sources.” - President Trump is now speculating that the media is covering up terrorist attacks

Speaking to the U.S. Central Command on Monday, President Trump went off his prepared remarks to make a truly stunning claim: The media was intentionally covering up reports of terrorist attacks. “You’ve seen what happened in Paris, and Nice. All over Europe, it’s happening,” he said to the assembled military leaders. “It’s gotten to a point where it’s not even being reported. And in many cases the very, very dishonest press doesn’t want to report it. They have their reasons, and you understand that.” The comment immediately harked back to comments from senior adviser Kellyanne Conway on MSNBC last week. - The Leftwing Has Placed Itself In The Trash Can Of History

At a time when the Western world desperately needs alternative voices to the neoliberals, the neoconservatives, the presstitutes and the Trump de-regulationists, there are none. The Western leftwing has gone insane. The voices being raised against Trump, who does need voices raised against him, are so hypocritical as to reflect less on Trump than on those with raised voices. Sharon Kelly McBride, speaking for Human Rights First, sent me an email saying that Trump stands on the wrong side of “America’s ideals” by his prohibition of Muslim immigrants into the US. - Trump Is Right: Silicon Valley Is Using H-1B Visas To Pay Low Wages To Immigrants

On the heels on its controversial immigration ban targeting seven Muslim-majority countries, the Trump administration has drafted a new executive order that could actually mean higher wages for both foreign workers and Americans working in Silicon Valley. The Silicon Valley companies, of course, will not be happy if it goes into effect. The order aims to overhaul and limit work visas, notably the H-1B visa program. Tech companies rely on these to bring in foreign talent. Their lobbyists claim there is a “talent shortage” among Americans and thus that the industry needs more of such work visas. This is patently false. The truth is that they want an expansion of the H-1B work visa program because they want to hire cheap, immobile labor — i.e., foreign workers. - O'Reilly said Putin is a killer. Trump's reply: ‘You think our country is so innocent?'

President Donald Trump has long been effusive in his praise for Russian President Vladimir Putin, despite criticism from Republicans and Democrats alike. In an interview with Fox News' Bill O'Reilly, which will air ahead of the Super Bowl on Sunday, Trump doubled down on his “respect” for Putin – even in the face of accusations that Putin and his associates have murdered journalists and dissidents in Russia. “I do respect him. Well, I respect a lot of people, but that doesn't mean I'll get along with them,” Trump told O'Reilly. O'Reilly pressed on, declaring to the president that “Putin is a killer.” Unfazed, Trump didn't back away, but rather compared Putin's reputation for extrajudicial killings with the United States. “There are a lot of killers. We have a lot of killers,” Trump said. “Well, you think our country is so innocent?” - Bill O’Reilly, meet the real “KILLER”. Barack Obama’s massive kill list in charts

Former POTUS Barack Obama may have played the part of a dainty liberal, but don’t be fooled, deep down Barack was a killer. A killer of mass proportions. As the US liberal and neocon media freak out over Trump’s interview with Fox News’ Bill O’Reilly, where Trump (GASP) admitted that he “respects” Putin, and America “is not so innocent” when it comes to killing…we present to you the real stone cold killer. When it comes to racking up ‘kills’, no one was more deadly these last eight years than Barack Hussein Obama. No world leader even comes close to Obama’s kill stats. - A bill has already been introduced in Congress to remove the US from the United Nations

A bill introduced by Alabama Rep. Mike Rogers earlier this month calls on the US to “terminate” its membership in the United Nations and effectively sever all ties with the organization. The bill, titled the American Sovereignty Restoration Act of 2017, was proposed on January 3. It is cosponsored by a handful of Republican lawmakers, including North Carolina Rep. Walter Jones, Arizona Rep. Andy Biggs, Missouri Rep. Jason Smith, Kentucky Rep. Thomas Massie, Tennessee Rep. John Duncan Jr., and Florida Rep. Matt Gaetz. Biggs said in a statement on Monday that he cosponsored the bill because he believes that “our sovereignty as a country is harmed by our membership in this body.” - Trump to order regulatory rollback Friday for finance industry starting with Dodd-Frank

President Trump plans to order a rollback Friday of regulations governing the financial services industry and Wall Street under the Dodd-Frank law and beyond, a White House source confirmed. Gary Cohn, White House Economic Council director, told the Wall Street Journal in an interview published last night that the administration would also move against a regulation designed to force retirement advisers to work in the best interest of their clients. That “fiduciary rule” is set to take effect in April. Promulgated by the Department of Labor, it’s meant to eliminate conflicts-of-interest among professionals dealing with people enrolled in qualified retirement plans and IRAs. - Trump’s Enemies Within

How on earth is all this stuff getting in the newspapers? Bob Haldeman told Richard Nixon that he had uncovered the culprit: Mark Felt, a top official at the FBI. “Now why the hell would he do that?” asked Nixon, who was secretly recording the exchange. Cracking down on Felt directly was out of the question, the two men agreed. “If we move on him, then he’ll go out and unload everything,” Haldeman said, of the man later revealed as Deep Throat. “He knows everything that’s to be known in the FBI.” - President Trump Speaks: Here's Why They Hate Him

The political elites hate him on both sides of the Atlantic. Why? Because he's not on board with their precious New World Order. RTV takes a closer look at President Trump's inauguration speech and its ramifications. Trump is far from perfect, but so was Constantine…and look how God used him. Pray for President Donald J. Trump! - U.N. Official Admits Global Warming Agenda Is Really About Destroying Capitalism

A shocking statement was made by a United Nations official Christiana Figueres at a news conference in Brussels. Figueres admitted that the Global Warming conspiracy set by the U.N.’s Framework Convention on Climate Change, of which she is the executive secretary, has a goal not of environmental activists is not to save the world from ecological calamity, but to destroy capitalism. She said very casually: “This is the first time in the history of mankind that we are setting ourselves the task of intentionally, within a defined period of time, to change the economic development model that has been reigning for at least 150 years, since the Industrial Revolution.” - Scientists have a plan to replace fossil fuels with nuclear fusion by 2030

Nuclear fusion is premised on building technology that would replicate the reaction that naturally powers our Sun – two light atoms, in this case, hydrogen, are fused together under extreme temperatures to produce another element, helium. The process would release vast amounts of clean energy drawn from an almost limitless fuel source, with nearly zero carbon emissions. However, it has yet to be done on a scale that would make it usable. Canadian scientists are hoping to change that, announcing plans to harness and develop nuclear fusion technology so they can deliver a working nuclear fusion plant prototype by 2030. What they need, however, is for the government to invest in their vision. - FDA quietly bans powerful life-saving intravenous Vitamin C

It would be naive to think that the FDA endeavors to protect the public’s health as its primary focus. Indeed, that would be a conflict of interest, as it serves its master, the pharmaceutical industry. Has the Food and Drug Administration engineered a shortage of intravenous vitamin C as part of an overall attack on natural and non-toxic approaches to healing that compete with prescription drugs? An analysis by Natural Blaze would suggest that the answer is yes. - Halftime HELL: Satan speaks through Lady Gaga to declare dominion over the Earth (while Pope Francis blesses) (satire)

Before you get into this article, note that I’m marking it “satire.” Yet none of the themes unveiled here are actually funny. This is serious stuff… it’s just that 99.9% of humanity isn’t ready to cognitively grasp what I’m about to present here, so until people are more ready to face the reality of demonic evil in our world, I’m going to label all this a weekend joke. Funny, isn’t it? If it’s too much for you, don’t take it too seriously. The NFL is a joke anyway, right? The average Superbowl viewer is so totally clueless about reality that they have no idea what they’re even watching. Over the last several years, the NFL has slowly given way to the agenda of truly evil globalists, pushing quack science fraud (breast cancer “awareness” propaganda), anti-American hatred (Colin Kaepernick’s nauseating antics), cultural subversion agendas and vulgar halftime shows that frequently invoke Satanic imagery in ritualistic fashion (see the multitude of photos and videos below for proof). - Liberal lynch mob trolling Trump could bring down US democracy

The Left's non-stop temper tantrum since Trump's election win is revealing an ugly underbelly of the Democratic Party – think Rosie O'Donnell mud-wrestling with a pig – where a rogues’ gallery of provocateurs aims to delegitimize conservative rule. First, some necessary background: for 15 uninterrupted years of US military escapades abroad, eight of those years on Obama's watch, the Liberal Left could not be awakened from its somnambulist slumber, not even to hold a meaningful antiwar protest in the spirit of their Vietnam-era forebears. - Permaculture, Politics and Solutions Thinking

How we think colours everything we do, that is indisputable. Our biases definitely affect our objectivity and clarity as well as our judgement, factors critical to effective solutions thinking. Permaculture is a discipline which embodies systems thinking, the ability to think holistically, to clearly see what is before us in its entirety, and to understand the relationships between elements of a system. Equally important to Permaculture is solutions thinking, the ability to create optimal solutions to address specific problems. - New Warming On European Banks

The European Banking Authority (EBA) just called for urgent action to be taken in regards to European banks’ bad loans. Because Italy is not the only country having to grapple with this problem: EBA’s chairman, Andrea Enria, is worried that ten European countries have more than 10% in non-performing loans (NPLs), which shows the extreme fragility of their banking system. Those NPLs are loans for which the payments are late for 90 days or more. - The Other “Ban” That Was Quietly Announced Last Week

Most of the world is in an uproar right now over the travel ban that Donald Trump hastily imposed late last week on citizens of seven predominantly Muslim countries. But there was another ban that was quietly proposed last week, and this one has far wider implications: a ban on cash. The European Union’s primary executive authority, known as the European Commission, issued a “Road Map” last week to initiate continent-wide legislation against cash. There are already a number of anti-cash legislative measures that have been passed in individual European member states. In France, for example, it’s illegal to make purchases of more than 1,000 euros in cash. - Pound, Dollar, Euro and Yen Will be Worthless Within Five Years

The new US Administration has taken over with the conviction that they will “make America great again”. I really wish they will succeed because a strong US would be good for the world. Sadly, the odds of achieving that admirable objective are totally stacked against them. At the end of the next 4 years, there is a risk that this Administration will be more hated than any government since Carter and possibly even more disliked than Hoover. - Is Italy’s Banking Problem Becoming Too Big to Solve?

Ever since the European Commission and ECB jointly decided that Italy’s government could bend EU banking rules out of all recognition in order to bail out the country’s third largest bank, Monte dei Paschi di Siena, Europe’s financial stocks have been on a tear. But the good times were brought to a grinding halt Monday after Italy’s largest bank, Unicredit, which employs 55,000 people in 17 countries, announced losses for 2016 of €11.8 billion. By the bank’s logic, it would have announced profits if it hadn’t had to write off €12.2 billion, including billions of euros of non-performing loans (NPLs) festering on its balance sheets. - Markets Smell a Rat as Central Banks Dither

Markets are suspecting that central banks are in the process of exiting this fabulous multi-year party quietly, and that on the way out they won’t refill the booze and dope, leaving the besotted revelers to their own devices. That thought isn’t sitting very well with these revelers. In markets where central banks have pushed government bond prices into the stratosphere and yields, even 10-year yields, below zero, there has been a sea change. - California in the red by $127.2 billion, state auditors say

A financial report issued by state auditors finds that the state of California is in the red by an unsustainable $127.2 billion. The report says that the state’s negative status increased that year, largely because it spent $1.7 billion more than it received in revenues and wound up with an accumulated deficit of just under $23 billion in fiscal year 2011-2012, the Sacramento Bee stated. Gov. Jerry Brown has referred to the deficit and other budget gaps, mostly money owed to schools, as a “wall of debt” totaling more than $30 billion, the Sacramento Bee reported. About half of the deficit came from the state issuing general obligation bonds and then giving the money to local governments and school districts for public works projects. The report listed California’s long-term obligations at $167.9 billion, nearly half of which ($79.9 billion) were in general obligation bonds, with another $30.8 billion in revenue bonds, the Sacramento Bee reported. - It’s Time We Talked About Our Owners – How vast asset managers impact “our increasingly cartelized economy.”

The world’s biggest asset manager, BlackRock, was splashed across the front pages of the Spanish financial news yesterday. The firm had just raised raised its stake in Spain’s telecoms giant Telefónica to 336 million shares — the equivalent of 6.7% of Telefónica’s total capital, with a market value of just under €3 billion. In the short space of five months BlackRock has almost doubled its holdings and is now the largest owner of Telefónica stock, ahead of Spain’s second biggest bank, BBVA, which holds 6% of the shares. The asset manager has also expanded its participation in Telefónica’s international subsidiaries, raising its holdings in Telefónica Deutschland to 0.76% and Telefónica Brasil to almost 2%, making it the firm’s biggest institutional shareholder. - We Are Moving Forward: The Future of Oil and Gas

Oil will hold a dominant position in the world energy demand at least next 20 years. Despite the small decline, oil will secure as many as 29 percent of world energy demand by 2035 vs 32 percent in 2015. The slight decline by 3 percent will occur because of gas, nuclear and renewables (including biofuels) sectors rise in the world energy demand share. ‘Global oil production becomes geographically more concentrated as low cost producers gain share. The Middle East, US, and Russia account for 63% of oil production in 2035, up from 56% in 2015.’ BP reports in its Energy Outlook-2017. BP publishes its energy outlooks on a regular basis. The Energy Outlooks allow to track in details the global energy trends. One of those energy trends is that BP expects 106 million barrels of oil per day as demand and 107 million barrels of oil per day as supply by 2035. North America will hold its dominant in gas production. BP considers North America will produce 1.33 billion t.o.e. of gas per year by 2035 what makes 31 percent share of the global gas production. North America has been keeping its dominant in gas production since 1995, by the way. Before 1995 episodically North America had been ‘overtaken’ in gas production by USSR. USSR collapsed in 1991 while the previous year – 1990 was the last year when Soviets could produce more gas than the entire North America. In 1990 USSR produced 672 million t.o.e of gas versus 584 million t.o.e produced in North America. In 1995 North America got 651.7 million t.o.e of gas while Soviets faced only 569.1 million t.o.e. North America leads in the global gas production ever since. - Whistle-Blower: ‘Global Warming’ Data Manipulated Before Paris Conference

A high-level whistleblower at the National Oceanic and Atmospheric Administration (NOAA) has revealed that the organization published manipulated data in a major 2015 report on climate change in order to maximize impact on world leaders at the UN climate conference in Paris in 2015. According to a report in The Mail on Sunday, NOAA scientist Dr. John Bates has produced “irrefutable evidence” that the NOAA study denying the “pause” in global warming in the period since 1998 was based on false and misleading data. The NOAA study was published in June 2015 by the journal Science under the title “Possible artifacts of data biases in the recent global surface warming hiatus.” - Shell To Sell Another $5B In Assets, Misses Profit Expectations

Royal Dutch Shell (NYSE:RDS.A) is making “significant progress” on selling another US$5 billion worth of assets, chief financial officer Simon Henry said on Thursday after the oil supermajor reported 2016 profits below analyst expectations. Shell’s current cost of supplies (CCS) – a key measure comparable with net income – came in at US$1.8 billion, excluding identified items, compared with US$1.6 billion for the fourth quarter 2015, the company said today. Full-year 2016 CCS earnings attributable to shareholders excluding identified items dropped to US$7.2 billion from US$11.4 billion in 2015. The fourth-quarter profit fell short of analyst estimates by around US$1 billion, according to Bloomberg. - Weatherford Slashes Another 3,000 Jobs

As part of its strategy to further cut costs and reduce debt, oilfield services company Weatherford International (NYSE:WFT) said on Thursday that it had launched another head count reduction plan totaling 3,000 employees. Weatherford’s Chief Financial Officer and Executive Vice President Christoph Bausch said at the company’s earnings call on Thursday for the fourth-quarter and full-2016 results: “At the time of this call, we have already reduced 2,000 employees out of the 3,000 mentioned before.” In its drive to cut more costs, Weatherford will also pull back its pumping operations in the U.S. and close additional uneconomical field locations, Bausch said, adding that all those actions are expected to generate additional annualized cost savings of about US$300 million. - Fukushima nuclear reactor radiation at highest level since 2011 meltdown

Extremely high radiation levels have been recorded inside a damaged reactor at the Fukushima Daiichi nuclear power station, almost six years after the plant suffered a triple meltdown. The facility’s operator, Tokyo Electric Power (Tepco), said atmospheric readings as high as 530 sieverts an hour had been recorded inside the containment vessel of reactor No 2, one of three reactors that experienced a meltdown when the plant was crippled by a huge tsunami that struck the north-east coast of Japan in March 2011. The extraordinary radiation readings highlight the scale of the task confronting thousands of workers, as pressure builds on Tepco to begin decommissioning the plant – a process that is expected to take about four decades. - Russian economy to emerge from contraction

Russia’s economy ministry on Monday said that GDP growth fell by one per cent in December from the same time last year. In October, the economy contracted by 0.6 per cent but grew in November by a revised 0.9 per cent. For 2016 as a whole, GDP fell 0.6 per cent from 2015. According to forecasts by the World Bank, International Monetary Fund and the UN, Russia’s economy has beaten the effects of US and European Union sanctions over the Ukraine crisis. In 2017, GDP growth is expected between one and 1.5 per cent. - Things Just Got Serious in Europe’s War on Cash

The central authorities in Europe just launched their most important offensive to date in their multiyear War on Cash. The new move comes directly from the European Union’s executive branch, the European Commission, which just announced its intention to “explore the relevance of potential upper limits to cash payments,” with a view to implementing cross-regional measures in 2018. Maximum limits on cash transactions already exist in most European countries, and the general trend is downward. Last year, Spain joined France in placing a €1,000 maximum on cash payments. Greece went one better, dropping its cap for cash transactions from €1,500 to €500. In simple terms, any legal purchase of a good or service over €500 will need to be done with plastic or mobile money. - Gerald Celente Issues Major Trend Alert On The Road For The Gold Market In 2017

With the price of gold surging above the critical $1,220 level, the top trends forecaster in the world, Gerald Celente, just issued a major trend alert on the road for the gold market in 2017. Here Is What To Look For In The Gold Market In 2017. Gerald Celente — Trends are born, they grow, mature, reach old age and die. The Donald Trump, President of the United States of America, Trend has just been born. Never in modern history has the nation stood so divided and nations across the globe so alarmed following the election of the leader of the world’s largest economy and most powerful military… - The Alternative Fact of the Cashless Society

Last week a new phrase was introduced into our lexicon by Trump Adviser Kellyanne Conway. When asked about why press secretary Sean Spicer had made statements that were (according to the press) unverifiable she said that he had used ‘alternative facts’. This prompted a raft of satire, journalists to flail their arms up at the audacity of Conway and Trump’s administration, and for people to rush out and buy George Orwell’s 1984. Penguin, the world’s largest publisher, ordered a 75,000 copy reprint last week. Apparently more than the ‘typical reprint’ for the 1949 Orwellian classic. The ‘alternative facts’ statement echoed of ‘Newspeak’ the language used by the totalitarian government in Orwell’s 1984 to influence and control its citizens of Airstrip One (previously Britain). - Cal Berkeley Fascists Violently Protest Free Speech

150 masked “protesters” at Cal Berkeley, precisely 0.0039 percent of the 38,000 student body was all it took to shut down free speech at the University of California, Berkeley. The protesters are so confused that they see the shutdown as a victory for free speech. Something is wrong here. The 150 violent protesters are masked, so we don’t know if they are students or a Deep State operation against President Trump. The protesters are behaving as fascists by shutting down free speech. By associating the exercise of free speech with fascism, the protesters appear to be too stupid to be Cal Berkeley students. When I was a graduate student at Cal Berkeley, there were high admission standards. Perhaps those standards have been declared to be racist and were thrown out with the bath water. - Leaked Draft of Trump’s Religious Freedom Order Reveals Sweeping Plans to Legalize Discrimination

A leaked copy of a draft executive order titled “Establishing a Government-Wide Initiative to Respect Religious Freedom,” obtained by The Investigative Fund and The Nation, reveals sweeping plans by the Trump administration to legalize discrimination. The four-page draft order, a copy of which is currently circulating among federal staff and advocacy organizations, construes religious organizations so broadly that it covers “any organization, including closely held for-profit corporations,” and protects “religious freedom” in every walk of life: “when providing social services, education, or healthcare; earning a living, seeking a job, or employing others; receiving government grants or contracts; or otherwise participating in the marketplace, the public square, or interfacing with Federal, State or local governments.” - Amazon sinks as revenue misses, guidance disappoints

The online retail technology company reported fourth-quarter earnings that beat analysts' expectations on Thursday, but revenue that fell short of estimates. It also gave future guidance that was below the average estimate. Shares dropped more than 4 percent after hours. The free-spending company has invested heavily in new projects and infrastructure to meet ballooning demand as more shopping moves online. Amazon keeps taking business from traditional retailers, which are closing stores by the hundreds. But it also offers promotions to have the lowest prices, a “cost of doing business,” chief financial officer Brian Olsavsky said. - Student Loan Reforms to Watch for in 2017

So far, the Trump administration continues to deliver on some key campaign promises. These promises include the travel ban, federal hiring freeze, and authorizing the construction of the US-Mexico border wall. Higher education is another issue Trump will likely be addressing in the coming months, as it continually ranks as the biggest source of consumer debt today. - America’s Problem with Student Loans Is Much Bigger Than Anybody Realized

The Department of Education recently released a memo admitting that repayment rates on student loans have been grossly exaggerated. Data from 99.8% of schools across the country has been manipulated to cover up growing problems with the $1.3 trillion in outstanding student loans. New calculations show that more than half of all borrowers from 1,000 different institutions have defaulted on or not paid back a single dollar of their loans over the last seven years. This comes in stark contrast to previous claims and should call into question any statistics provided by government agencies. The American people haven’t fully grasped the long-term implications of loaning a trillion dollars to young people who have no credit or assets. - US Productivity Growth Has Never Been This Low For This Long

Despite slowing US productivity growth QoQ in Q4 (from +3.5% in Q3 to +1.3% in Q4), overall productivity in 2016 grew at 1% – the best annual growth since 2013. However, that silver-lining is akin to being the tallest midget as over the longer-term, US productivity growth has never been this low for this long. - Fed Leaves Policy Rate Unchanged, Offers No Hint on When It Might Next Move

The Federal Reserve said Wednesday it remains on track to gradually raise short-term interest rates this year and gave no hint about when the next increase might come. Following a two-day policy meeting, officials voted unanimously to hold their benchmark rate steady in a range between 0.50% and 0.75%, while noting in a statement some recent improvements in the economy, including an uptick in consumer confidence. They lifted rates by a quarter percentage point in December and penciled in three quarter-point moves in 2017. Investors hadn’t expected the Fed to move Wednesday and were looking for a signal about its next meeting on March 14-15. Market reaction to the statement was muted. - Gold Gains as Trump Shocks Markets by Doing What He Said He’d Do

President Donald Trump’s policies have brought gold back to life. Gold futures rose for a second day, posting the biggest monthly gain since June, on investor concern over moves by Trump that included barring entry by citizens from seven predominantly Muslim nations and firing the acting U.S. attorney general for refusing to enforce the order. The dollar headed for a third straight decline against a basket of 10 currencies, and U.S. stocks slid. Confusion over U.S trade and immigration policies has helped rekindle haven demand for gold, which in December capped its biggest quarterly decline in more than three years. Money is also flowing back to precious metals as speculation mounts that the Federal Reserve may be more cautious in raising U.S. interest rates amid concerns Trump’s policies could stifle economic growth. Protests from New York to Atlanta to Detroit were held Sunday. - GOP Rebrands Obamacare Strategy From ‘Repeal’ to ‘Repair’

Some Republicans in Congress are starting to talk more about trying to “repair” Obamacare, rather than simply calling for “repeal and replace.” There’s good reason for that. The repair language was discussed by Republicans during their closed-door policy retreat in Philadelphia last week as a better way to brand their strategy. Some of that discussion flowed from views that Republicans may not be headed toward a total replacement, said one conservative House lawmaker who didn’t want to be identified. Using the word repair “captures exactly what the large majority of the American people want,” said Frank Luntz, a prominent Republican consultant and pollster who addressed GOP lawmakers at their retreat. - ALERT: Former Soros Associate Just Warned We Are About To Witness ‘Absolute F*cking Chaos’ Across The Globe

Today a former associate of George Soros told King World News that we are about to witness “absolute f*cking chaos” across the globe in a little over two months. Victor Sperandeo oversees over $3 billion, has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Below is what Sperandeo had to say. Victor Sperandeo: “What people are underestimating is the upcoming election in the Netherlands on March 15. A month later France is going to hold their election… - Mexican border wall could take just two years to build

The Mexican border wall could take just two years to build and parts could be “see through,” according to the new head of the Department of Homeland Security. “The wall will be built where it’s needed first, and then it will be filled in. That’s the way I look at it,” Secretary John Kelly told Fox News. “I really hope to have it done within the next two years,” the retired four-star Marine general added. Fox’s Catherine Herridge reported Thursday that Kelly told her that the wall won't all be solid and sections of it may be transparent. - U.S. appeals court revives JPMorgan silver futures rigging lawsuits

A U.S. appeals court on Wednesday revived three private antitrust lawsuits accusing JPMorgan Chase & Co (JPM.N) of rigging a market for silver futures contracts traded on COMEX. The 2nd U.S. Circuit Court of Appeals in New York said a lower court judge held hedge fund manager Daniel Shak and two other traders to an excessively high legal standard when deciding last June 29 to dismiss their complaints. Shak, Mark Grumet and Thomas Wacker accused the largest U.S. bank of having in late 2010 and early 2011 placed artificial bids on the trading floor, harangued staff at metals market COMEX to obtain prices it wanted, and made misrepresentations to a committee that set settlement prices. The traders said this forced them to post more capital to support their positions in silver futures spreads, and ultimately to liquidate them at heavy losses. - As Brazil Unemployment Hits Record High, Rio's Murder Rate Soars

With Brazil stuck in what may be its worst depression on record, it will surprise nobody that the homicide rate in Rio de Janeiro climbed by 20% in 2016 from the previous year, as violence soared in the Brazilian metropolis amid rising unemployment and sharp cuts in public security budgets. Worse even than Chicago, state security statistics released on Wednesday and cited by Reuters showed that 5,033 people were murdered in Rio during the year, up from 4,200 in 2015. - Researchers: Fake News Did Not Alter Election Results

As social media sites like Facebook and Snapchat move to eliminate “fake news” reports from their sites, researchers from Stanford and New York Universities say Americans can be sure of one thing: the phenomenon did not affect the results of the presidential election. The new study released last month investigated the influence that fake news may have had on President Trump’s victory. NYU economics professor Hunt Allcott and Stanford economics professor Matthew Gentzkow led the research. The pair ran a series of tests to determine which fake news articles were circulated, how much of it was circulated, and the amount of voters that believed the stories to be true. - The Central Banks Pull Back: Now It's Up To Fiscal Policy To “Save The World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank “save” has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy? Those days are gone. Nowadays, central banks cautiously continue the bond buying programs they've had in place for years, but their policy initiatives are tepid at best: they talk about expanding asset-buying programs to include more stocks, or discuss notching interest rates higher in some cases; but the talk is subdued, as expectations are being consciously lowered. - State Minimum Wage Hikes Already Passed Into Law Expected To Cost 2.6 Million Jobs, New Study Finds

Even though we know that Bernie and his alt-left compatriots will never tire of their endless “Fight for $15” no matter how much data we throw at them, we thought we would go ahead and highlight yet another economic study detailing the devastating job losses that will result from minimum wages hikes that have already been passed in states all around the country. The latest study comes for the American Action Forum (AAF) and estimates that 2.6 million jobs will be lost around the country over the next several years as states phase-in minimum wage hikes that have already been passed. - BOOM! Companies That Openly Criticized Trump For “Making America Safe Again” Take Stock Market Hit

The Dow Jones industrial average fell around 120 points after sliding more than 223.39 points, dropping below 20,000, with Goldman Sachs contributing the most losses. Most of the companies who criticized Trump’s temporary travel ban on the 7 nations Obama’s DHS identified as terror hotbed nations lost money in the stock market today. Apparently keeping our country safe takes a back seat to these companies, unless of course, we see another major terror attack in America by an unvetted refugee, then they’ll all be lining up behind Trump and complaining he didn’t do enough… - Trump pledges to end political limits on churches

Declaring that religious freedom is “under threat,” President Donald Trump vowed Thursday to repeal a rarely enforced IRS rule that says pastors who endorse candidates from the pulpit risk losing their tax-exempt status. “I will get rid of and totally destroy the Johnson Amendment and allow our representatives of faith to speak freely and without fear of retribution,” Trump said at the National Prayer Breakfast, a high-profile event bringing together faith leaders, politicians and dignitaries. Trump's pledge was a nod to his evangelical Christian supporters, who helped power his White House win. So far he has not detailed his plans for doing away with the rule, which he has previously promised to rescind. Named after then-Sen. Lyndon Johnson, the regulation has been in place since 1954 for tax-exempt charities, including churches, though it is very rare for a church to actually be penalized. - Pastor Lindsey Williams introduces Pastor David Bowen – February 2, 2017

Pastor Lindsey Williams introduces Pastor David Bowen with his regular short weekly video for readers of Pastor Williams’ weekly newsletter.

Precious Metals Are The Only Lifeboat! I have persistently WARNED you what was happening in the gold market and why you needed to convert your paper assets to physical gold and silver. You need to hedge against the financial instability with physical gold and silver. Call the experts to help you convert your IRA or 401k into Gold, Silver and Other Precious Metals. Contact Birch Gold NOW before it's too late!

Latest News Articles – February 2, 2017

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From January 27, 2017 to February 2, 2017:

- Trump Fights to Takedown Bad Guys

According to precious metals and financial expert Bix Weir, what’s going on in Washington now is simply a struggle for control between good and evil. Weir explains, “The left is going nuts. They say they are not violent, but they are causing all these riots and protests everywhere. I am convinced that this takedown of the bad guys is going to get a lot uglier. It will get uglier because the left leaning Obama people have been given so many rights that are not in the Constitution and are not anywhere in a capitalistic society. It’s more towards socialism, and when you try to take away the rights given to socialists, they get armed. They go into the streets.” - Why One Trader Thinks “The Fed Is About To Take Out The Last Pillar Supporting The Dollar”

Fed Can’t Help Dollar Bulls in Denial. Expect the Fed to take out one of the last pillars of dollar support today. Dollar bulls are still not capitulating despite it being on target for a sixth consecutive week of losses. While some doubts are finally starting to creep in, the majority of analyst notes this week suggest the FOMC can put the dollar uptrend back on track. I’m surprised. It’s hard to see how the Fed can be hawkish given the economic policy turmoil of the last couple of weeks. All measures taken so far by Trump’s administration are negative for growth rather than reflationary. This is particularly pertinent when put in context of how optimistic expectations were only two months ago. - White House Blackballs CNN; Refuses To Send Surrogates On “Fake News” Network

Well, it's official…according to a note from Politico, the White House has confirmed that surrogates of the Trump administration will no longer appear on CNN and will instead go to “places where we think it makes sense to promote our agenda.” “We’re sending surrogates to places where we think it makes sense to promote our agenda,” said a White House official, acknowledging that CNN is not such a place, but adding that the ban is not permanent. A CNN reporter, speaking on background, was more blunt: The White House is trying to punish the network and force down its ratings. “They’re trying to cull CNN from the herd,” the reporter said. Of course, this development should come as little surprise to anyone who has been paying attention given that Trump has constantly blasted CNN as a “Fake News” outlet ever since his heated exchange with Jim Acosta at a press conference on January 11th. - Gorsuch Will Not Shift The Balance Of Power On The Supreme Court As Much As You May Think

On Tuesday, President Trump announced that he would nominate Neil Gorsuch to fill the open seat on the U.S. Supreme Court. Gorsuch currently serves on the 10th U.S. Circuit Court of Appeals in Denver, and he was confirmed unanimously by the Senate when he was appointed to that position by President George W. Bush in 2006. Gorsuch appears to have some strong similarities to Antonin Scalia, and many conservatives are hoping that when Gorsuch fills Scalia’s seat that it will represent a shift in the balance of power on the Supreme Court. Because for almost a year, the court has been operating with only eight justices. Four of them were nominated by Republican presidents and four of them were nominated by Democrats, and so many Republicans are anticipating that there will now be a Supreme Court majority for conservatives. - Trump Picks Anti-Choice Federal Judge Neil Gorsuch for Supreme Court

Within minutes of President Trump’s nomination of federal judge Neil Gorsuch to the Supreme Court, several hundred demonstrators had converged on the steps of the Supreme Court in Washington, D.C. to protest his selection. Waving signs proclaiming, “Gorsuch: Extreme and Dangerous” and “#NoWall #NoBan,” the protesters and a stream of speakers linked the conservative nominee to the administration’s unconstitutional ban on immigrants from seven predominantly Muslim countries, and pledged to defy both. - Lindsey Williams – The Energy Non-Crisis – Call To Decision Presentation

Lindsey Williams talks about his first hand knowledge of Alaskan oil reserves larger than any on earth. And he talks about how the oil companies and U.S. government won’t send it through the pipeline for U.S. citizens to use. - Ron Paul Warns: “Second Financial Bubble Going To Burst Soon… Even Trump Can't Stop It”

By all appearances notes SHTFPlan.com's Mac Slavo, President Trump is doing his damnedest to turn around the economy, revitalize jobs and bring back prosperity. But the larger trends are already in place; the cycle is turning, and the bust cannot be put off forever. “Federal Reserve policy has literally set the country up for collapse, and though the central bank has been very creative in making the impossible work, and putting off disaster, nothing can hold back the flood forever. Unfortunately, it looks like Trump may be blamed for a financial crisis that he didn’t cause. Analysts, including notably Brandon Smith, may be correct in pinpointing the attempt to use the new and highly controversial president as a scapegoat for the dirty work of the bankers. The conditions are there, and the consequences were built in when the bubble was still being pumped up. Someday it will burst. When, how, and how bad remains to be seen.” - The other “ban” that was quietly announced last week

Most of the world is in an uproar right now over the travel ban that Donald Trump hastily imposed late last week on citizens of seven predominantly Muslim countries. But there was another ban that was quietly proposed last week, and this one has far wider implications: a ban on cash. The European Union’s primary executive authority, known as the European Commission, issued a “Road Map” last week to initiate continent-wide legislation against cash. There are already a number of anti-cash legislative measures that have been passed in individual European member states. - Japan Thinks It Can Balance Its Budget

A recurring problem for most developed-world governments is explaining why last year’s plan didn’t work while convincing voters that this year’s new and improved plan will do the trick. This is especially tough when the new plan is pretty much the same as the old one and therefore just as likely to fail. Let’s take Japan as our first object lesson. Its government is the world’s most deeply indebted relative to GDP. Its population is the world’s oldest, with the number of retirees on public assistance soaring. Yet for some reason its leaders keep promising to balance the budget, only to be forced to push the date further into the future with each new report. - Adventures in Currency Debasement

The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value, as measured by the dollar index, increased from 79.78 to 103.30 – or 29 percent. Since then, the dollar index has dropped to about 100. In addition, President Trump has said that the dollar is “too strong” and Treasury Secretary Steven Mnuchin has called the dollar “excessively strong.” - Senate confirms Rex Tillerson for secretary of State

The Senate confirmed former ExxonMobil CEO Rex Tillerson as secretary of State on Wednesday, even as Democrats blocked progress on other Cabinet nominees chosen by President Trump. Three Democrats and one Independent who generally votes with the Democrats joined a solid rank of Republicans in approving Tillerson 56-43. The vote puts a man who has negotiated business deals with countries around the world, including some hostile to the United States, in position to negotiate on behalf of Trump in matters of war and peace, climate change and human rights. - BUCKLE UP: Available Physical Gold & Silver Supplies Drying Up In London’s LBMA As The Price Of Silver Surges

In what promises to be a wild 2017 we are already seeing physical gold and silver supplies drying up in London’s LBMA as the price of silver surges. James Turk: “There has been a lot of gold and silver moving to China recently, prior to the Chinese New Year, and that’s starting to show up in terms of the lack of liquidity over here in London. And even as prices were going down as the options were ready to expire, we were seeing backwardation in gold. The spot price of gold was a dollar or so above what February delivery prices were and it was only a few days until February delivery. So we are seeing the tightness in terms of the way the market is trading. We are also seeing the tightness in terms of the spreads and the backwardation in gold plus the metals flows themselves. Eric, I keep reminding myself of where we were several years ago, back in 2009-2010. We have those same kind of circumstances (where gold and silver skyrocketed) developing right now and nobody is paying attention. - Here Are The Technical Reasons Why Oil Is About To Plunge

There are basically two ways to analyze markets and make trading decisions, the fundamental and the technical. Logically speaking, fundamental factors and analysis always have the upper hand, particularly over a longer time period. In the case of crude oil, for example, if supply is outstripping demand the price is going down, no matter what your charts indicate. In the short term, though, as traders pay attention to technical factors they can be enormously powerful. Right now there is a battle going on between the fundamental and technical in the WTI market and, unusually, this looks like one that technical factors will win. Two weeks ago here I predicted higher oil and we did climb from around $51 to $54, but the likely outcome of this battle has caused me to expect another drop from here. - BlackRock: Inflation Is Surging, So Buy Some Gold

Russ Koesterich discusses the signs that inflation is rising faster than many expect, and what that means for your portfolio. Like the proverbial frog that does not notice the rise in water temperature until it’s too late, investors seem to be experiencing a similarly stealthy rise in inflation. Changes in headline inflation measures suggest a gentle firming in prices. However, underneath the surface there is evidence that inflation may continue to rise past the steady 2% nirvana that central banks prefer. - Barron’s Calls For Dow 30K Already

The financial magazine which has made an art out of calling for big, round numbers in the Dow Jones Financial Index (as a reminder over 20% of the Dow’s surge since the election is due entirely to Goldman Sachs), most recently with its “get ready for Dow 20,000” call from just over a month ago, has done it again. While there are still those – pretty much anyone who still cares about fundamentals – who are scratching their heads at Dow20K, according to Barrons “the Dow hitting 20,000 was no fluke. Today’s stock prices are well supported by solid prospects for corporate earnings and economic growth.” - China Sets the Stage to Replace the U.S. As Global Trade Leader

Saturday marked the Lunar New Year, the most important date in the Chinese calendar. It’s also the start of the longest holiday at two weeks, during which the largest mass migration of humans occurs every year as families reunite and go on vacations, both domestic and overseas. 2017 is the year of the 10th Chinese zodiac, the fire rooster, one of whose lucky colors is gold. Year-to-date, gold—the metal, not the color—is up 3.5 percent, which is below the 5.7 percent it had gained so far around this time last year. Unfortunately, gold prices won’t find support from Chinese traders this week, as markets will be closed in observance of the new year. If you remember, the yellow metal had one of its worst one-day slumps of 2016 back in October during China’s Golden Week, when markets were similarly closed. - THE NEW AGENDA – Knowing This Is Your Key To Survival – A New DVD From Pastor Lindsey Williams

THE NEW AGENDA – Knowing This Is Your Key To Survival! The Elite Agenda – Point by Point. Reserve Currency – Which One? How Long Do We Have? Why The Elite Changed Their Agenda. MONEY – Under The New Agenda. Gold and Silver. Suggested New Mindset. THE NEW AGENDA – Knowing This Is Your Key To Survival! The New DVD From Pastor Lindsey Williams. Order NOW Online For SHIPMENT NOW! - Embry – A Jaw-Dropping 8.6 Million Ounces Of Paper Gold Longs Just Blew Up At The Comex!

With the Dow tumbling back below the 20,000 level, one of the greats in the business told King World News that a jaw-dropping 8.6 million ounces of paper gold longs just blew up at the Comex! U.S. Economy Weakest Since 2008 Collapse. John Embry: “With all of the chaos regarding the immigration decrees, I think most observers have lost track of what is really happening with the U.S. economy. Instead they are focusing on the turmoil in the country and the record highs on the Dow… - The Media Is Now The Political Opposition

Bannon is correct that the US media—indeed, the entire Western print and TV media—is nothing but a propaganda machine for the ruling elite. The presstitutes are devoid of integrity, moral conscience, and respect for truth. https://www.rt.com/usa/375271-bannon-trump-media-cnn/ Read the comments in which morons define freedom of the press as the freedom to lie to the public. Who else but the despicable Western media justified the enormous war crimes committed against millions of peoples by the Clinton, Bush, and Obama regimes in nine countries—Afghanistan, Iraq, Libya, Pakistan, Yemen, Syria, Somalia, Palestine, and the Russian areas of Ukraine? - Dow 20K, US Debt $20 Trillion, Trump and Gold US: Dow 20K … US Debt $20 Trillion … Trump and $15,000 Go

In case you’ve been hiding under a rock, the Dow Jones Industrial Average reached 20,000 earlier this week for the first time in its 132 year history to much media fanfare. Since Trump’s election US market indicators, including the Dow have been ticking up – it has been labelled the Trump rally. This latest milestone is something that the new President is happy to take credit for. In fact, he tweeted ‘Great! #Dow20K’ in response. - Why 2017 Could See the Collapse of the Euro

2017 could be the year that the euro collapses according to Joseph Stiglitz writing in Fortune magazine and these concerns were echoed over the weekend by former Bundesbank vice-president and senior European Central Bank official, Jürgen Stark, when he said that the ‘destruction’ of the Eurozone may be necessary if countries are to thrive again. Stark and Stiglitz are too of many respected commentators, from both the so called right and the so called left, who are warning that the common currency and the Eurozone itself will not survive the financial and political turmoil already besetting the European monetary union and set to deepen in the coming months and years. - Why Our System Is Broken: Cheap Credit Is King

Cheap credit–newly issued money that can be borrowed at low rates of interest–is presented as the savior of our economic system, but in reality, it’s why our system is broken. The conventional economic pitch goes like this: cheap credit enables consumers to buy more goods and services (and since the system needs growth or it implodes, that’s good). Cheap credit also enables companies to invest in new productive assets (capital). Last but not least, low rates of interest enables the government at all levels to borrow money at relatively low cost. - Remember When Obama Supported A Border Wall?

There really is no limit to the mainstream media’s support for the far-left’s hypocrisy, or their use of a double standard when it comes to covering the Democrats… none. For months we’ve heard all about how the “integrity of our democracy” was under siege by “thugs” like Vladimir Putin, while no one has been talking how “thugs” like Barack Obama and Jey Johnson were using the Department of Homeland Security’s computer systems to try and hack into several states’ election systems AFTER the voting had taken place, but BEFORE results were certified. Yeah, good luck explaining that one. Thankfully, as of January 17th, the Inspector General of the DHS, John Roth, was cleared to being his investigation into the matter. - Fed Will Be Forced to Print & Kill Dollar

Economist John Williams warned last year the U.S. economy never really recovered, and it was going to turn down again. That downturn happened Friday when the latest GDP figures came in below 2% growth in the fourth quarter of 2016. Williams says the economy “contracted,” and he contends it’s going to get a lot worse before it gets better. Williams explains, “I think there is reason for optimism in terms of the economy down the road. The problem is irrespective of who is president. When you introduce new policies, it takes about nine months to a year before we see the impact. So, the impact of all the happy things that are happening now won’t start to surface until 2018 barring other complications. I expect you to see a pickup in the economy then. Unfortunately, we are still in an economy that is turning down. You are going to see that in the reporting in the next several months. We never really recovered from the economic collapse going into 2009. There was a little bit of a rebound, and we started to see the economy turn down again in 2014. If you look at the underlying series such as industrial production, freight indices and petroleum consumption, there has been no recovery. We are turning down again. This is the longest and deepest economic contraction since the Great Depression.” - Trump’s Busy First Week, Voter Fraud is Real, Updates on War and Economy

Donald Trump had a very busy first week in office. He started work on the day he was sworn in as the 45th President of the United States. First thing he did was sign an Executive Order to take away some tax burdens for people who have to pay a penalty for not having health insurance. He also pushed ahead on the long stalled XL Pipeline, clamped down on immigration and took the first steps to build a wall between the U.S. and Mexico. Trump also made the claim that “three to five million” illegal votes were cast in the 2016 election, and that cost him the popular vote. The mainstream media (MSM) basically called him a sore winner and a liar and said there was no evidence of voter or election fraud. So, Trump ordered an investigation to get evidence of widespread fraud. - Now It Is The Elite That Are Feverishly ‘Prepping’ For The Collapse Of Society

Once upon a time, “prepping” was something that was considered to be on “the lunatic fringe” of society. But in 2017, wealthy elitists are actually the most hardcore preppers of all. This is particularly true in places such as Silicon Valley, where a whole host of young tech moguls are putting a tremendous amount of time, effort and money into preparing for apocalyptic scenarios. So while interest in prepping among the general population has fallen extremely low right now, the election of Donald Trump has given liberal wealthy elitists even more urgency to prepare for what they believe is a very uncertain future. - The United States Is On The Precipice Of Widespread Civil Unrest

It doesn’t take much of a trigger to push extremely large crowds of very angry protesters into committing acts of rioting and violence. And rioting and violence can ultimately lead to widespread civil unrest and calls for “revolution”. The election of Donald Trump was perhaps the single most galvanizing moment for the radical left in modern American history, and we have already seen that a single move by Trump can literally cause protests to erupt from coast to coast within 48 hours. On Friday, Trump signed an executive order that banned refugees from Syria indefinitely and that placed a 90 day ban on travel to the United States for citizens of Iran, Iraq, Libya, Somalia, Sudan, Syria and Yemen. Within hours, protesters began to storm major airports, and by Sunday very large crowds were taking to the streets all over the country… - Is It Just A Coincidence That The Dow Has Hit 20,000 At The Same Time The National Debt Is Reaching $20 Trillion?

The Dow Jones Industrial Average provides us with some pretty strong evidence that our “stock market boom” has been fueled by debt. On Wednesday, the Dow crossed the 20,000 mark for the first time ever, and this comes at a time when the U.S. national debt is right on the verge of hitting 20 trillion dollars. Is this just a coincidence? As you will see, there has been a very close correlation between the national debt and the Dow Jones Industrial Average for a very long time. For example, when Ronald Reagan took office in 1991, the U.S. national debt had just hit 994 billion dollars and the Dow was sitting at 951. - Eurozone ‘destruction' necessary if countries are to thrive again, warns former ECB hawk

The eurozone must break up if its members are to thrive again, according to a former European Central Bank official. Jürgen Stark, who served on the ECB’s executive board during the financial crisis, said it was time to “think the unthinkable” and work towards a “reset” of Europe that pulled power away from Brussels. The former vice-president of Germany’s Bundesbank said the creation of a two-speed eurozone, with France and Germany at its core, would help to ensure the smaller bloc’s survival. - Trump orders ISIS plan, talks with Putin and gives Bannon national security role

President Trump on Saturday ordered the Pentagon to devise a strategy to defeat the Islamic State and restructured the National Security Council to include his controversial top political adviser as he forged a partnership with Russian President Vladimir Putin in their first official phone call. Trump and Putin spoke for one hour and vowed to join forces to fight terrorism in Syria and elsewhere, according to the White House and the Kremlin, signaling a potential shift in U.S.-Russian relations that have been marked by high tension. - New World Order Pushing Cashless Agenda in India and Around the World

The cashless agenda has taken a giant leap forward worldwide in the last 2 months, mainly due to Indian Prime Minister Narendra Modi. Modi took the bold, detested and despised step of banning the 2 highest denomination notes in India (the 500 and 1000 rupee notes, worth around US$7.50 and $15 respectively). This wiped out around 80% of the value of circulating cash widely used by many segments of society for trade. His reason was to cut down on the black money circulating in India upon which tax is not paid. However, from the broader perspective of the worldwide New World Order (NWO) conspiracy, converting the entire world economy to solely digital transactions is not just about extracting more tax revenue from the ruled populations; it’s about knowledge and power. It’s about surveillance on an extraordinary scale. The cashless agenda is about acquiring the capacity to monitor literally every single financial transaction that takes place on the planet. Unsurprisingly, the new cash ban hurt many poor Indians who either don’t have a bank account or who rarely use one. Also unsurprisingly, the idea for the ban did not originate from Modi. The truth is that India is being used as the latest guinea pig to push forth the NWO cashless agenda, and a particular US Non-Governmental Organization (NGO) was instrumental in the rollout. - Trump’s education secretary pick plans to get rid of Common Core standards

Betsy DeVos, Donald Trump’s pick for Secretary of Education, will put the brakes on the contentious Common Core standards if she is confirmed by the Senate. “It’s time to make education great again in this country,” she said at a Trump rally in Grand Rapids, Mich., on Friday. “This means letting states set their own high standards and finally putting an end to the federalized Common Core.” DeVos, a prominent Republican donor and the former head of the Michigan GOP, is known as a charter-school advocate and a booster of school choice and education vouchers. DeVos’ five-minute speech echoed her new boss’s stance. - A Tariff with Mexico Will Ensure Americans Pay for Border Wall

The AP is reporting that Sean Spicer has informed reporters that President Trump is considering a 20% on Mexican goods as a way to fund his Mexican border wall. Though Trump has insisted throughout his presidential campaign that “Mexico will pay” for any such project, this move would ensure that it is Americans who will suffer the costs as they are forced to pay extra on Mexican goods coming into the country. - Trump Can't Avoid The Coming Financial Crisis

The Federal Reserve's policies of printing trillions of dollars back in '08-09 have locked into place a serious financial crisis at some point in our future. It's unavoidable, and even Donald Trump can't stop it. Trump will unfairly get the blame though. - Trump’s Executive Order on Refugees — Separating Fact from Hysteria

To read the online commentary, one would think that President Trump just fundamentally corrupted the American character. You would think that the executive order on refugees he signed yesterday betrayed America’s Founding ideals. You might even think he banned people from an entire faith from American shores. - Trump pick for Energy secretary sits on Dakota Access Pipeline company's board

Donald Trump's pick for Energy secretary, Rick Perry, sits on the board of directors of Energy Transfer Partners, the company whose Dakota Access Pipeline has been fiercely opposed by Native American tribes and their allies. Dallas-based Energy Transfer's top executive and other employees also contributed millions of dollars to support the former Texas governor's short-lived 2015 bid for the White House. - Dear Bernie, Meet the “Big Mac ATM” That Will Replace All Of Your $15 Per Hour Fast Food Workers

Dear Bernie, as you continue in your never-ending “Fight for $15”, we thought you might benefit from a simple example of how economics work in a real life, functioning, capitalistic society. You see, Bernie, labor, much like your daily serving of crunchy granola, is just another “good” that businesses can choose to consume more or less of, depending on price. And, just to be crystal clear, when the price of labor (i.e. wages) increases, businesses tend to consume less of it. Finally, our dearest Bernie, when misinformed politicians radically disrupt labor markets by setting artificially high base prices, like your proposed $15 federal minimum wage, then businesses simply stop consuming labor completely and instead replace that labor with this “Big Mac ATM Machine.” - Americans Pay More in Taxes than on Food, Clothing, and Housing Combined

Our annual Tax Freedom Day report finds that the nation’s Tax Freedom Day will come on April 21st this year, which is three days later than last year. The calendar measure represents how long Americans as a whole need to work in order to pay the nation’s tax burden. The report estimates that Americans will pay about $4.5 trillion dollars in taxes of all kinds in 2014, with $3 trillion going to the federal government and $1.5 trillion dollars going to state and local governments. This is approximately 30.2 percent of the nation’s income paid in taxes. In total, Americans will pay more in taxes in 2014 than on food, clothing, and shelter combined. - What They Tell You: Trump Is Restarting The Pipeline. What They Don't Tell You: It's 70 Miles From Standing Rock And Made With American Steel

If the United States is to become more energy independent, some say, then it is imperative that additional oil and gas pipeline infrastructure is built. And that includes the Keystone XL and the Dakota Access Pipelines, which is why President Donald Trump has signed executive orders to allow permitting to be streamlined. But the key question is whether presidential support can overcome the economics of the Keystone project, as well as the fierce environmental opposition to it and the Dakota line. While the president has the power the microphone, he does not have the power of a monarch. The lines still need the approval of the states they'll operate in. - MAINSTREAM MEDIA IS OVER! Look What Trump Just Installed in The Back of The Press Room!

The media’s WAR on Trump continues but he is fighting back! Trump’s Press Secretary, Sean Spicer, just announced the installation of their SECRET WEAPON that will take all the power away from the mainstream media! Spicer started by DESTROYING the media for their dishonest coverage of Trump. Spicer said: “I THINK THERE’S AN OVERALL FRUSTRATION WHEN YOU WHEN YOU TURN ON THE TELEVISION …YOU’RE CONTINUALLY TOLD IT’S NOT BIG ENOUGH, IT’S NOT GOOD ENOUGH, YOU CAN’T WIN.” After these comments, Spicer announced their SECRET WEAPON that they installed in the press room to take away CNN’s and the FAKE NEWS media’s power! - Trump advances two energy infrastructure projects: Keystone XL and the Dakota Access pipelines… can he balance infrastructure with environmental protection, too?

On the official “Day 2” of the new administration, President Donald J. Trump continues to dismantle the legacy of his predecessor using all executive means at his disposal, fulfilling his promise to “Make America Great Again.” This morning, the president signed documents that will advance the eventual approval and construction of the Keystone XL and Dakota Access pipeline projects, both of which were stalled by President Barack Obama over the false notion of “climate change/global warming.” - A Horrific Ending As The World Moves One Day Closer To Armageddon

With the Dow surging above 20,000, while bonds and the dollar were weak once again, one of the greats in the business just warned that a horrific ending is coming as the world moves one day closer to Armageddon. John Embry: “Eric, I read Egon von Greyerz’s KWN interview over the weekend and it was such a tour de force that I’m not sure what I can add to what he already said. However, I agree with every word of his interview, and the fact that the vast majority of the population, including most of the rich and famous, seem oblivious to that reality and the resulting coming catastrophe, this virtually guarantees it can’t be avoided… - Halliburton reports $5.7 billion in losses

Halliburton, the world’s second largest oil field services company, reported dramatic losses Monday after a failed bid to take over rival Baker Hughes. Halliburton, based in Houston, said it lost $5.7 billion or $6.69 a share in 2016, compared to losses of $671 million in 2015, or 78 cents per share. It was the “sharpest and deepest industry decline in history”, said Dave Lesar, Halliburton Chairman and chief executive. In his 40 years in the business never had he seen such a rapid decline. A failed $28 billion merger with Houston-based oil field services firm Baker Hughes is to blame for such major losses. The event, which occurred back in May, cost Halliburton more than $4 billion dollars. - 11 bizarre home remedies our grandparents used that actually work!

To this day my grandparents are still giving me bizarre treatments for minor injuries. Just the other week I took a tumble down the stairs, and my Grandma piped up, telling me to boil an egg and rub the extremely hot breakfast item all over my extremely swollen ankle. And you now what? It worked! The swelling went down within an hour, and I felt almost as good as new by the next morning. Thanks, Gran! - New EU Energy Strategy To Create Up To 900,000 Jobs